Returning to the Normal Noise

It would appear the cataclysmic “debt ceiling” debate could be in our rear-view mirror. However, never underestimate the ability of Congress to snatch defeat from the jaws of victory. I’m not suggesting higher debt and borrowing are good for our economy, but not paying our debt is 100% bad for America.

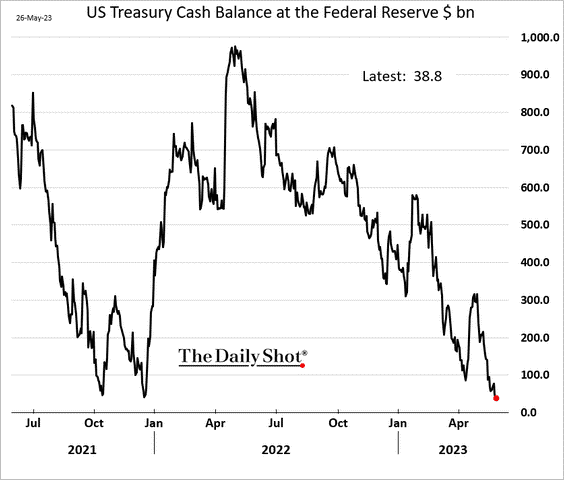

While Congress is cutting it close as the Treasury runs out of cash in the coming week, equity markets are likely to greet the final passage of the bill with a resounding yawn. 1

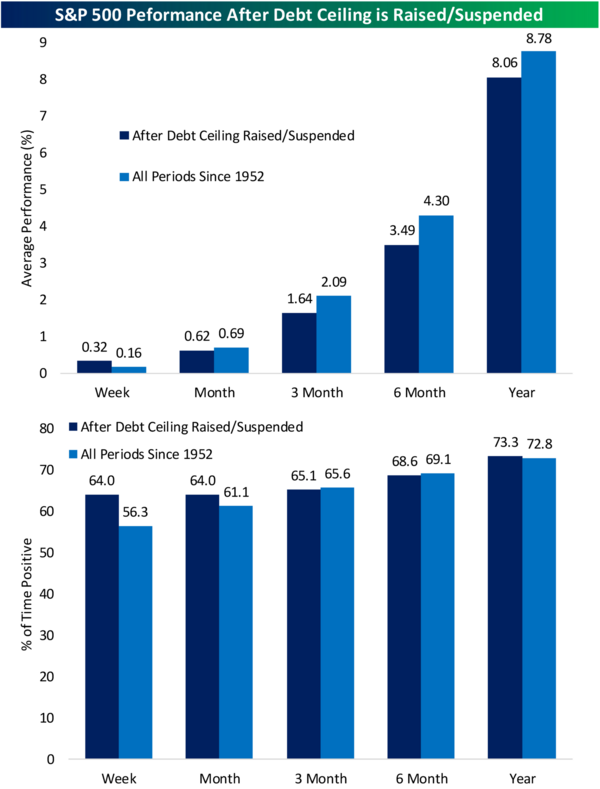

Our friends at Bespoke did a little historical fact-checking on market returns post-debt ceiling deals. Here’s what they found. Equity markets quickly digest the news and returns revert to the average after passage. 2

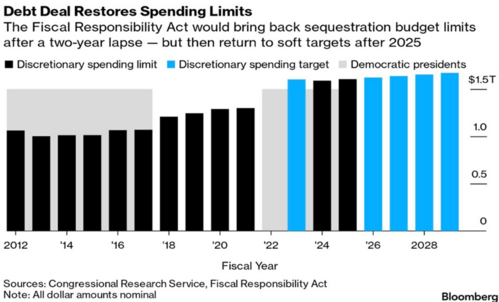

The macroeconomic impact from the current sequestration deal might provide a little drag to GDP as government spending gets a dose of constraint in the coming two years. It’s hard to know how these fiscal maneuvers translate into the real economy. Sequestration is a familiar term from the Obama-era spending limits. 3

While it slowed the pace of the economic recovery coming out of the Great Financial Crisis, it didn’t dampen the long-term equity return picture. 4

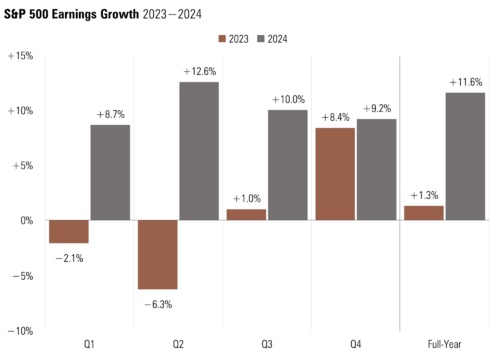

So, let’s pivot (or hope we can) to what’s next: rate hikes, recession talks, and China. However, what’s next may not be what matters most. What matters most is earnings. 5

Earnings estimates suggest earnings are poised for a strong recovery regardless of one more rate hike, recessionary fears, and geopolitical drama. It’s certainly much easier being a very long-term investor focused on earnings than trying to maneuver through all of the noise.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: