Q4 Earnings Season: Tech Giants Take Center Stage

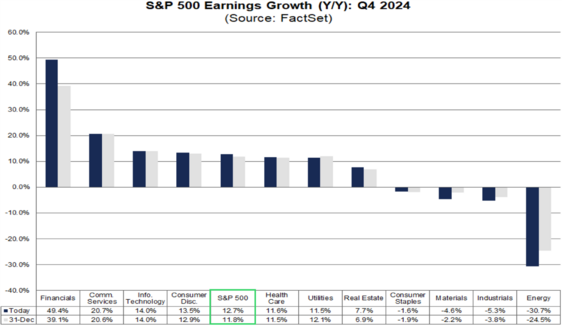

Despite this morning’s market turbulence sparked by Chinese startup DeepSeek’s low-cost AI model challenging tech valuations, the latest wave of Q4 earnings reports has injected fresh optimism into market sentiment, particularly following upbeat results from major financial institutions in the first two weeks of reporting. Of the S&P 500 companies that have reported at this point, 80% have beaten analyst expectations by an average of 7.3%, pushing expected growth for the quarter to 12.7%. 1

Market attention now focuses on earnings reports from the Magnificent Seven technology companies (Apple, Microsoft, Meta, Alphabet, Amazon, NVIDIA, and Tesla), which will shape market sentiment through early February. The reporting calendar begins Wednesday with Tesla, Microsoft, and Meta, followed by Apple's results on Thursday. The following week brings updates from Alphabet on February 4 and Amazon on February 6. 2

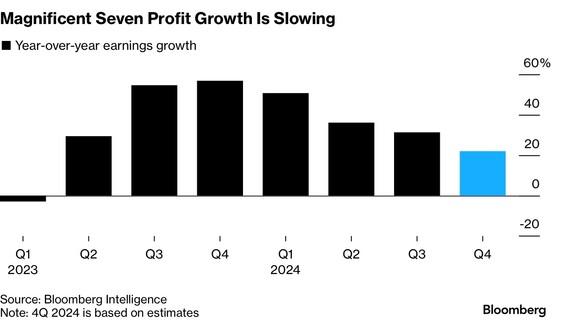

While the Magnificent Seven continue to deliver robust earnings growth that outpaces the broader market, analysts anticipate a moderation in Q4 performance. After three consecutive quarters in 2024 where profit growth exceeded 35%, these tech leaders are projected to deliver more modest – though still impressive – earnings growth north of 20%. 3

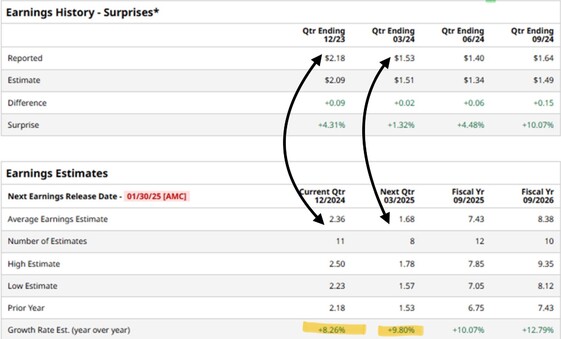

However, the year-over-year cycle of earnings comparisons will help a few companies, like Apple. Year-over-year comparisons demonstrate how base effects influence growth rates. For instance, Apple faced challenges in Q4 2023, primarily due to weakness in China. The company's Q4 2024 growth rate is expected to improve as it cycles past this softer comparison period from the previous year. 4

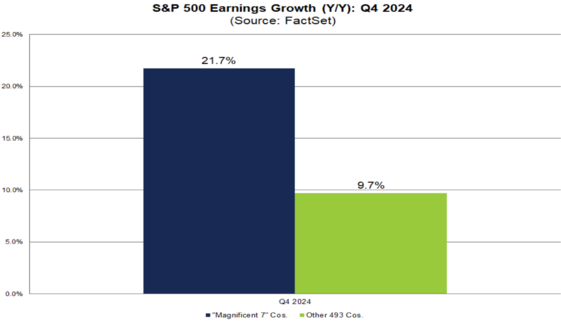

The impact of these seven companies on the overall market remains significant: excluding them from the calculation would reduce S&P 500 earnings growth for the quarter from 21.7% to 9.7%, highlighting their continued outsized influence on market fundamentals. 5

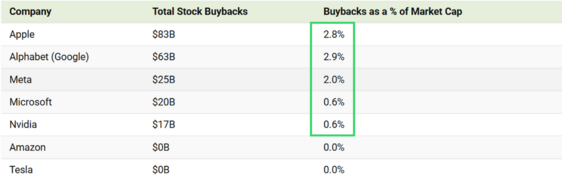

Additionally, major technology companies continue to repurchase their own stock at a significant pace, suggesting strong confidence in future growth prospects. 6

The upcoming earnings reports from the Magnificent Seven will be pivotal for market sentiment as these industry leaders navigate a transition from exceptional to more moderate growth rates. Despite this cooling pace, their aggressive stock buybacks and market-leading performance demonstrate sustained momentum for corporate America.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_012425.pdf

- https://x.com/eWhispers/status/1882791057491914852

- https://www.bloomberg.com/news/articles/2025-01-26/asia-eyes-cautious-open-as-tariffs-remain-in-focus-markets-wrap

- https://www.nasdaq.com/articles/heres-what-expect-apples-next-earnings-report

- https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_011725.pdf

- https://www.visualcapitalist.com/stock-buybacks-of-the-magnificent-seven/

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.