Q4 2024 Look Ahead- The Deep Breath Before the Pivot

As we turn the corner into Q4, the economic data paints a story of contrasts and transitions—a “two-speed economy” where consumers continue to spend, yet job growth is faltering. It’s a balancing act that will define the year-end and set the stage for 2026.

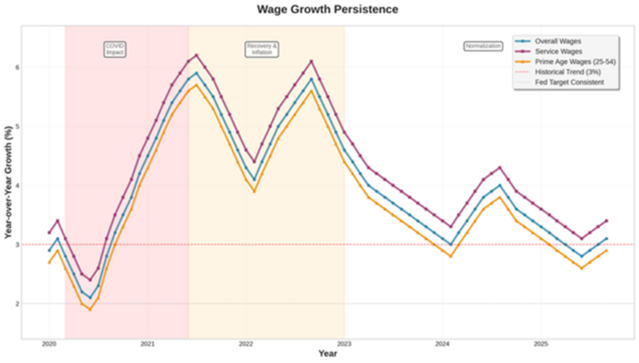

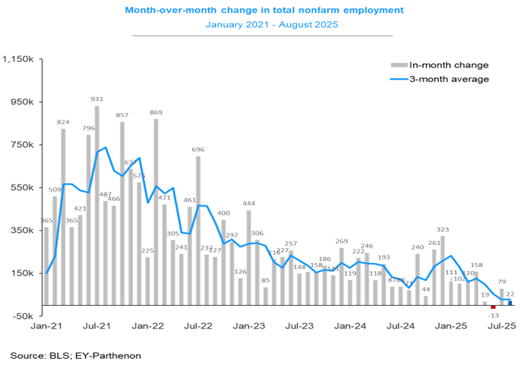

Take a look at the wage growth vs. job growth chart. Wages remain elevated, fueling spending power, yet the jobs chart shows growth essentially flatlining—and even turning negative after revisions. The message is clear: holiday consumption could make or break Q4 GDP.

Inflation Cools, Cuts Loom

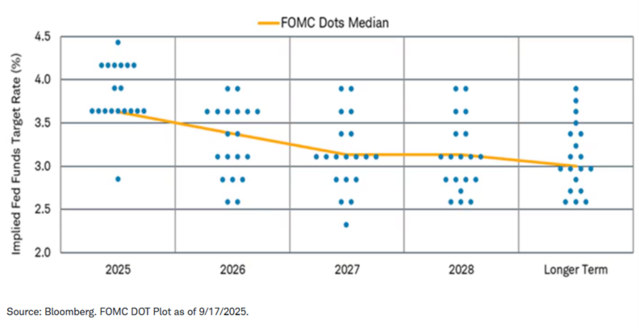

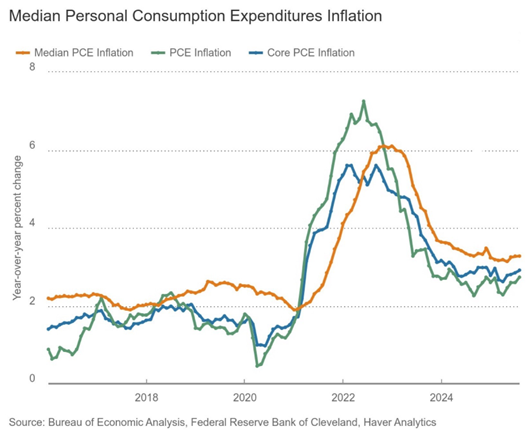

The Fed rate path chart shows policymakers planning two more cuts in Q4, targeting 3.75%. Inflation is sticky thanks to housing, but the broader trend is cooling. This is where policy meets markets—will lower rates reignite momentum?

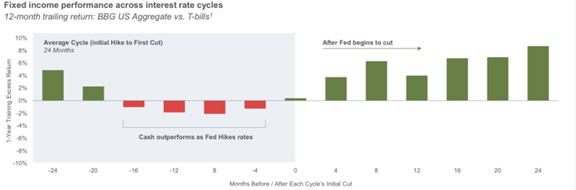

What’s Next for Fixed Income

Our historical bond market chart shows why fixed income is back on the radar. In past cycles, much of the return came in the first eight months after cuts begin. With over half of U.S. debt set to refinance soon, fixed income is no longer an afterthought.

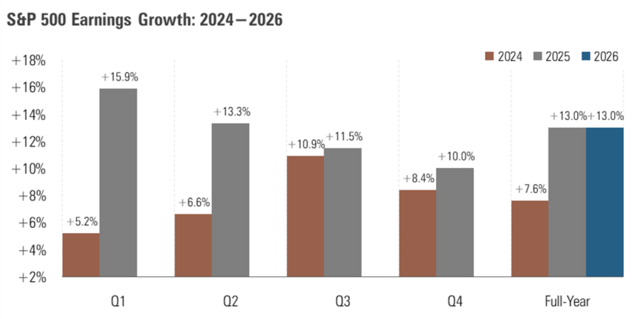

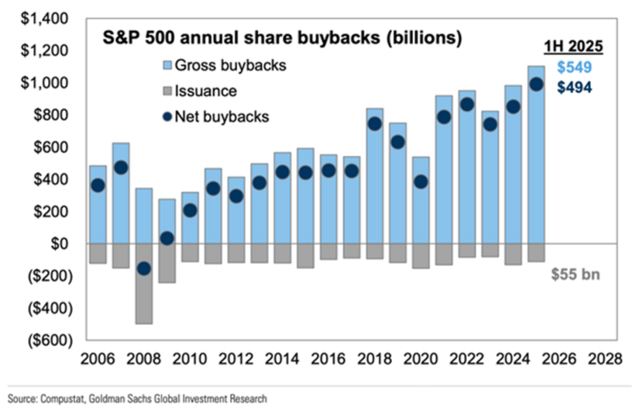

Earnings Momentum Meets Reality Check

The earnings vs. valuations chart tells a story of strength with caution. S&P 500 earnings are growing at 13% year-over-year, but valuations sit 21% above their 10-year average. Add in record buybacks and you’ve got a market where optimism meets reality.

This coming quarter isn’t about extremes—it’s about transition. Wages, Fed cuts, fixed income positioning, and earnings strength provide optimism. But valuations, debt, and jobs remind us that we’re walking a fine line.

Q4 2025 feels like the deep breath before the economy pivots into its next phase.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

The charts and data presented are sourced from a combination of public domain materials and licensed data providers. Their use is intended solely for educational and analytical commentary and falls within the scope of fair use. For a representative list of sources, please click here.

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.