Profit Margin Season Meets the Margin of Error

Earnings season was supposed to be simple: margins near record highs, analysts expecting another solid quarter, and the Federal Reserve setting the stage for an easier policy path. But just as corporate America started polishing its prepared remarks, a familiar risk re-emerged — tariffs and trade tensions with China.

That unexpected headline dropped a “margin of error” into what had looked like a predictable reporting cycle.

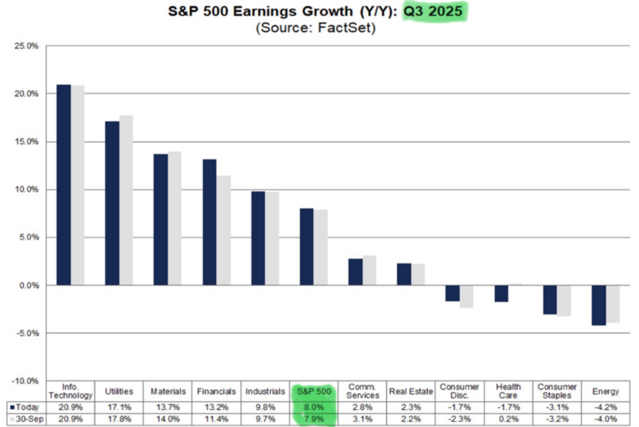

Let’s start with where we were before the trade disruption. S&P 500 earnings growth was on solid footing heading into Q3 — led by technology, financials, and utilities — with the consensus expecting roughly 8% year-over-year growth.

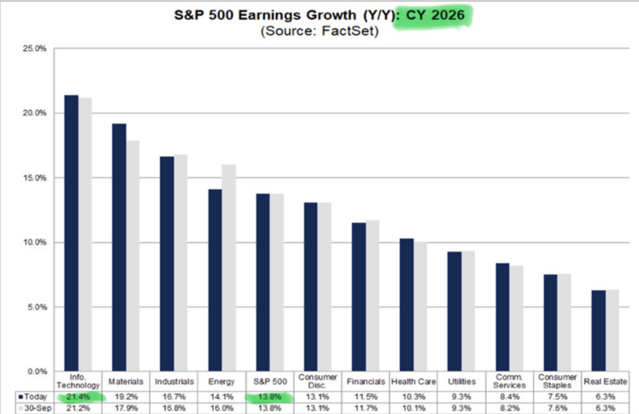

Looking further out, 2026 estimates still look robust — over 20% earnings growth for information technology and double-digit gains across most sectors.

Long term optimism had been baked into earnings expectations extending through next year, but that could now be challenged by another round of trade tensions between the worlds two largest economies.

Tariffs rarely show up immediately in quarterly results. The Q3 numbers won’t tell us who’s hurt — the guidance will. That’s the margin of error we need to be mindful of.

Expect management teams to walk a fine line: confident about current results, but cautious about what comes next. The tell will be in the language — “monitoring,” “supply chain exposure,” “potential headwinds,” and “trade uncertainty” are all being drafted into CEO comments as you read this.

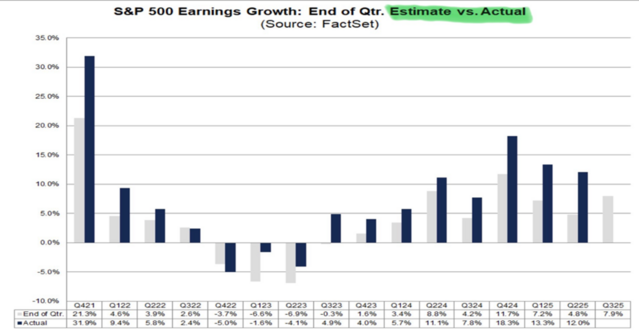

Historically, companies have tended to outperform muted expectations. Pessimism tends to overshoot reality, and that might again be the case as reports about great corporate margins contrast with CEOs building in some margin for error.

But tariff uncertainty changes the calculus. Companies can beat on Q3 and still lose the narrative if they hedge guidance too much. That’s the “margin of error” now embedded in forward commentary.

The setup is unusually tense:

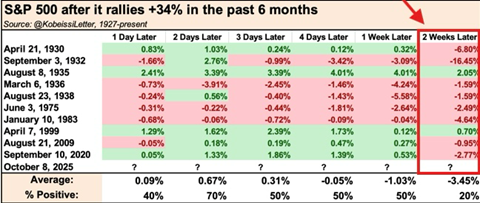

- The S&P 500 just rallied more than 30% over six months — a surge that historically leaves little room for error.

- Past episodes with similar gains often saw a 2-week pullback averaging roughly -3.5%

So, even if earnings are strong, expectations might be too. Markets may need a pause to digest both strong numbers and new risks.

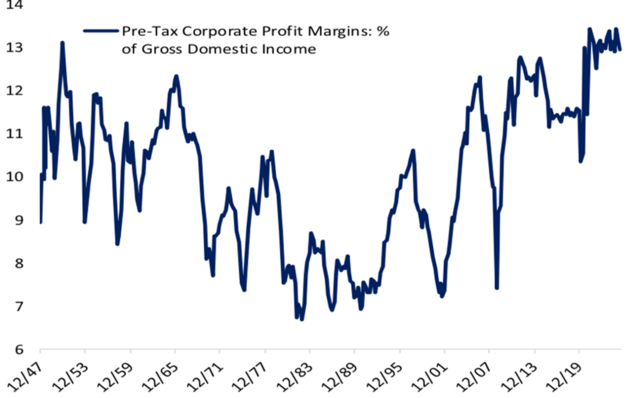

Corporate profit margins remain near 13% of GDP — close to post-war highs — providing key support for current premium valuations.

Trade frictions threaten that margin stability. Tariffs act like a tax on global supply chains — squeezing costs higher and potentially compressing profitability for multinational firms.

That’s why this round of earnings isn’t just about what companies made, but how much flexibility they have left.

As we begin this earnings season, the focus might be less on actual results and more on future concerns. If the gap between expectations and reality proves wide, it could be painful—but let’s remember, the future rewards the resilient.

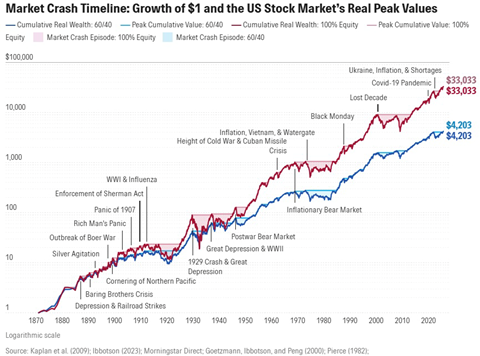

Market drawdowns tied to policy shocks are common — but they’re rarely fatal. The long-term trajectory of the U.S. market shows that even severe disruptions fade over time. Every downturn, from tariffs to wars to pandemics, ultimately gave way to recovery. Long-term investors who stayed invested through the noise captured exponential gains.

This earnings season won’t just test profits — it’ll test posture.

CEOs and CFOs now face two audiences:

- Analysts, eager for confirmation that growth remains intact.

- Investors, anxious about how trade risk reshapes that growth story.

The numbers may still impress, but the tone may not. That is the new margin of error — not in the spreadsheets, but in the sentences.

Earnings measure what’s happened. Guidance measures what’s possible. And in a world of shifting trade winds, that margin of error just got a little wider.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

The charts and data presented are sourced from a combination of public domain materials and licensed data providers. Their use is intended solely for educational and analytical commentary and falls within the scope of fair use. For a representative list of sources, please click here.

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.