Playing Catch Up

This is an unusual period for investors as we digest the past, while trying to consume the current and future news.

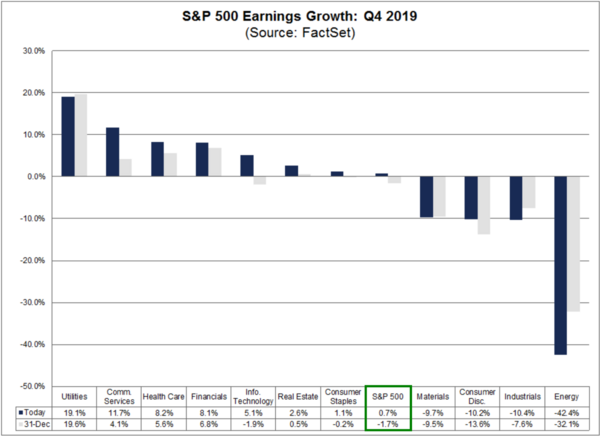

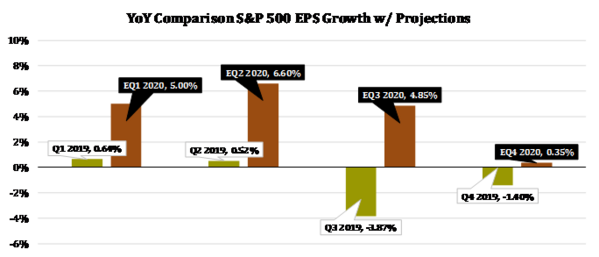

First, the past news as it relates to corporate earnings is nothing short of outstanding relative to expectations. Fourth quarter S&P 500 earnings are now expected to grow 0.7% year-over-year compared to expectations at the end of 2019 calling for a 1.7% decline. [i]

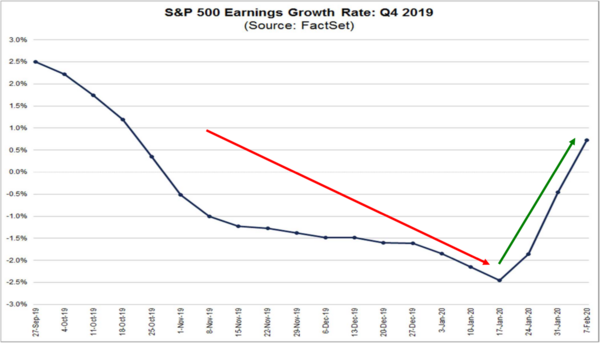

For a prolonged period, S&P 500 earnings were expected to be negative in Q4 2019. However, as you can see in the chart below the expected S&P 500 earnings growth rate turned positive over the past week. [i]

If fourth quarter earnings growth had been negative, it would have marked the fifth consecutive quarter of negative earnings growth―something we had not seen since 2015.

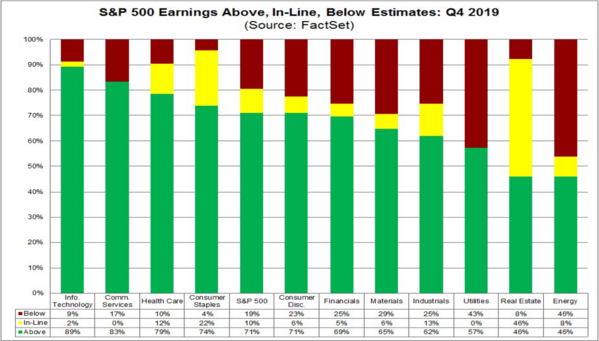

As it stands now with 64% of companies having reported Q4 earnings, 71% of those companies have reported results ahead of expectations. [i]

My view is that the recent stock market rally has largely been driven by these expectations.

Unfortunately, investors can’t buy the past, they can only buy future cash flows and earnings.

We are currently facing a challenging macroeconomic environment. With the coronavirus consuming the news cycle and death tolls from the outbreak rising, it is easy to lose sight of what’s actually occurring on the ground.

We are fortunate to have a leading research firm in China, CICC Research, at our disposal to help us decipher the real information without media hype. Make no mistake, the loss of life is tragic but, there appears to be some moderating data.

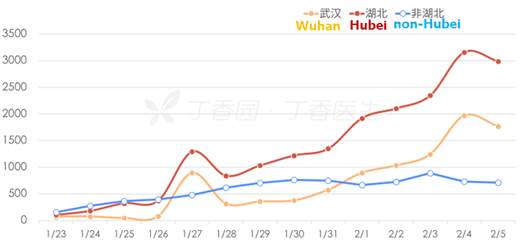

According to CICC, there were 3,143 new coronavirus cases reported in mainland China from February 7 to February 9, of which 2,447 were in the epicenter province of Hubei (-18% DoD). That is down 14.9% day-over-day (DoD). [ii]

The critical cases are rising, but there is a lag effect from total cases to critical cases. The expectation is for critical cases to peak and begin to decline over the next 10 to 14 days. [ii]

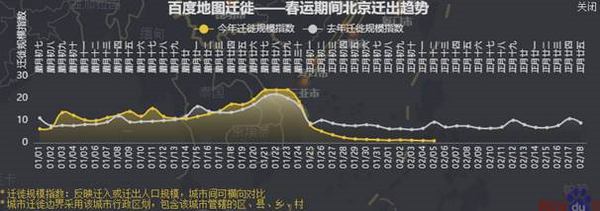

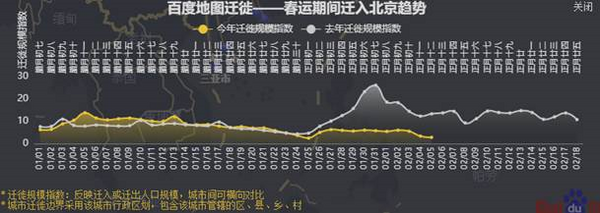

The bigger issue is the return to work and associated travel restrictions from the combination of the Chinese New Year and the coronavirus outbreak. The chart below from our partners at CICC, shows the travel in and out of major economic centers in China compared to last year. (Gray line is 2019, yellow is 2020) [ii]

Travel out of Beijing:

Travel back into Beijing:

You can see there is some delay with respect to migration back into Beijing. That is also the case for Shanghai and Shenzhen.

So, what is the impact of the delays and slower start to reopening the industrial base in China?

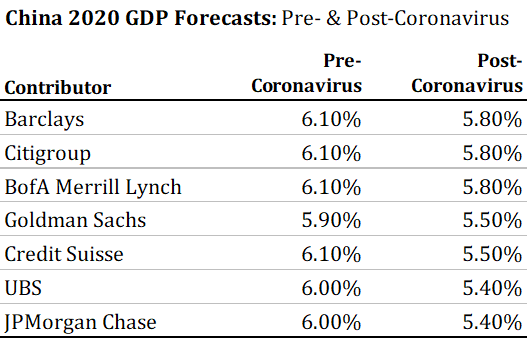

The simple answer is about approximately 140 basis points off Chinese GDP growth, according to Bloomberg. [iii]

Globally, China’s largest trading partners, or importers of Chinese goods, will be the countries most impacted. [iv]

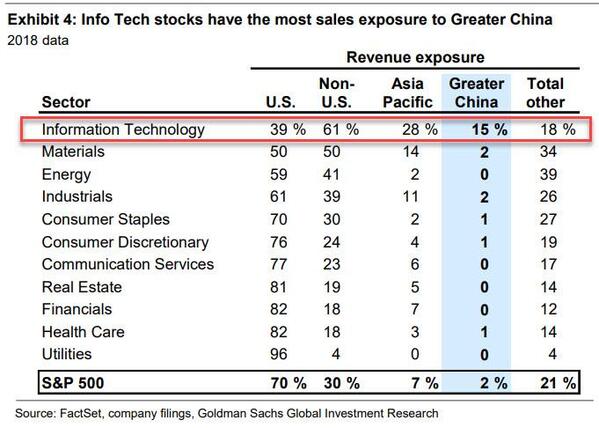

While the United States is the largest importer from China, our industry-specific exposure is limited. The S&P 500 only has aggregate revenue exposure of 2% to greater China; sector-wise only the Information Technology sector has meaningful revenue exposure. [v]

Global GDP is being discounted as well, with expectations being adjusted down due to the slowdown in China―especially because of a delay in Chinese citizens returning to work. [vi]

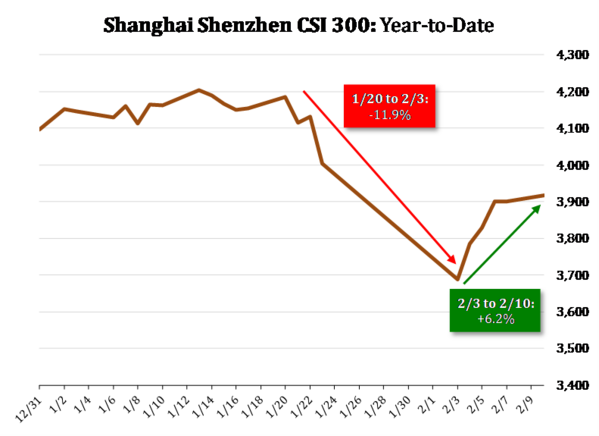

I suspect the moderating data and the tremendous stimulus being pumped into China’s economy by the People’s Bank of China has created the lift in their stock market. [vii]

I’m not suggesting we’re done digesting or discounting ongoing data, but even the local investor in China―which makes up around 80% of their stock ownership―is showing some optimism.

Looking ahead, we will likely see some adjustments to earnings expectations in Q1 2020. Right now, they look pretty good. [viii]

If corporate executives have a chance to lower growth expectations, they might just do that―and I suspect they will in the coming weeks; especially given the easy comparables to Q1 2019. In turn, this may make the “quiet period” before first quarter earnings reports especially volatile.

We have digested pretty good news from the past, but the current news flow is daunting, due to the tragic yet anomalous coronavirus situation. This makes future results difficult to forecast.

We will see if markets catch up to the negative data or trade up on expectations of continued earnings growth for the S&P 500.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://insight.factset.com/sp-500-earnings-season-update-february-7-2020

ii. https://research.cicc.com

iii. https://www.bnnbloomberg.ca/coronavirus-may-drag-china-gdp-to-4-5-in-first-quarter-1.1382291

iv. https://oec.world/en/visualize/tree_map/hs92/export/chn/show/all/2017/

v. https://www.zerohedge.com/s3/files/inline-images/tech%20gs%20china%20exposure_0.jpg?itok=YyUQzutd

vi. https://www.bloomberg.com/quote/CNGDPYOY:IND

vii. https://www.bloomberg.com/quote/SHSZ300:IND

viii. https://PHILLIPSANDCO.COM/files/7615/7800/3261/Look_Ahead_-_2020Q1_-_Final.pdf