Play Your Game

It is difficult to digest the mixed signals the economy is putting out in this current –and certainly unique– economic cycle while also remembering the investment game you are playing.

Let’s start with the Federal Reserve: Chair Powell effectively acquiesced and removed his standing language that inflation would be transitory. 1

“We tend to use [the word transitory] to mean that it won’t leave a permanent mark in the form of higher inflation,” Fed Chairman Jerome Powell told Congress on Tuesday. “I think it’s probably a good time to retire that word and try to explain more clearly what we mean.”

The onset of market-based confusion trickled its way into volatility, as expected. 2

As an important note, Chair Powell reiterated that he expects inflation to moderate closer to the 2% target sometime in 2022.

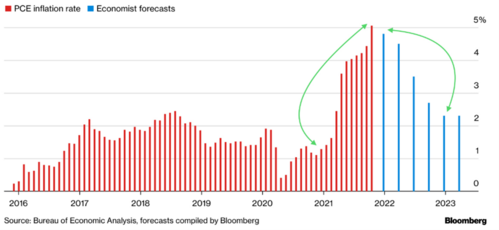

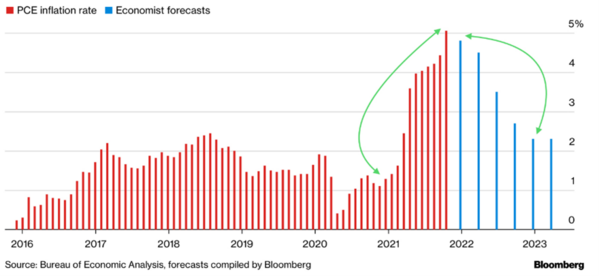

When I look at the rate of change effect inflation is measured by, I also conclude that inflation was not going to be transient until the second half of 2022. 3

However, it is possible that it moderates sooner.

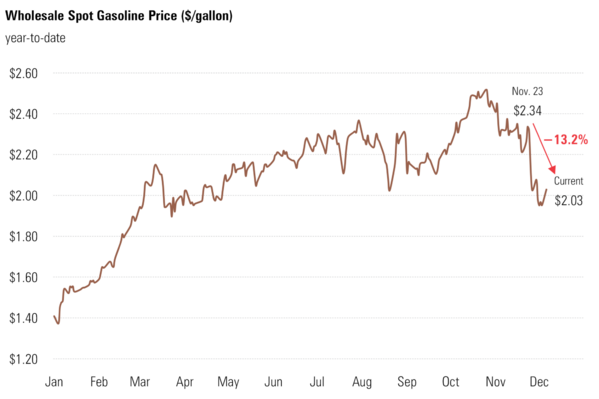

There are some signs that core components of inflation are moderating. Wholesale gasoline prices are on the decline. 4

That tells me we should see some relief at the gas pumps in the weeks to come.

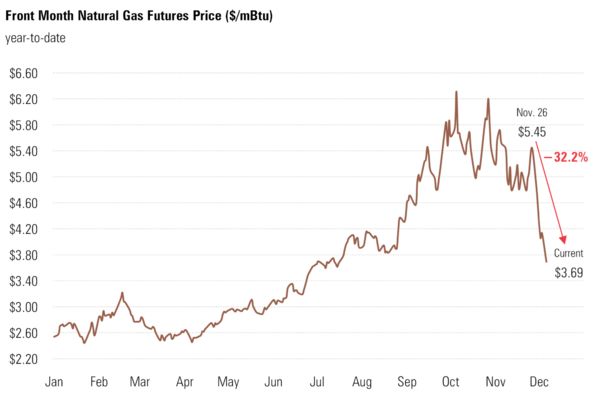

Further, natural gas futures prices have been dropping as supply has come back online. In fact, prices are down 32% over the last seven trading sessions. 5

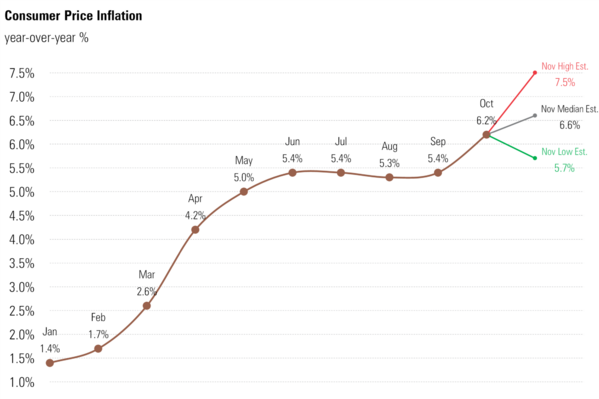

When we get November CPI numbers on Friday, I suspect the inflation reading will be even worse that October. Perhaps, we could see a reading over 7%. 6

Referring back to the rate of change chart: In November 2021 you can see PCE CPI is reading very low inflation and perhaps a touch of deflation. The base effect is still inflating the inflation numbers excessively. It’s my view that when we round the corner in the second half of 2022, inflation numbers will moderate substantially. Perhaps even sooner, as we see commodity prices decline.

A quick note on Semiconductor supply, as reported by Nikkei Asia: “Conditions took a turn for the better in the July-September quarter of this year. Total inventories at the five chipmakers rose 0.7% on the year, marking the first gain in three quarters. Four of the five saw an increase in inventories.”

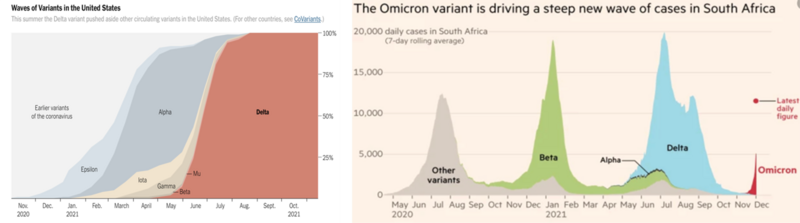

Perhaps the Omicron variant is creating a supply/demand imbalance that is driving inflation. We are likely still a couple of weeks away from knowing how virulent this variant is. It takes about two weeks from first reports to get hospitalization rates and another week or so to get the mortality rates according to a recent interview given by Professor Ben Cowling, Chair Professor of Epidemiology at the School of Public Health at the University of Hong Kong. (listen to the podcast here) If you want to know about epidemics and pandemics, this is the definitive source as he has been dealing with these issues full-time and in real time his entire career. High density populations mixed with seasonal outbreaks are prime territory for knowing a thing or two about viruses.

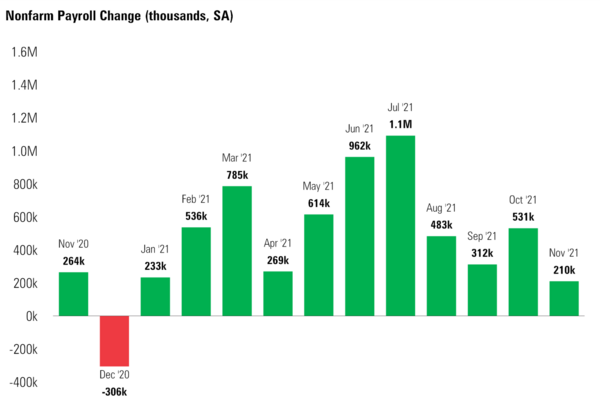

The Fed signaling their intention to end tapering sooner than expected –and likely start raising rates earlier than anticipated—could also be fueled by the recent jobs report. The headline number was on the anemic side relative to trend. 6

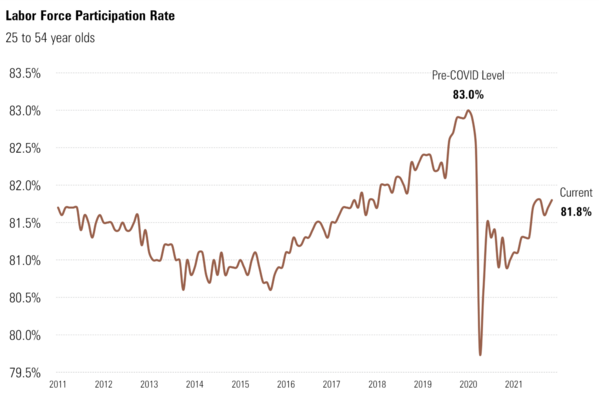

Yet, the real gold nugget in the report is the participation rate of the prime working age cohort of 25–54. That participation rate is now at nearly 82%, just shy of the pre-pandemic high of 83%. That’s certainly close to full employment. 6

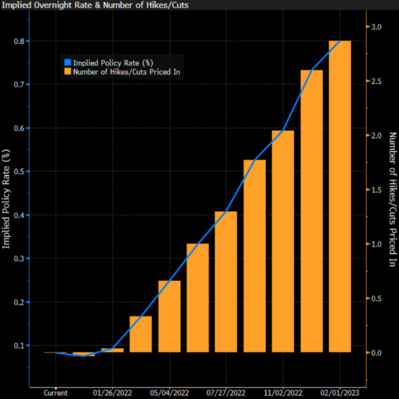

The cross current of events has clearly changed expectations for tapering and rate increases. 7

Regardless of if you believe that inflation is transitory (as I do, by mid-to-end next year) or if you believe we are doomed to hyperinflation year after year, one thing is certain; the Fed has a tough job in soft-landing this economy somewhere between mildly-expansionary with moderate inflation and a recession.

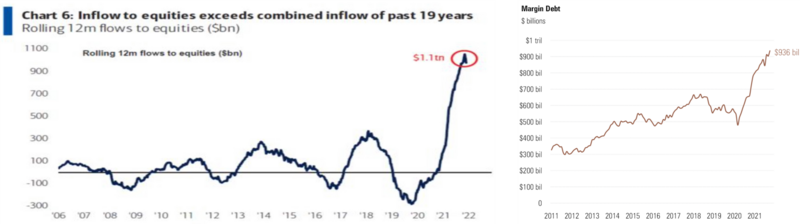

With record cash inflow into U.S. equites and margin borrowing levels at record highs, let’s brace for some more volatility as we sort out so many issues facing the economy, workers, and investors. 8

What should investors do in light of all of this?

First, remember the game you are playing. In fact, our friend and author Morgan Housel reminds us of that fact here.

The game we play is managing assets for the very long-term across market cycles. Seeing as we are in the midst of a rocky part of this cycle, it’s always best to make sure you have ample liquidity for your needs. Taking cash out of the equity markets for personal spending at the wrong time can be very costly.

Continue to look for long-term compounding to protect and grow your wealth.

Remind yourself of your maximum drawdown thresholds in the face of extraordinary volatility. If you don’t know what your portfolio downside is, let us help you. Just email me here and I will make sure our team provides you with that insight.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

1. https://www.wsj.com/articles/sic-transitory-gloria-inflation-transitory-jerome-powell-pat-toomey-11638314379

2. https://www.cboe.com/tradable_products/vix/

3. https://www.bloomberg.com/news/articles/2021-12-02/fed-officials-backing-faster-taper-mount-amid-high-inflation

4. https://www.eia.gov/todayinenergy/prices.php

5. https://www.eia.gov/dnav/ng/hist/rngwhhdD.htm

6. https://www.bls.gov/news.release/empsit.nr0.htm

7. https://www.bloomberg.com/news/articles/2021-12-02/traders-signal-fed-overshooting-outlook-for-interest-rate-hikes

8. https://www.finra.org/investors/learn-to-invest/advanced-investing/margin-statistics