Return to Normal

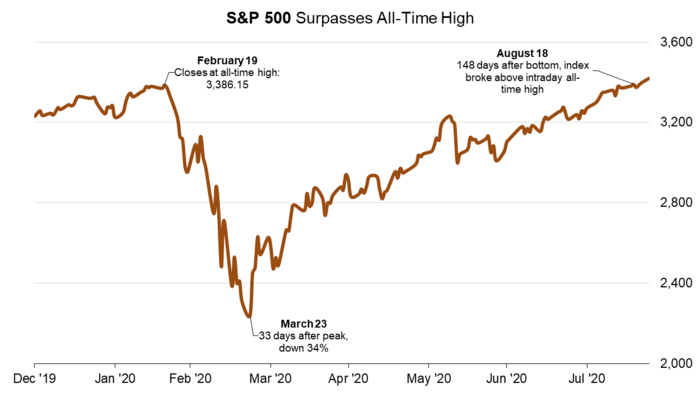

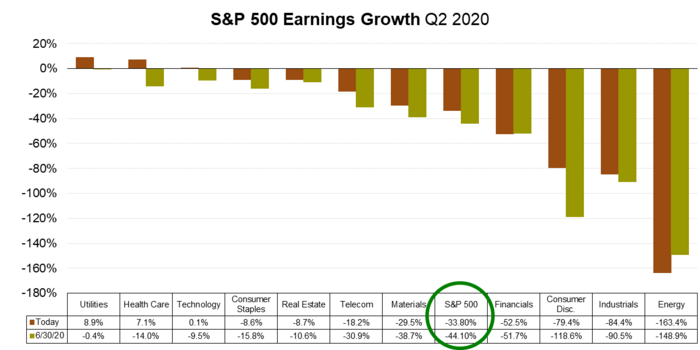

When we’ve talked about a return to normal, one of the last things we would think of is a return to all-time highs on the S&P 500. But, that is exactly what occurred last week, 148 days after bottoming, the S&P 500 broke above its all-time high on August 18th! [i]

This has most market watchers, investors, and prognosticators baffled. However bizarre this might seem during a global pandemic, perhaps it reflects investors’ collective belief: Things should return to normal once we get past the virus and that should include the S&P 500.

People are People

If you’ve done any extensive traveling you know one immutable truth; humans are more similar than dissimilar. We all want a better life for ourselves and our family, we want a better standard of living, and a sense of community and security. That’s true in Oregon, Kazakhstan, or remote Amazonian villages.

We have often looked at China as a guidepost to a return to normal and tracked their progress.

Just last week in the city of Wuhan―the origin of the virus―it appears many of those citizens wanted to get back to normal. For Wuhan’s millennial generation, it was attending a massive pool party. [ii]

You can see there appears to be a compelling desire to get back to normal, with zero compunction to socially distance or wear a mask.

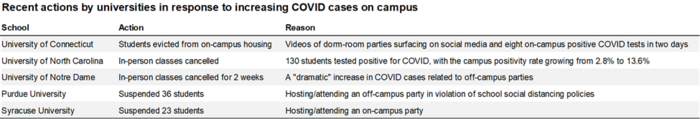

I would suspect that is also the case here in the United States, with several universities announcing suspensions, expulsions, and closures due to young adults wanting to just get back to normal. [iii]

I’m sure this does not provide comfort to many reading this blog. To me, this is the essence of our economic recovery.

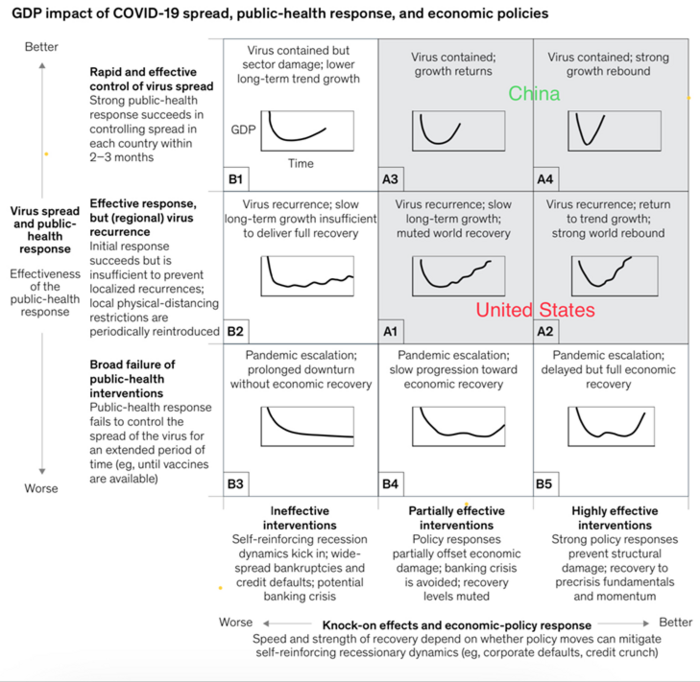

Turning to the global leader in consulting, McKinsey, where they seem to have captured the multiple versions of an economic return to normal: [iv]

While China had the governance and culture to force a long, hard lockdown, the United States had a more geographic response to reflect our liberal democracy. One led to an immediate recovery while the latter has had a slower progression. Nonetheless, people are still people―whether from Florida, California, Montana, or Wuhan.

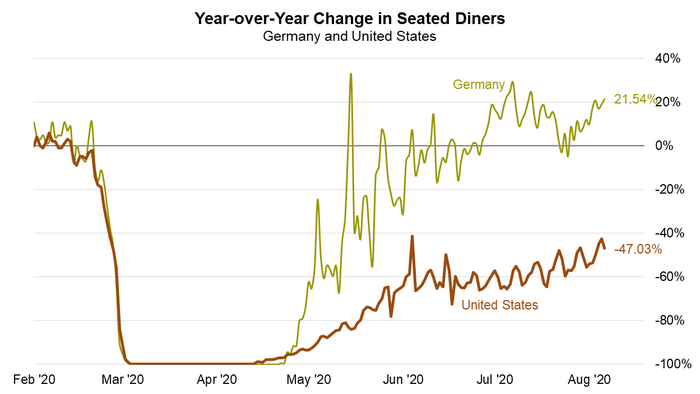

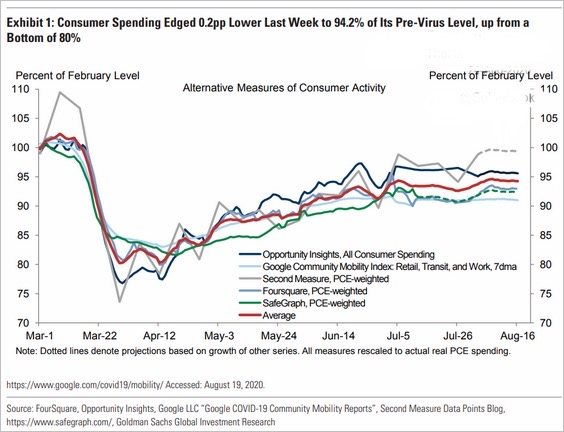

People want to get out and do the things they want to do, mostly all require spending money and consuming. That’s reflected in two of the most troubled industries: dining out and traveling. Both continue to show signs of a recovery—albeit a bit stalled out currently—with hopes of a reacceleration soon.

Restaurants are on a strong comeback when looking at bookings in the United States. Even more proof that people are similar, is found by comparing that to German bookings. Germany made a full recovery from a year ago and we can expect the United States to do the same. [v]

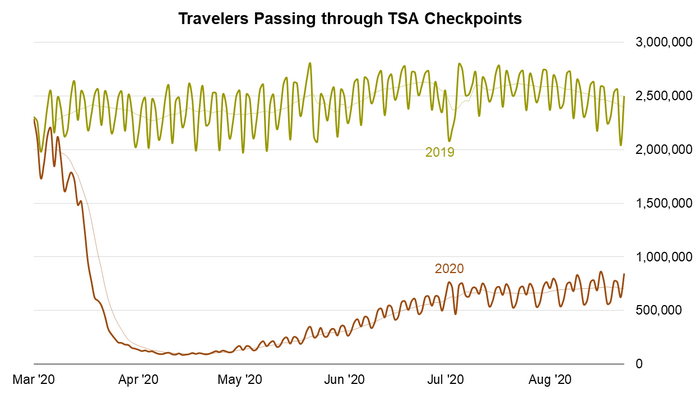

Air travel is also similar, with a recovery in progress. [vi]

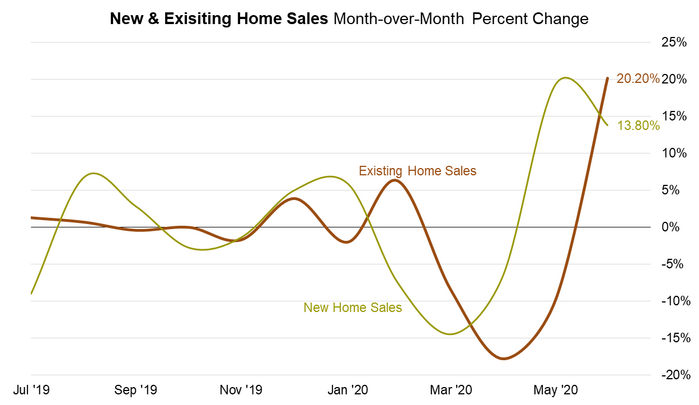

Housing continues to recover, with homebuyers ramping up their purchases of properties in July. Likewise, mortgage purchase applications have been hovering near their highest level in a decade as attractive financing costs continue to encourage homebuyers to re-enter the market. [vii] [viii]

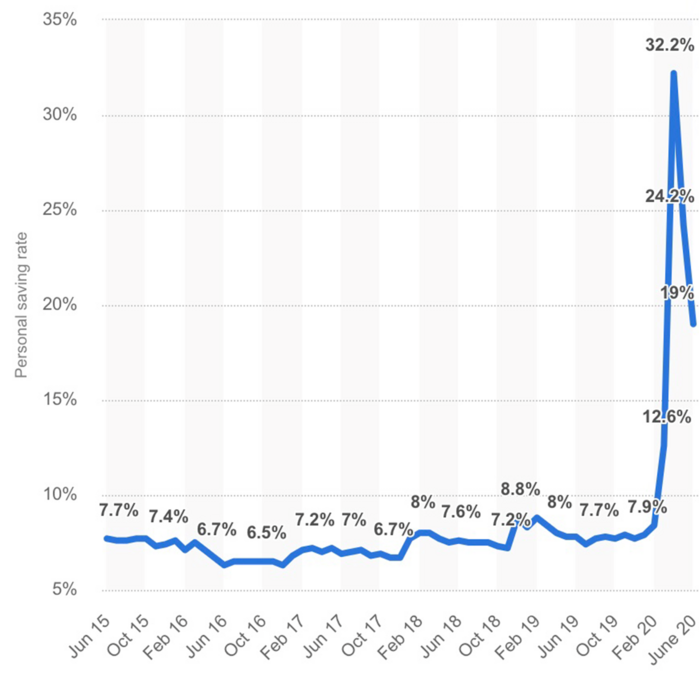

Further, the U.S. Consumer is still sitting on substantial savings compared to pre-COVID. Evidentially, they are also willing to spend down that savings even considering the uncertainty of the current environment. [ix]

Just consider these numbers:

- When the U.S. Consumer spent down their savings from 32% to 19% of disposable personal income in June that was $2.34 trillion, or 10.8% of 2019 GDP.

- If the U.S. consumer continues to spend down their savings from here back to the pre-pandemic level of 7.9%, that could potentially add an additional $1.97 trillion, or 9.1% of 2019 GDP this year

i. https://www.bloomberg.com/quote/SPX:IND