Real Earnings Growth vs. Beating Expectations

As we start the 2016 Q3 earnings report season, it's prudent to take a look at how this third quarter might turn out. Now that the election outcome is looking a little more certain and "status quo" oriented, market participants might take this time to start turning their attention toward earnings.

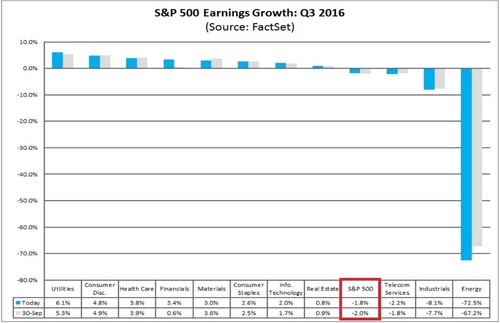

Expectations are for Q3 earnings continue the 5 quarter trend of declines. FactSet expects earnings to decline by -1.8% this quarter, making Q3 the 6th consecutive quarter of the current earnings recession. [i]

Perhaps a review of some macro themes that drive earnings can shed some light on what's to come.

One of the biggest drags on earnings has been the strength of the dollar. On a year-over-year basis, the U.S. Dollar has been about flat, compared to other currencies. [ii]

This should help companies that are very dependent on exports which make up 31% of S&P 500 companies revenue. [iii]

The other major drag on earnings over the last 5 quarters has been energy. Energy represents 7.3% of the S&P 500 and has created a significant drag on the macro earnings. The energy sector is expected to report the largest year-over-year decrease in sales for the quarter at -13.0%. [iv] [v]

However, oil prices have basically stabilized on a year-over-year basis. In fact, they have rallied 85% off the bottom, which was set this year on 2/11/2016. [vi] [vii]

Macroeconomic growth is also looking better. When comparing GDP growth on a year-over-year basis, growth was 1.2%. Looking to Q3 2016, expectations are for growth to accelerate to 2.6%. [viii]

Furthermore, bottoms up earnings-per-share expectations, comparing this year to last year look only slightly negative for Q3, and are forecasted to have growth in Q4. [ix]

Outside of Energy, a significant drag on earnings may be the large drop in interest rates. The 10-year Treasury rate is down -22% on a year-over-year basis. Rates have not risen as the Fed had hoped when they started their rate increase cycle, but instead have fallen quite sharply. [x]

Overall, I believe that macro trends favor a surprise to the upside on earnings expectations in the coming weeks. Frankly, it would be just in time to offset one of the most dysfunctional elections in our history.

Crossing over into a growth period is certainly in question. However, if there is a chance, the macro themes suggest it could happen with this next round of earnings reports.

Real earnings growth might just finally trump, beating expectations.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Chris Porter, Senior Investment Analyst – Phillips & Company

References:

[i] http://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_10.14.16

[ii] https://fred.stlouisfed.org/series/GDPC1#0

[iii] http://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_10.14.16

[iv] http://us.spindices.com/indices/equity/sp-500

[v] http://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_10.14.16

[vi] https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=RWTC&f=D

[vii] https://fred.stlouisfed.org/series/GDP

[viii] http://www.nasdaq.com/markets/crude-oil.aspx?timeframe=1y

[ix] http://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_10.14.16

[x] https://fred.stlouisfed.org/search?st=10-Year+Treasury+Constant+Maturity+Rate