Retail Therapy

On Thursday, February 14, 2019, investors will get an advanced look at retail sales numbers from the December 2018 holiday shopping season. Retail sales numbers are one of many economic indicators to which investors should pay attention. Retail sales provide a unique glimpse into the behavior of consumers.

With 70 percent of the U.S. economy driven by consumption, it is important to understand the portion of consumption attributable to retail sales. Retail sales constitute 31.2 percent of consumption and a hefty 21.3 percent of overall GDP. [i]

The consensus expectations for retail sales in the upcoming report projects monthly growth of 0.20 percent. For the full year 2019, Kiplinger expects retail sales growth of at least 4 percent year-over-year. [ii] [iii] [iv]

The 2019 forecast for retail sales, at 4 percent growth, is a small downshift from 2017 and 2018. However, it is important to keep in mind that next year’s forecast remains well above the long-term average.

The advanced look at retail sales should provide investors with a decent indication of what to expect for Q1 2019 U.S. GDP. Current Q1 2019 GDP growth is forecasted at 2.17 percent. This suggests more muted growth compared to prior quarters, but that is not a big surprise given the seasonality effect in Q1 GDP numbers. [v]

As you can see, based on the seasonality effect, Q1 GDP is typically the slowest quarter of growth. [i] [v]

Moreover, comments by The Conference Board show that trade tensions with China and the on-again-off-again U.S. government shutdown are contributing to increased business uncertainty. That, coupled with higher operating costs, will reduce business profitability in 2019, which is likely to slow U.S. GDP growth in 2019. [vi]

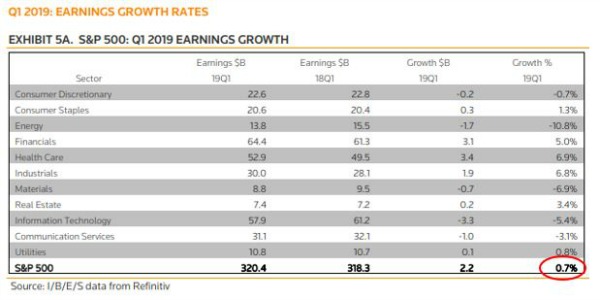

Retail sales can also be an early indicator of what corporate earnings growth could look like. As it stands, Q1 2019 earnings growth looks to be nonexistent at 0.70 percent. [vii]

Meanwhile, my view is that market participants are looking past a relatively dismal Q1 earnings season and focusing on growth reemerging later in the year. [viii]

It seems like a lot could be riding on this week’s advanced look at retail sales. This announcement should provide an early look for investors as they prepare for Q1 GDP and Q1 corporate earnings. Healthy retail sales will likely pave the way for an upside surprise. But remember, any disappointment in retail sales could also give investors an early look at a slowing U.S. economy.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Robert Dinelli, Investment Analyst, Phillips & Company

References:

i. https://www.bea.gov/system/files/2018-12/gdp3q18_3rd_1.pdf

ii. https://www.census.gov/retail/marts/www/marts_current.pdf

iv. https://fred.stlouisfed.org/series/RSAFS#0

v. https://www.newyorkfed.org/research/policy/nowcast

vi. https://www.conference-board.org/data/usforecast.cfm

vii. http://www.trpropresearch.com/pdf/This_Week_In_Earnings.pdf/