Playing the Game

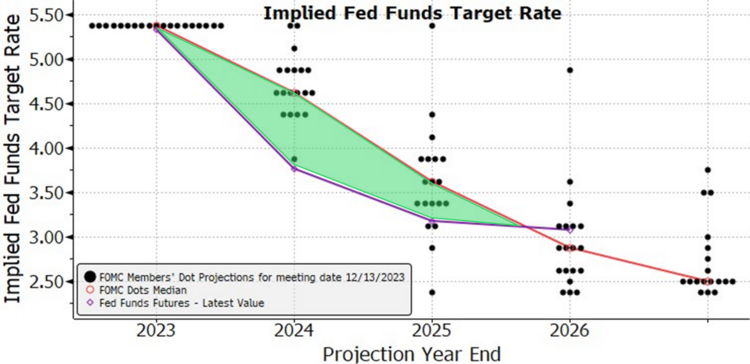

2024 was always going to be the year of the interest rate. Coming into the year we knew of the large discrepancy between what the Fed was forecasting for rate cuts and what Wall Street believed was the making of market risk. 1

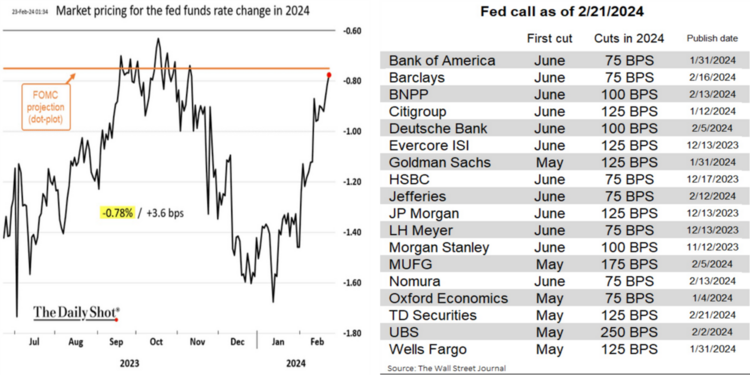

The discrepancy is in the shaded area. Today that picture looks entirely different. Wall Street is trending much closer to the Fed’s forecast than their prior forecast. Here is a sample of what Wall Street thinks now. 2

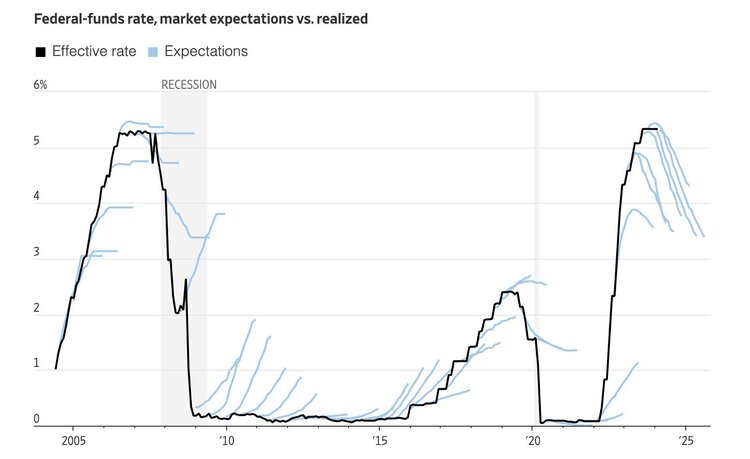

June seems to be the overriding consensus on when the first-rate cut could occur according to the big brains on Wall Street. Here’s the truth: Wall Street along with most investors – including me – is terrible at forecasting interest rates. Our friends at Bespoke did a nice job of plotting the actual Fed Funds rate (black line) and expectations for the Fed Funds rate (blue lines). As you can see, the “best and brightest” are generally wrong. In fact, playing the interest rate guessing game is a trap for fools. 3

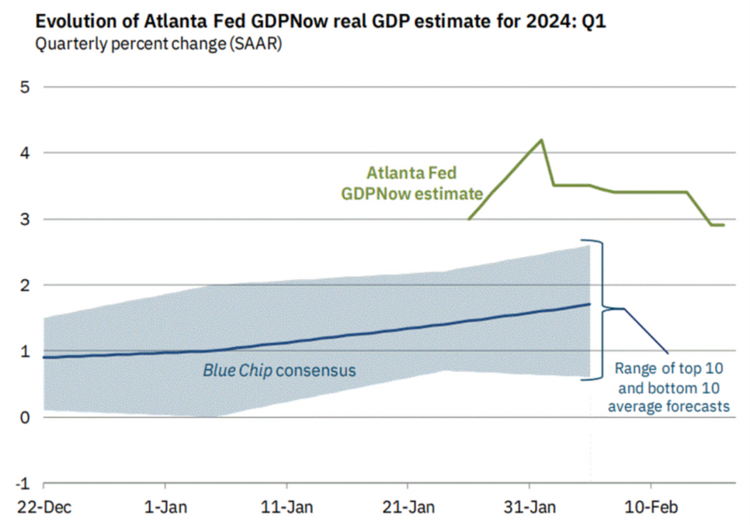

More important, from a macro perspective, is how U.S. GDP growth looks. In the case of Q1 2024, growth looks very strong. According to the Atlanta Fed, GDP growth is targeted at over 3% for Q1. 4

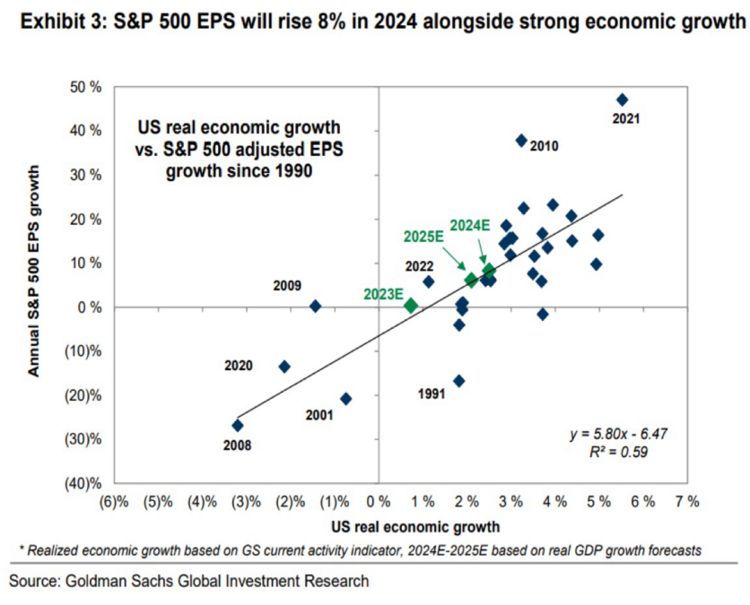

Overlaying GDP growth with S&P 500 performance tells a much more accurate story across various interest rate scenarios. Historically, S&P 500 growth is correlated to US GDP growth. 5

Since the start of the year, the S&P 500 is up 6.59% and that leaves little in the way of forecasted upside potential. 1

In fact, a market correction might be in our future. Frankly, corrections are always in our future as they occur quite frequently.

So, if we are going to play the game, here’s how we might do it:

- Adding duration to fixed income. That means we’ve been going from two years of duration to six years which happens to be close to benchmark duration.

- Keeping our equity tilts to growth to pre-position for rate cuts.

- Consider adding some slight tilts to liquid alternatives to add a little ballast in case of obvious market corrections.

- Reaffirming our slight overweight to emerging markets. With rate cuts comes a weaker U.S. Dollar.

This should keep us out of the interest rate guessing game and let the game come to us in the next 6 months.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: