Repricing is Painful, but Necessary at Times

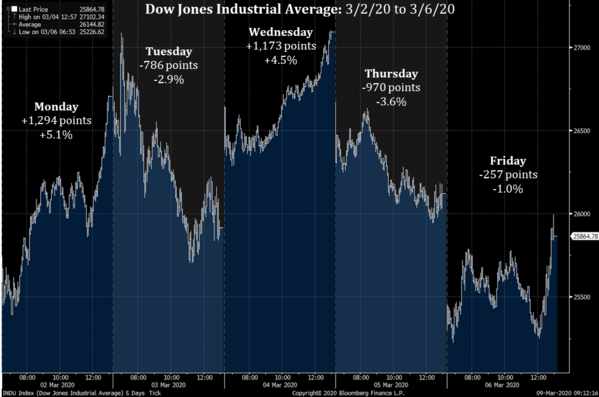

The last week was as anticipated…volatile. (see our Special Panic Edition blog here). We had days that were up over 1,000 points and days that were down more than 900 points on the Dow Jones Industrial Average. [i]

To most investors, this would look like erratic, emotional behavior by investors—and perhaps there is some truth in that.

To me, this is just a process that investors go through when trying to value future cash flows from companies they own or would like to own. At the end of the day, when we buy stocks future cash flows (future earnings, dividends, and stock buybacks) is all we own.

To that end, you can only imagine how hard it is to discount those cash flows in the face of the coronavirus with unpredictable macroeconomic implications.

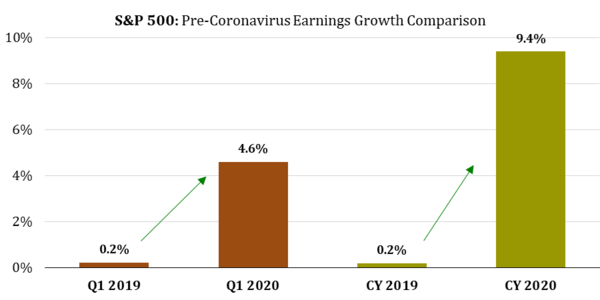

Let’s start with expectations for Q1 and full-year 2020 earnings. Those looked promising coming into this year. [ii]

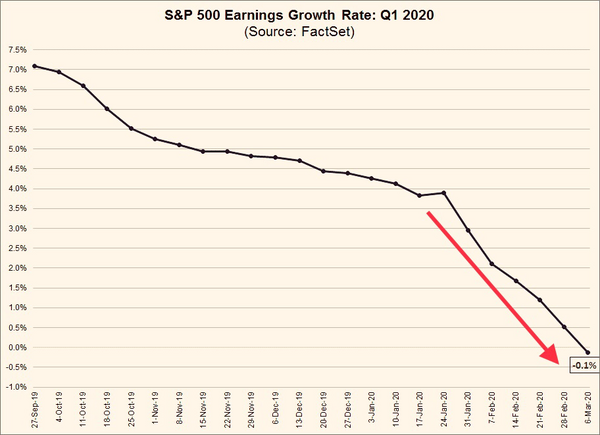

Now compare that to the noticeable deceleration in earnings expectations for Q1 over the last several weeks. [iii]

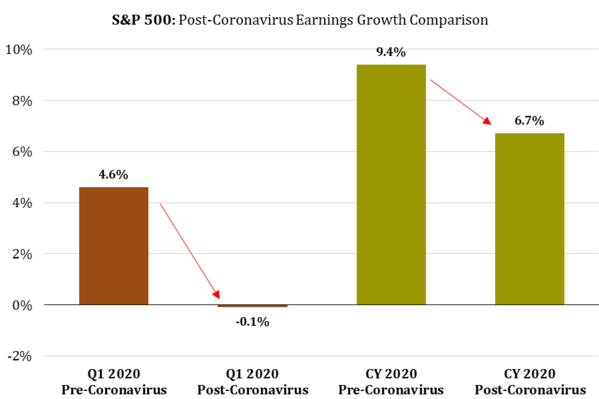

Looking at the quarter-over-quarter and year-over-year comparisons now, you can see a downshift in expectations. [iii]

The fact is companies and analysts have been adjusting down earnings over the last few weeks as the virus has taken center stage. Imagine how hard it would be to discount this continued flow of negative adjustments. Now you know why we have the volatility that we have.

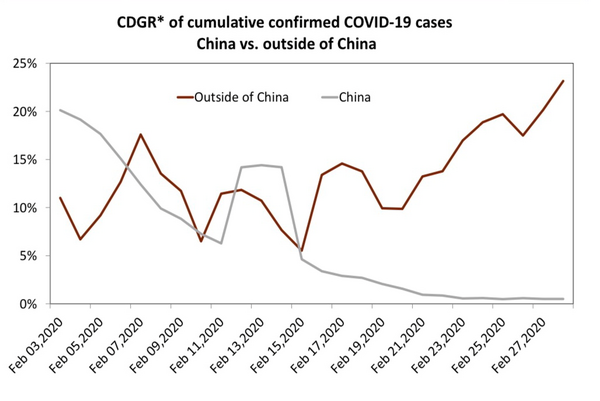

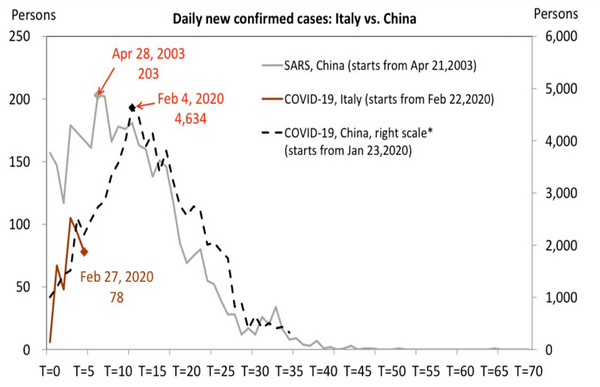

Let’s roll forward to what’s ahead. While we cannot know what the ultimate outcome will be on the depth and breadth of the coronavirus in the United States, we do have one successful model to look toward… China. China is successfully battling the spread of the virus by sacrificing parts of their economic expansion. By taking decisive action, they are now close to full eradication of the virus. [iv]

A one-time cut to Chinese GDP growth of between 1% and 3% would be expected.

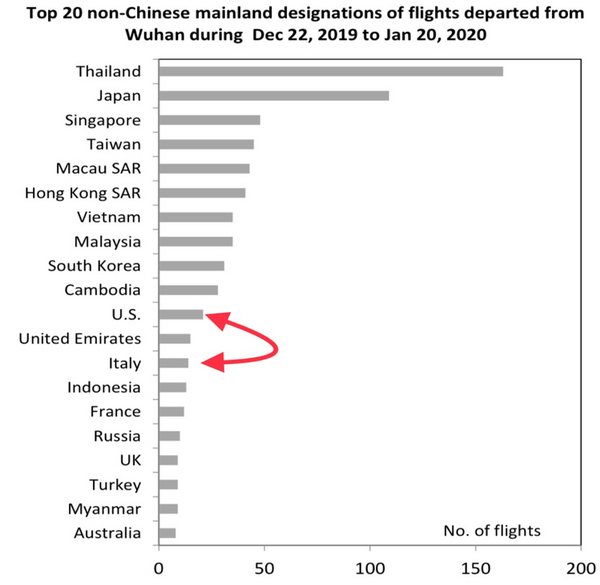

Turning to the United States, we should expect a sizable increase in those infected with the virus, perhaps along the lines of what is currently happening in Italy. If you consider the source of the virus to be from Wuhan, China then the following table sheds some light on the possible exposure. [iv]

Flights from Wuhan to the United States during the incubation period look as significant as Italy. Perhaps we should expect a similar exposure level in the United States simply based upon the source flights from Wuhan.

China has been able to nearly eradicate the virus in just 40 days by using draconian quarantine measures. We are now seeing similar responses in Italy and we should anticipate the same in parts of the United States.

Market participants will certainly be digesting and discounting future cash flows based upon the facts and the nearest examples we have (Italy and China). [iv]

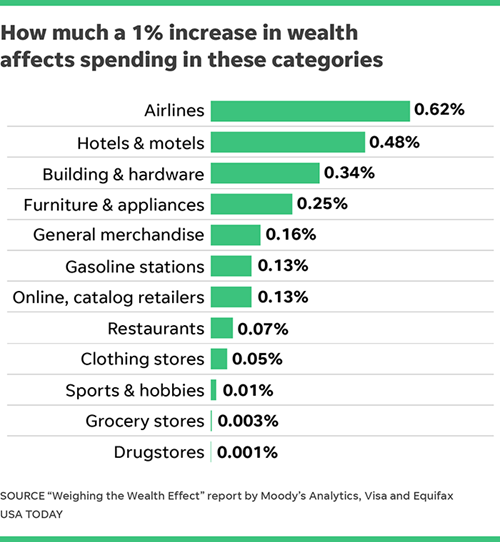

This will lead to some impact on our feeling of wellbeing from a financial perspective. Simply put, when you feel wealthy you spend more and the inverse is true as well. [v]

When people feel wealthy, they spend on travel and leisure (hotels, airlines). We can safely assume when people feel less wealthy, they cut spending in these categories. In fact, the S&P 500 has declined by about 17% from its the peak on February 19th, temporarily wiping away approximately $9 trillion in wealth.

The coincidental news with this inverse wealth effect is the virus impacting the same discretionary categories (travel and leisure)—Just over $1 trillion dollars in spending or about 5% of our total GDP. [vi]

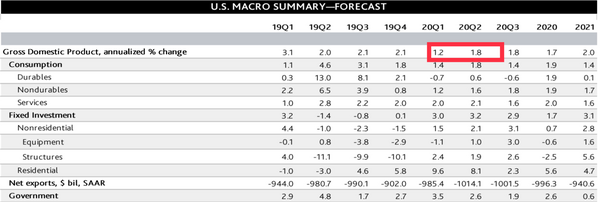

Assuming our outbreak matches Italy and that we delay rolling quarantines, we might see a 2% hit to GDP growth between Q1 and Q2. While it is unlikely to put us in a recession, it might put us pretty close. Looking at Moody’s GDP expectations from February 11th, we can see GDP growth was muted but, still positive. With a hit to travel and leisure split between Q1 and Q2 we could see near-zero GDP growth for that period of time. [vii]

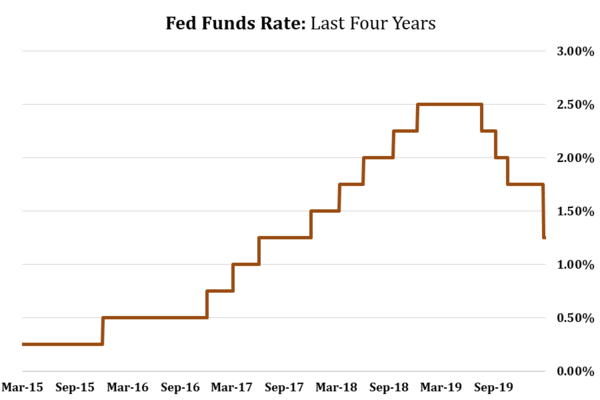

Perhaps that’s why the Fed cut interest rates by 50 basis points last week. [viii]

The rate cut won’t cure the virus however, it will act as a prophylactic in the coming months in case we face an Italy-style outbreak. There is a lag effect to interest rate cuts and perhaps the lead time for this cut will coincide with the peak pain threshold we might face 40 to 60 days from now.

While there may be an inverse wealth effect, it might be short-lived and not too deep. Of course, that is simply impossible to predict.

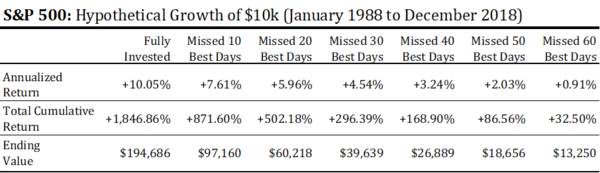

Recall, if you miss just a few days of the market exposure you can miss all the advantages. [ix]

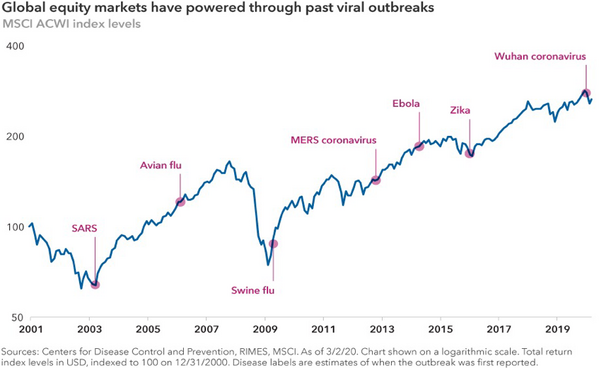

Further, if you look at past virus outbreaks, you can see they only look like small blips on the overall wealth generation equity investing can deliver. [x]

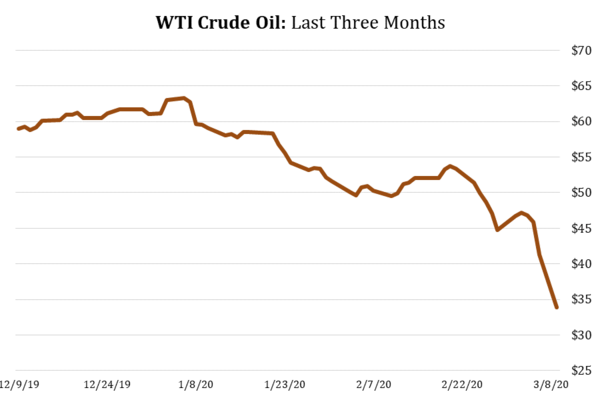

Let’s also remember the Federal government has tremendous fiscal resources to stimulate our economy and provide relief if the political circus can take a break and focus on the best outcomes for Americans. Inflation is off the table for now, especially as you can see a significant drawdown in oil prices based upon the breakdown in talks between Russia and OPEC+ this weekend. Energy might be cheap and that will be helpful to stimulate spending and growth in the United States. [xi]

So, what should investors do at this stage?

• Re-examine your plan and make sure your spending can withstand a reasonable drawdown in your portfolio. Weathering the one-time implications of the virus should be front and center. Your advisor should help you with that.

• If you have avoided anchoring to a plan, get one done now! Flying blind in the face of these dislocating events can be disorienting, in turn leading to poor decision-making.

• Rebalancing your portfolio is critical when asset classes get cheaper. If you have a balanced portfolio you will likely see your fixed income holdings with positive returns in the short run and equities down. Rebalancing is key.

• We bias toward Emerging Markets as they represent better valuations, better earnings growth, and specifically China as it emerges early from the impact of the virus.

• Finally, if you can add to your retirement savings or your taxable portfolio in the form of averaging in, do that selectively over this uncertain period if you have a holding period of five or more years.

Knowing why sudden repricing can occur might reduce anxiety, allowing you to step out of the moment and view the current environment objectively. It takes time and, fundamentally, that’s what you need when investing in equities; allow time to shape risk.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.bloomberg.com/quote/INDU:IND

ii. https://www.factset.com/hubfs/Resources Section/Research Desk/Earnings Insight/EarningsInsight_122719.pdf

iii. https://www.factset.com/hubfs/Resources Section/Research Desk/Earnings Insight/EarningsInsight_030620.pdf

iv. https://research.cicc.com/

v. https://www.thundertech.com/blog/March-2018/The-Wealth-Effects-Effect-on-Destination-Marketing

vi. https://www.ustravel.org/answersheet

vii. https://economy.com/

viii. https://www.bloomberg.com/quote/FDTR:IND

ix. https://www.zacksim.com/perils-moving-investments-cash/

x. https://www.capitalgroup.com/advisor/insights/articles/how-stay-calm-when-markets-stumble.html?cid=sm_og_fb_sf_cap_ci_6292026

xi. https://www.bloomberg.com/quote/CL1:COM