Rising Rates No, Rising Inflation Yes

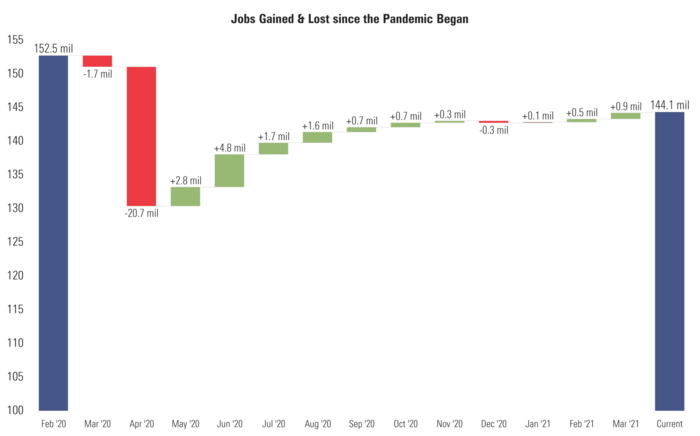

Adding nearly 1 million jobs in the latest jobs report (including revisions from the prior month) would suggest we are fast on our way to a full recovery. [i]

Under normal circumstances, investors would be quick to conclude rising rates are on the horizon to stem fast-approaching inflation– especially if you consider the historic amounts of stimulus.

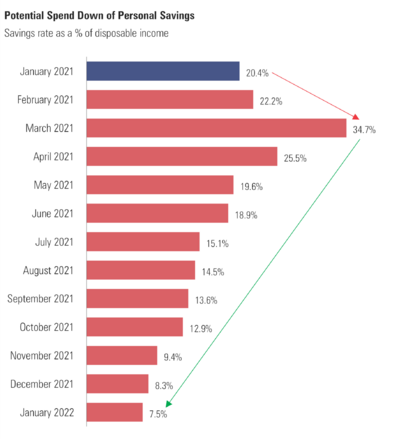

We know the $1.9 trillion in stimulus will be deployed over the coming year as long as consumers don’t take the replacement income and turn it into precautionary savings. [ii]

In fact, it could add $2.65 trillion to our economy in the coming year.

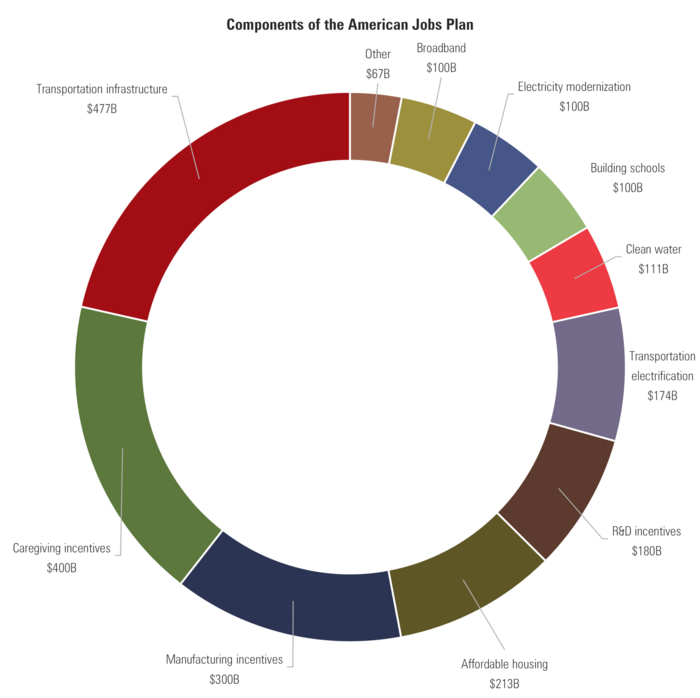

Further stimulus in the form of an infrastructure spending bill to the tune of $2.3 trillion will be another additive. [iii]

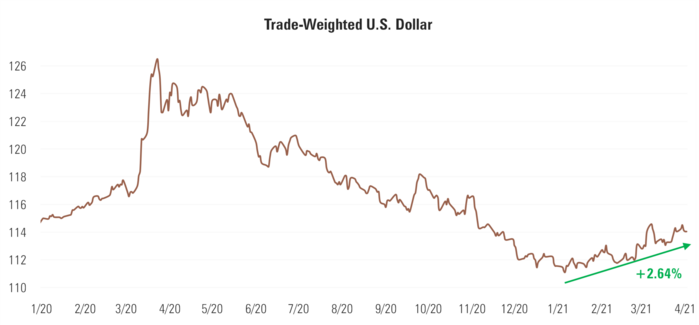

Before we address the threat of rising interest rates, let’s address the challenge of a rising U.S. dollar. With such massive fiscal support, the U.S. Dollar will likely be rising as we need foreign investors to fund our massive debt levels by buying U.S. Treasuries. [iv]

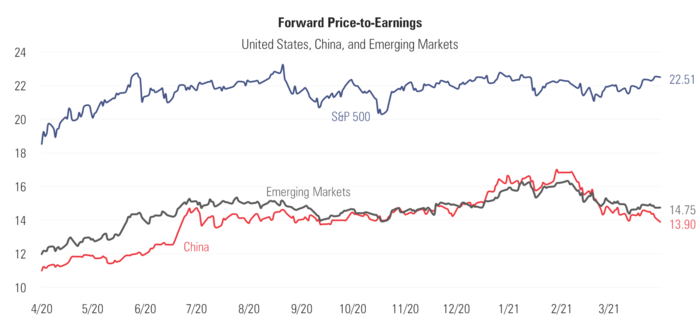

A strengthening trade-weighted U.S. dollar will impact equity and debt flows for the short-run in emerging markets, creating an even better buying opportunity– especially in China. [v]

This is going to require investors to have some patience as we find a new dollar equilibrium in emerging markets.

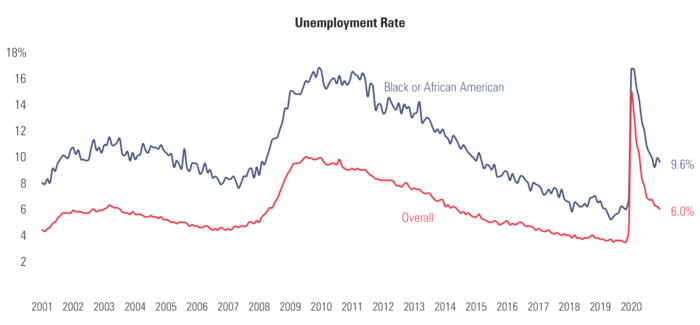

Let’s pivot back to rising interest rates and U.S. jobs. The March jobs report was indeed historic but, was in no way the main screen on the Federal Reserve’s dashboard. As we have been suggesting for nearly a year, lifting lower-end wages—especially for Black Americans—is high on the priority list for the Federal Reserve. [vi]

"Inflation that is persistently low can pose risks…The result can be worse economic outcomes in…both employment and price stability…with the costs likely falling hardest on those least able to bear them.”

Fed Chairman Jerome Powell, August 2020

When looking at Black employment, you can see we have a long way to go to return to pre-pandemic levels relative to the rest of the labor force. [vii]

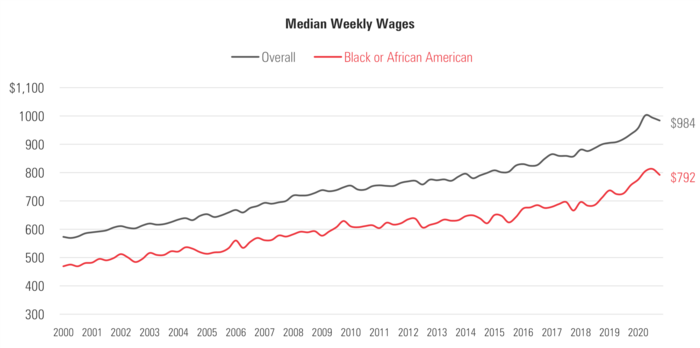

Further, wages for Black Americans will need lifting compared to overall wages. [viii]

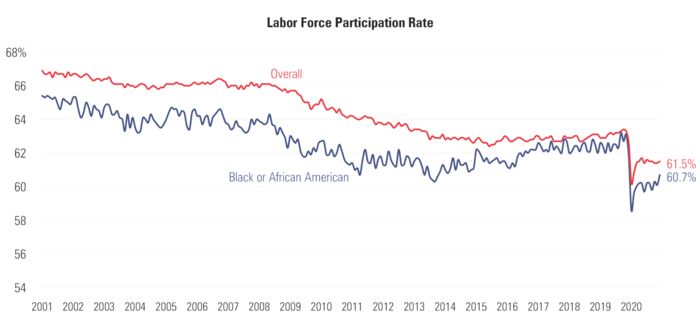

Finally, labor force participation rates for Black Americans are considerably lower post-pandemic compared to the overall workforce and that will need massive engagement. [vii]

Leaving rates near zero at the shorter end of the maturity curve—which is entirely within the Fed’s direct control—is obvious. As rates naturally rise on the longer end of the maturity curve, we expect the Fed to engage in some form of long-term purchases to drive those rates down.

Rising rates won’t help lift those in the lower income brackets out of the terrible hole they find themselves in. Rising inflation will—especially if it’s reasonable wage inflation.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://fred.stlouisfed.org/series/PAYEMS

ii. https://fred.stlouisfed.org/series/TDSP

iii. https://www.whitehouse.gov/briefing-room/statements-releases/2021/03/31/fact-sheet-the-american-jobs-plan/

iv. https://fred.stlouisfed.org/series/DTWEXBGS

v. https://www.bloomberg.com/quote/SPX:IND

vi. https://www.federalreserve.gov/newsevents/speech/powell20200827a.htm

vii. https://www.bls.gov/news.release/empsit.nr0.htm

viii. https://www.bls.gov/charts/usual-weekly-earnings/usual-weekly-earnings-over-time-by-race.htm