Rates & Returns – Regime Change or Not?

There is an inflection point, of sorts, occurring in U.S. capital markets these days. It is abundantly clear that investors are facing a choice with respect to interest rates and equity returns. We anticipated much of this when we published our Q1 2021 Look Ahead.

A period of time where interest rates might be rising could put a damper on fixed income returns and diminish equity returns. Frankly, rising rates force investors to make capital markets decisions between investing in fixed income or equites.

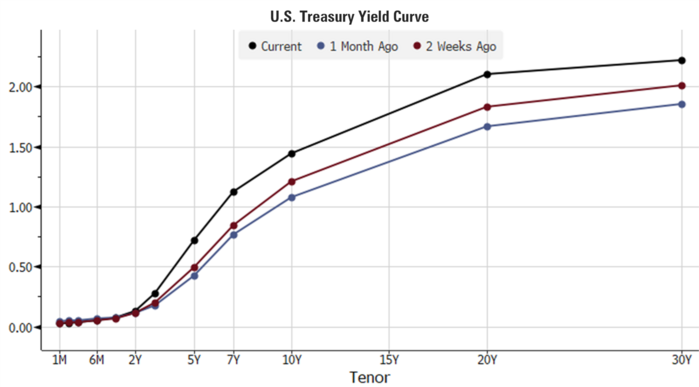

First, looking at interest rates, they have been on the rise for the last month. [i]

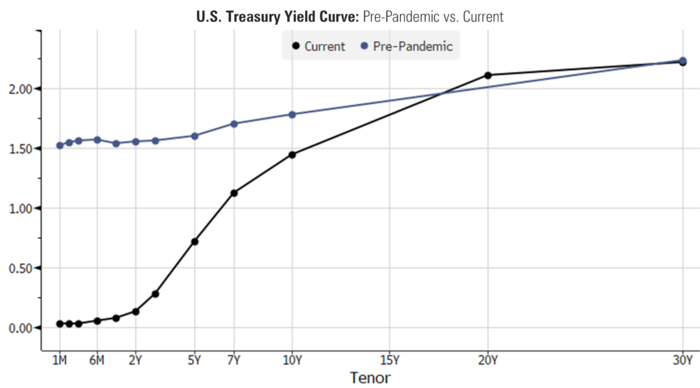

The steepening of the yield curve almost matches where we were just before the pandemic. [i]

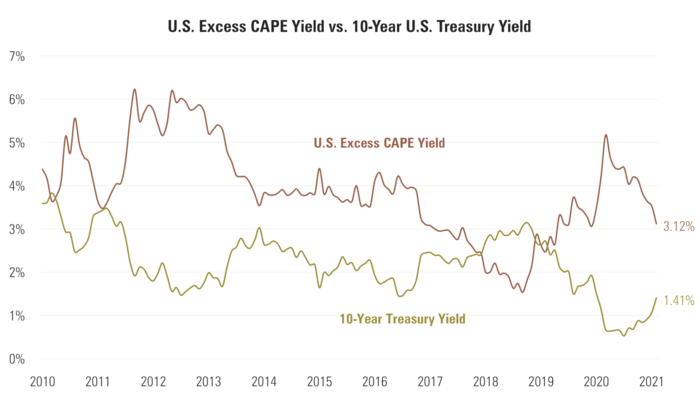

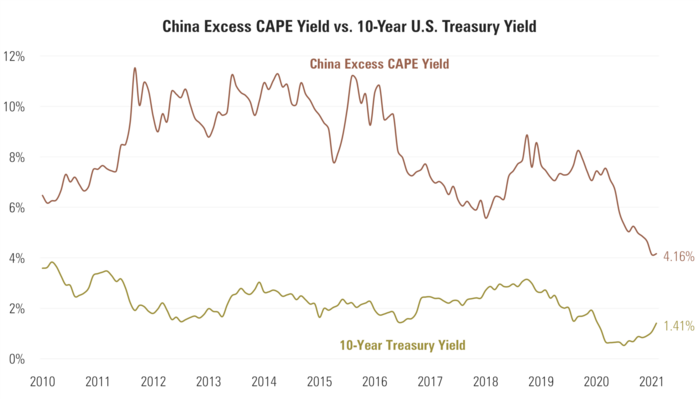

Investors are faced with looking at the yields on fixed income compared to the “earnings yield” (earnings over price) on stocks to see the risk premium for stocks over bonds. [i] [ii]

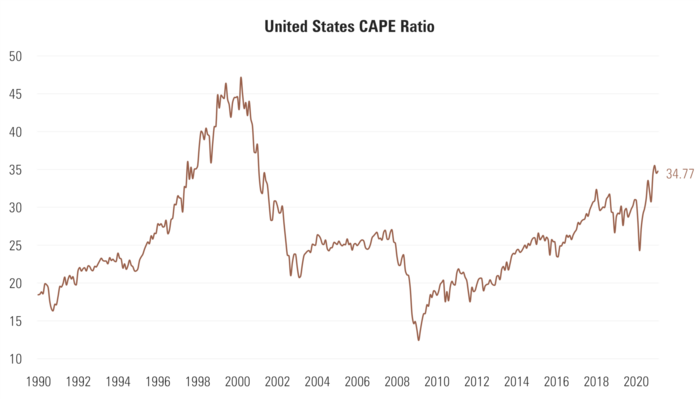

Looking at this dichotomy from another perspective perhaps gives us a different view. In a recent paper published by Robert Shiller, Ph.D. on his famed valuation ratio called CAPE, he suggests that we might not be in as difficult a paradigm as conventional wisdom suggests.

CAPE is a measure of the price to earnings ratio but adjusted for inflation. Put another way, it is the historic valuation of a company’s earnings minus inflation over a 10-year period.

Here is the current CAPE ratio for the U.S. equities. [iii]

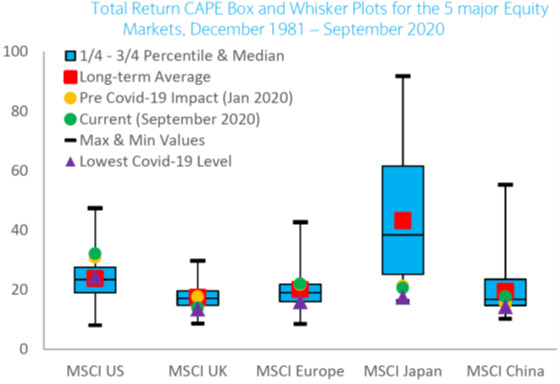

Now looking across the globe (taken from Shiller’s paper) we can see how the CAPE ratios of various markets look. [iv]

U.S. equities look to be at the highest levels (green dot)—well above their long-term average (red box) but, certainly below the Max value (top line). China and Japan on the other hand, look to have the best valuations, with China offering up the most upside to its max.

Taking this one step further, similar to the risk premium, we can take the cyclically-adjusted earnings yield and subtract the 10-year Treasury yield to see how much more premium you get for holding stocks over bonds.

In the case of the United States, the spread is 171 basis points. [iii]

In the case of China, the spread is 275 basis points. [iii]

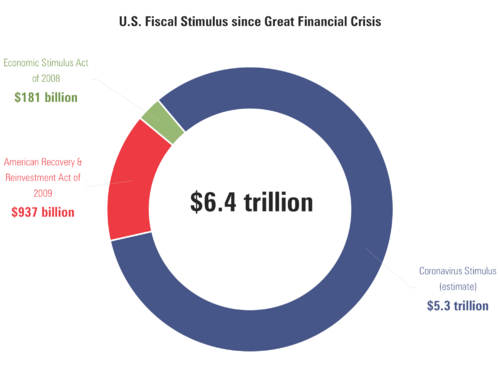

It’s my view that rates are going to rise and the Fed will be forced to adopt some form of yield curve control to dampen the long end of the yield curve. That is, if they don’t want to waste the $6+ trillion in fiscal stimulus over the past 12 years trying to save the economy from various disasters. [v]

The focus of their effort will continue to be full employment over inflation and, from that perspective, this will be more about new monetary tools than a regime change in rate policy. While they may appear modest, the conditions for continued equity appreciation may still exist.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

ii. https://www.bloomberg.com/quote/SPX:IND

iii. https://indices.barclays/IM/21/en/indices/static/historic-cape.app

iv. https://indices.barclays/file.app?action=shared&path=qis/insights/qis-insights-cape-covid.pdf

v. https://www.pgpf.org/blog/2021/01/heres-everything-congress-has-done-to-respond-to-the-coronavirus-so-far