Psychological Immune System

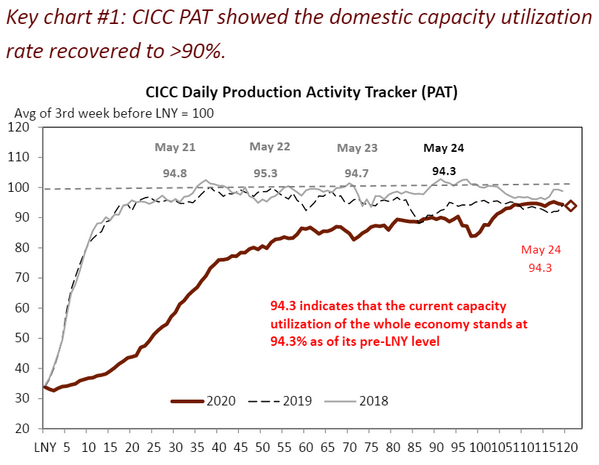

No one knows how the economy will recover and what sectors will make a full or partial comeback but, a lot can be learned from the China experience. Their overall economy has recovered to over 90% of capacity. [i]

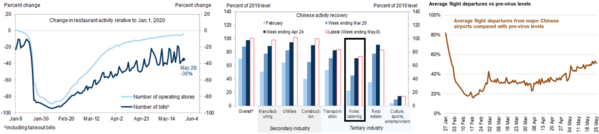

When looking at some of the areas still lagging in China, it is no surprise that restaurants, hotels, airlines are all dragging well below the 90% mark. [ii] [iii]

Let’s all face one simple fact: With consumption making up 70% of our GDP and nearly 60% of Chinese GDP, understanding consumer psychology is as important as understanding economic fundamentals.

So, feelings really do matter.

Put succinctly by Noble Prize-winning psychologist Daniel Kahneman, "If people don't know what they’re going to want, and they don’t know how they’re going to feel about what they get; then rational planning of action becomes extremely difficult." [iv]

Harvard University social psychologist Daniel Gilbert goes further, “We underestimate how quickly our feelings are going to change in part because we underestimate our ability to change them." [iv]

We build up a psychological immune system—of sorts—to bad news, during times we may be feeling pretty lousy. Applied to today, that lousy feeling might take the form of our current pandemic-driven lockdown or the incredibly difficult racial tension sweeping our country. Here is a link to the full study if you want to take a deeper dive.

Assuming this basic building block of human behavior persists, what might happen as we begin to feel better?

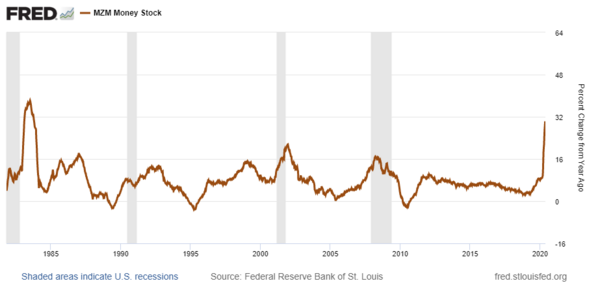

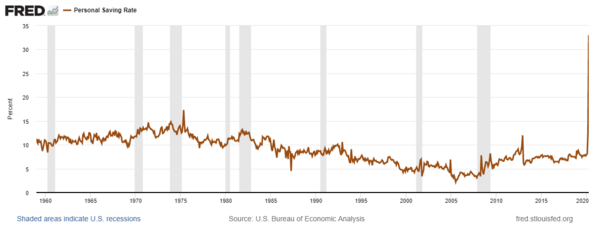

In my estimation, we could see a huge rush to consumption and likely investing. Just look at the various measures of liquidity which will find a more efficient home sooner or later:

MZM Money Stock, which measures the liquid money supply within an economy, is near record highs: [v]

The Personal Saving Rate, or the difference between income and expenses that can be applied to housing or investing, is also at record highs: [vi]

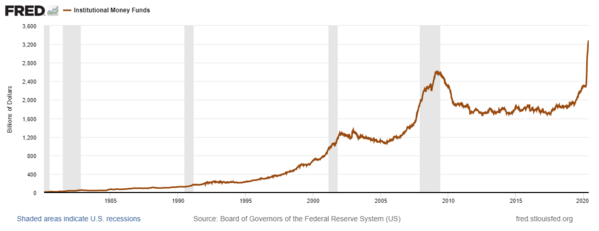

Institutional Money Funds, or money market funds used primarily by institutional investors and corporations, have shattered any measurable past record, topping $3.28 trillion last week: [vii]

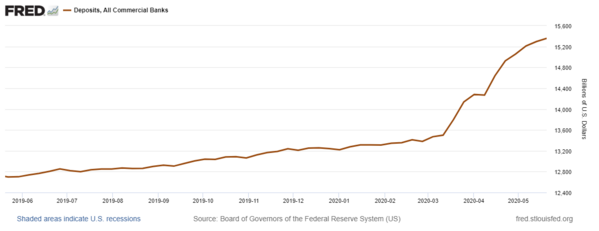

Add to this commercial bank deposits which are sitting at over $14 trillion: [viii]

The specific triggers for spending cash may indeed be more psychological than economic, such as:

- Returning to your job

- Seeing more activity in your community

- Driving

- Dining at restaurants

- The development of a Covid-19 vaccine

- Developing a defense against the virus without a vaccine

If people have no objective way to evaluate how they will feel in the future, it is hard to say they won’t feel better sooner than even they would expect.

Equity investing in the age of a global pandemic and widespread rioting may be more about gaining confidence in our own resiliency and belief that our negative feelings will not last as long as we would have previously believed.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://research.cicc.com/

ii. https://research.gs.com/

iii. https://about.bnef.com/

iv. https://www.apa.org/monitor/oct01/strength

v. https://fred.stlouisfed.org/series/MZM

vi. https://fred.stlouisfed.org/series/PSAVERT

vii. https://fred.stlouisfed.org/series/WIMFSL

viii. https://fred.stlouisfed.org/series/DPSACBW027SBOG