Pricing in a Recession

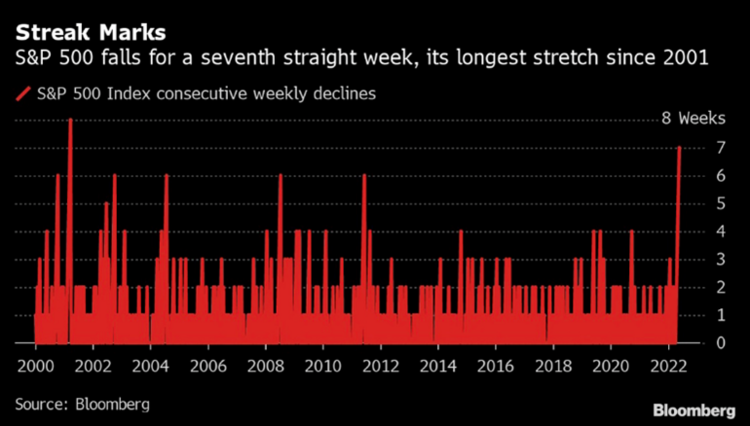

Last week’s market activity took an even darker turn, with the S&P 500 falling for the seventh consecutive week. 1

The S&P 500 touched bear market territory, if only briefly, down 20%. 2

Bear markets are just part of the cycle and that’s the risk we accept when we need equity like returns to meet our funding targets. 3

In my opinion, in the prior six weeks we went from pricing in (equity markets discounting) rising rates to pricing in a recession last week. I’ve been writing about a Federal Reserve policy error induced recession since our Q1 2022 Look Ahead.

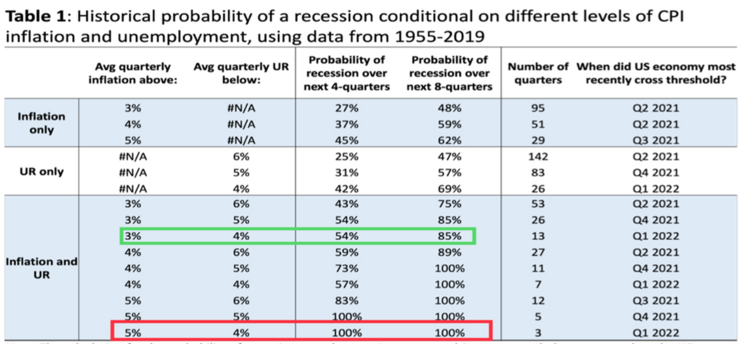

One common refrain lately has been the Fed’s inability to lower inflation by more than 2% without causing a recession. In fact, a recent study (link to study) by famed economist Larry Summers suggests something similar. 4

“Since 1955, there has never been a quarter with average inflation above 4 percent and unemployment below 5 percent that was not followed by a recession within the next two years.”

Here’s the thing about this study. It assumes inflation is persistently above the 4% to 5% level. The current Federal Reserve forward guidance suggests something quite different. With a 2023 Fed Funds rate at 2.75%, it’s hard to see this rate fighting 8% inflation. If the Fed wanted to fight 4%, 5%, or 8% inflation they would likely need to match the Fed Funds rate to that level. (the Taylor Rule)

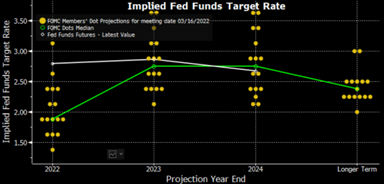

The Fed is made up of over 2500 smart, motivated people with access to excellent data including 400 PhD-level economists. Let’s give them the benefit of the doubt for now. If you review their dot plot closely, the consensus of the Fed Governors informed by this well-trained staff suggests rate cuts just after 2024. 5

Cleary the forward guidance from the Fed is for inflation to moderate, matching their 2.75% Fed Fund’s target level in 2023 or 2024. The Fed continues to believe they can moderate inflation without a recession.

Let’s assume the worst-case scenario, with the people at the Fed being wildly wrong about how the real economy works, and we slip into a recession.

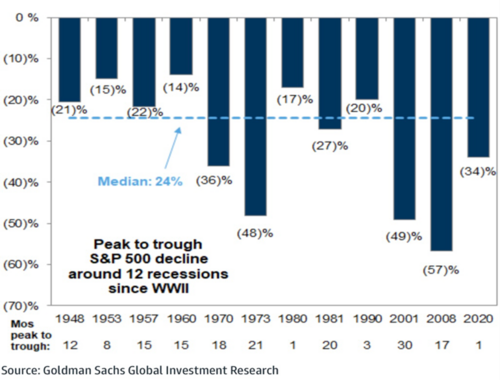

Historically, we are likely closer to the end of the market drawdown than the beginning. According to Goldman Sachs, the median drop in the S&P 500 is 24% compared to our current 20% drop in the S&P 500. 6

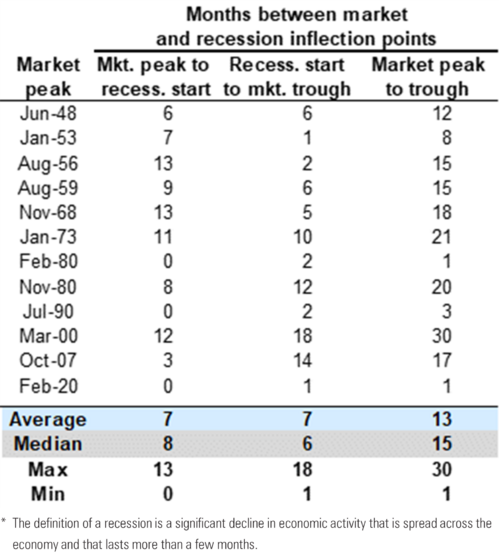

While the average length of time from peak to trough for the S&P 500 relative to the start of a recession is much longer, the current drawdown has been much more dramatic. The average length of time from market peak to recession start is seven months vs. our current ~5 months, assuming we are in a recession now. 6

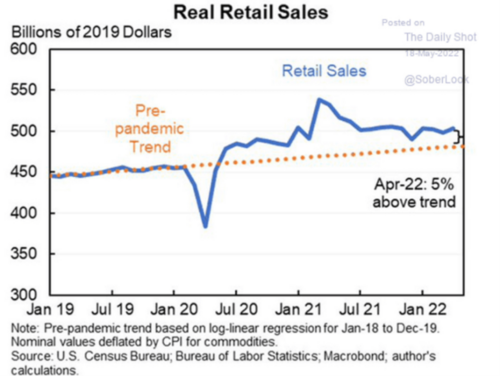

Let’s put aside the fear of recession for now and look at what really drives our economy. It would appear the consumer, which makes up 70% of our economy, is still full steam ahead with spending. The recent data on retail sales suggests we are still far from a decline in economic activity, as spending is 5% above trend. 7

It would appear investors jumped ahead of the data and priced in an above average chance of a recession.

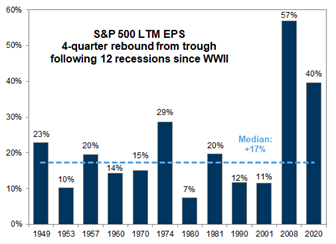

The good news is if the Fed smartly lands inflation without a recession, the equity markets should rally. If there is a recession, it’s perhaps almost fully priced and we can see a strong rally in a reasonable amount of time. In fact, the rally could be quite pronounced. 6

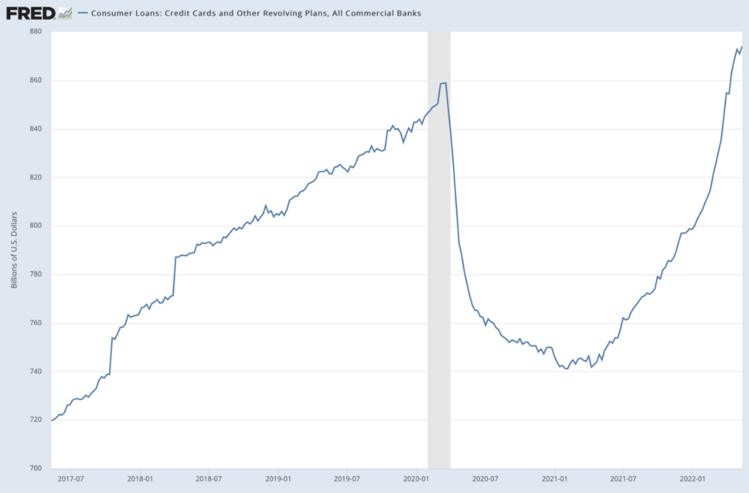

My base assumption is the consumer will continue to consume as consumption is foundational to Americans persistent behavior. The 2001 Tech Bubble, 9/11, the 2008 Great Financial Crisis, the 2020 pandemic; in all of these dramatic economic instances the consumer returned to their post-WWII behavior and consumed.

While we can never know when Americans become net savers versus spenders, I leave you with this one chart on revolving credit. That should tell us all we really need to know about the resilience of the U.S. Consumer. 7

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.bloomberg.com/news/articles/2022-05-20/s-p-500-sinks-into-bear-market-amid-brutal-equities-selloff

- https://schrts.co/CjmEsfmH

- https://awealthofcommonsense.com/2022/05/how-long-do-bear-markets-last/

- https://www.hks.harvard.edu/sites/default/files/centers/mrcbg/files/Recession_blog.pdf

- https://www.bloomberg.com/news/articles/2022-03-16/the-fed-s-new-dot-plot-after-its-march-policy-meeting-chart

- https://research.gs.com

- https://fred.stlouisfed.org/series/CCLACBW027SBOG