Plenty of E Very Little P

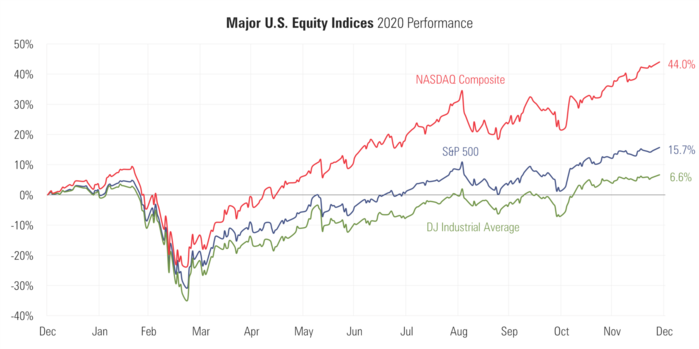

It is not so prophetic to suggest you’ve been paid your returns for 2021. It is entirely possible that what you’ve gained in 2020 is a 100% deposit on what you might get in 2021, at least from a U.S. equity perspective. [i]

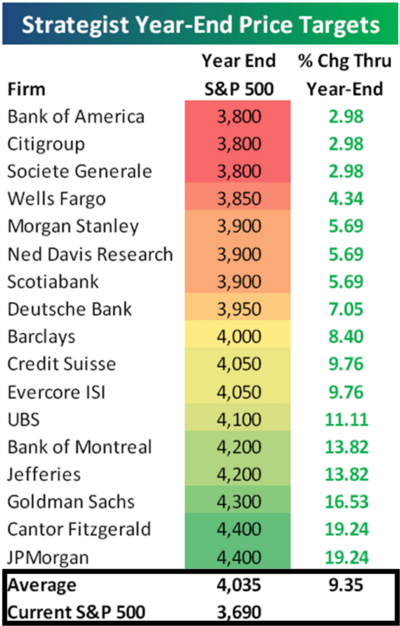

This view, however, is certainly not the consensus. In fact, it is an outlier. Just look at what the major Wall Street firms are forecasting for 2021. [ii]

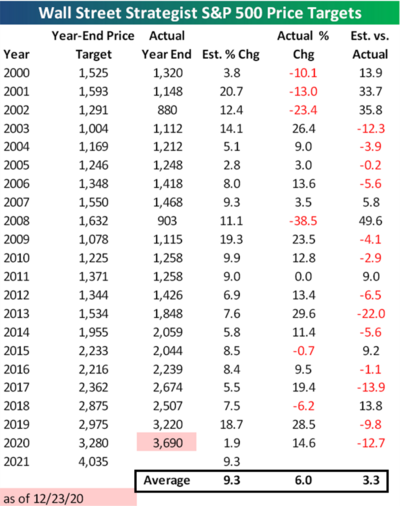

Let’s not put too much weight into the traditional year-end Wall Street Parlor trick. They know a thing or two about the common investor: The common investor is likely going to forget their prognostications, they don’t really care how accurate Wall Street is, or they simply don’t believe them. In any case, it is a low-risk game of guessing when it comes to these major financial brands making some very precise and inaccurate guesses. [ii]

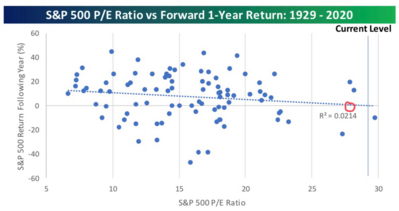

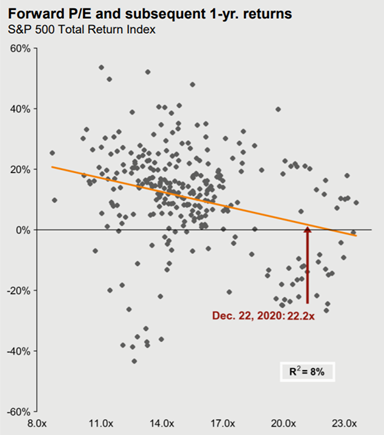

You can see the average inaccuracy rate is 35.5% off. Perhaps a more accurate review of what the S&P 500 has in store for us resides in how investors react to prospective valuations. Based upon current valuations, prices tend to tread water the subsequent year. Here is one view from our friends at Bespoke. [ii]

Although JP Morgan made the most aggressive forecast, of 19.24% price appreciation, they published similar data to Bespoke calling for muted returns in 2021 based on current valuations. [iii]

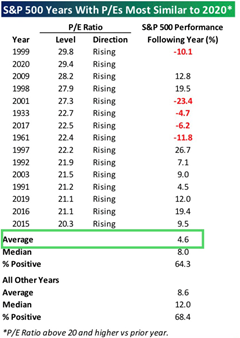

Another way to cut the valuation data is to look at similar periods to 2020 from a valuation perspective. The average return is just over 4.5% not the whopping average 9.3% Wall Street experts are forecasting. [ii]

You can see, based upon current valuations, forward returns one year look quite muted for the S&P 500.

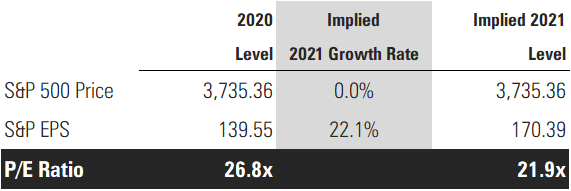

Just look at 2021 S&P 500 EPS growth rates. The base effect of having such a terrible 2020 in corporate earnings provides for some pretty easy 2021 comps. [iv]

In fact, if we do achieve the 2021 year-end EPS expectations with the historical low returns, we could see valuations normalize back to around 22x.

While there is an expectation for strong earnings per share growth in 2021, perhaps those earnings will be reflected in moderating valuations versus price appreciation. Lots of E (earnings) and very little P (price) appreciation.

To be completely transparent, I do believe there are opportunities to exceed historically mediocre returns data in the United States. To see that, tune into our Quarterly Look Ahead that will be published next week. You will see how some unique trends could unleash a skyrocketing of corporate earnings well above expectations that may indeed fuel returns closer to the Wall Street crowd’s expectations.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.bloomberg.com/quote/SPX:IND

ii. https://www.bespokepremium.com/

iii. https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/guide-to-the-markets/

iv. https://insight.factset.com/