Q3 Look Ahead

As the third-quarter of 2019 begins, we hope you have a chance to review our Q3 2019 Look Ahead.

A link to the PDF presentation can be found here with a narrated version here.

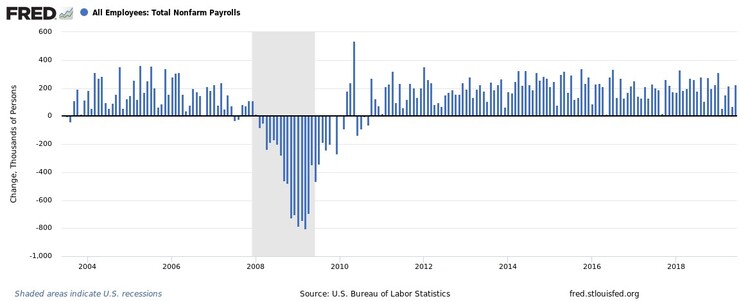

Friday released an amazing jobs report that might assuage investor anxiety around a slowing economy. [i]

But not so fast!

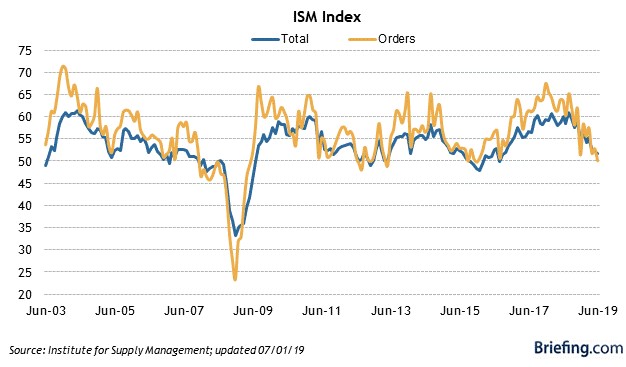

As you will see in our Look Ahead, global manufacturing is slowing. [ii]

Further, our belief is that Trump’s managed trade war will back the Fed into a corner, leading them to cut rates. Certainly, expectations are calling for a rate cut this year. [iii]

To see our forecast for rates going forward, click this link for a look.

Further, there is a downshift in GDP growth with the two largest economies – China and the United States. [iii]

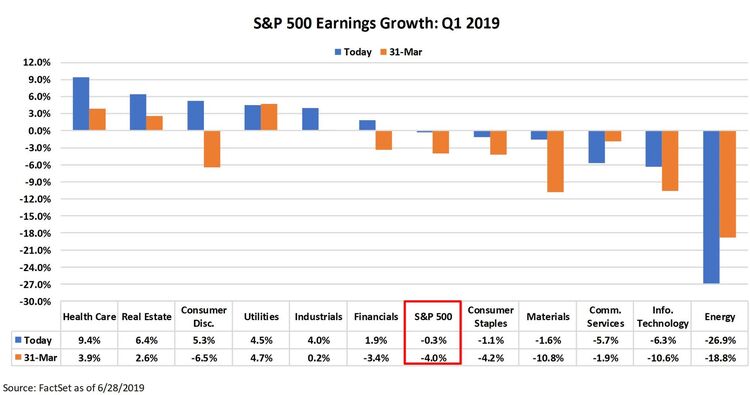

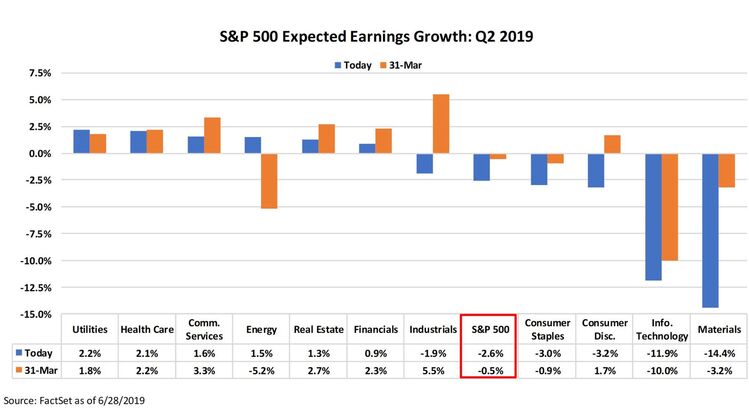

Fortunately, the ‘risk on’ approach investors have taken helps us work our way through what we believe is an earnings recession (defined as two-quarters of no earnings growth). [iv]

We hope you dive deeper into our views and share your ideas with us.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Resources:

i. https://fred.stlouisfed.org/graph/?g=olq7

ii. https://www.briefing.com/Investor/Calendars/Economic/Releases/napm.htm

iii. https://phillipsandco.com/files/6715/6262/4051/Look_Ahead_-_2019Q3.pdf

iv. https://www.factset.com/hubfs/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_070319.pdf