Predictable and the Counterintuitive

Tim Phillips, CEO – Phillips and Company

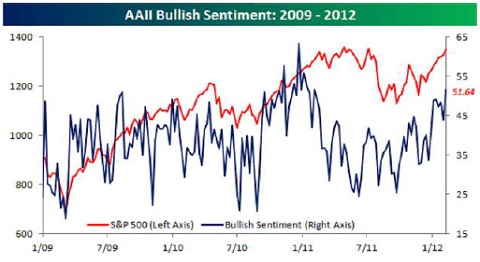

Markets have been on a rip roaring rally these last few weeks. The S&P 500 was up 4.48% in January and is up 6.98% YTD. Under normal circumstances coming off a year like last year where returns seemed non-existent, one would expect a strong start.

After a solid jobs report in January and stronger than expected improvements in consumer credit, it can be easy for one to conclude we’re currently in the throes of an improving economy.

In fact, this is one of the few times individual investors and professionals are normally optimistic about the markets. However, if you looked at analyst expectations of future corporate earnings you would see an entirely different picture.

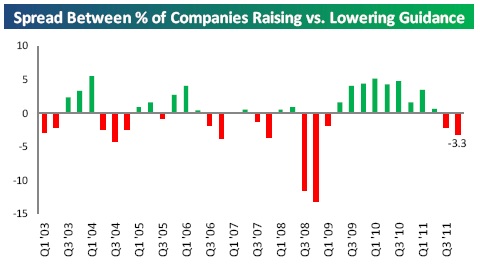

Wall Street analysts have been reducing earnings expectations in droves. The following is a chart by Bespoke showing the daily net change in analyst’s upgrades (downgrades). As you can see, there has yet to be a single day this year where there were more upgrades than downgrades.

Numbers did improve throughout this earnings season as we suspected. However, during this earnings season companies continue to still lower guidance and expectations.

While this might suggest we’re about to face some headwinds in our rally (which wouldn’t surprise me given the YTD performance numbers), calling market tops and bottoms is nearly impossible. Credit Suisse has also taken noticed of the interesting contrast between analyst opinions and the YTD performance numbers. This anomaly can be seen in a research study they did which compared the changes in earnings estimates with actual stock market performance. Below is a chart that summarizes their findings.

From this chart, it appears when earnings estimates are lower than they were at the start of the year, the equity markets tended to finish higher roughly 2 out of 3 times. This underlines one of our core investment philosophies: it’s not about timing the market; it’s about time in the market. Markets can be “irrational” longer than a logical investor’s patients.

If you have questions or comments please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can Email me directly.

Tim Phillips, CEO – Phillips & Company

Adam Gulledge, Associate – Phillips & Company

Hatip: Bespoke Investment Group for Sentiment Chart, Analyst Upgrades/downgrades and Guidance data.