Q4 Look Ahead

As we wrap up a stellar third-quarter investment period, it’s time for our look ahead into Q4.

For an audio narration of our Q4 2017 Look Ahead, click here.

For a PDF of our Q4 2017 Look Ahead, click here.

Q2 earnings, which were reported from mid-July through mid-August, grew by 10.3 percent [i].

That’s a very strong number. As you can see from the chart of the S&P 500 during Q3 below, equity markets reacted to the strong earnings growth accordingly [ii].

We find it crucial to always understand what drives investment, and in the case of U.S. equities, it’s not complicated: consumption! Put another way, it’s the U.S. consumer.

Our Q4 Look Ahead suggests the U.S. consumer is looking strong, with more purchasing power left to unleash in Q4, barring some ‘system-shocking’ event.

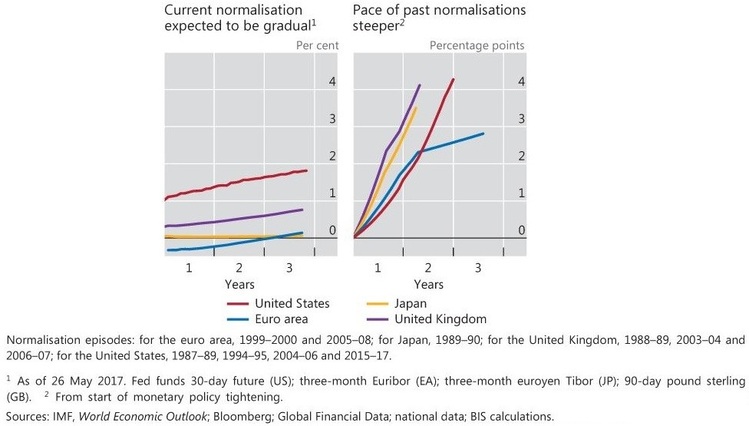

We also think the Central Banks throughout the world will likely begin to normalize their monetary policy, just as the United States began to in 2015 [i].

.

Much of the confidence in central banks’ ability to begin normalizing monetary policy has been driven by a resurgence of moderate inflation and a move away from the threat of disastrous deflation [i].

Rising inflation could likely lead to the strengthening of the U.S. dollar over the coming quarter, which may have a negative impact on earnings in Q1 2018 and beyond.

Without giving the entire Q4 Look Ahead away, we invite you to click the following link for an audio narration of our Q4 2017 Look Ahead.

We also discuss the potential for a ‘Trump Bump’ in Q4, driven by the President’s apparent desire to achieve some positive outcomes. In fact, his base might even support his bipartisan negotiation. Furthermore, on October 6, 2017, he reached out to Senator Chuck Schumer to discuss a possible compromise on Obamacare reform [iii].

We hope you click through to hear the narration of our Q4 2017 Look Ahead. If you prefer to peruse the data deck without the narration, click here to access the PDF. Please feel free to share with your friends and colleagues.

We always welcome referrals and your feedback.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Warm regards,

Tim Phillips, CEO, Phillips & Company

Robert Dinelli, Investment Analyst, Phillips & Company

References:

i. https://phillipsandco.com/files/9615/0756/3860/Look_Ahead_2017Q4_-_Final.pdf

ii. https://fred.stlouisfed.org/series/SP500#0

iii. https://twitter.com/realDonaldTrump/status/916638685914951680