Rising Rates—All Systems Go!

The Federal Reserve got the green light to continue raising interest rates as May inflation reports [x] showed it had finally reached its 2 percent target inflation rate after five years of waiting. [i] [ii] [iii]

Given that the Fed has met its inflation objective, I don’t see any reason that would warrant any additional rate hikes this year beyond the two more that the Fed has already been telegraphing. Although the Fed has officially met its target inflation rate, the tricky path forward gives me pause.

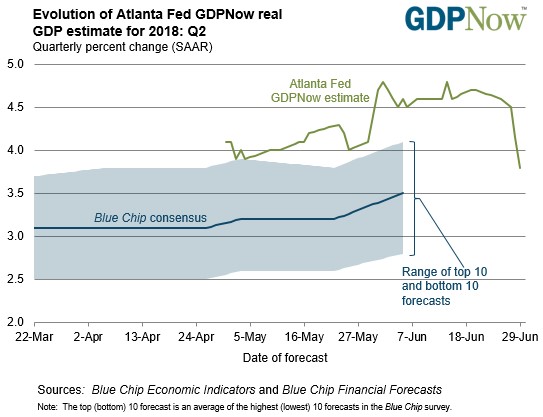

According to the Federal Reserve Bank of Atlanta, the U.S. economy is growing at a rapid pace and is expected to continue its trajectory into the near future. [iv]

Currently, the Federal Reserve Bank of Atlanta is projecting Q2 2018 GDP growth to come in at 3.8 percent. This is phenomenal growth for a country with an economy over $19 trillion. [iv]

The unemployment rate (as imperfect as this indicator can be) is sitting near historic lows that have not been seen since the early 1970’s. [v]

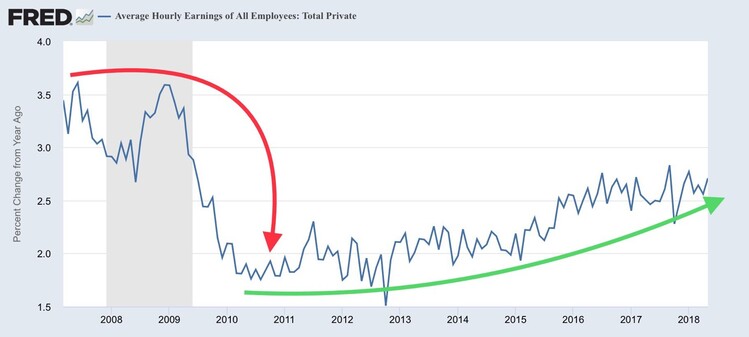

Additionally, wage inflation, albeit still somewhat muted, continues its current and steady upward trend. [vi]

It’s these types of trends that put the Federal Reserve in the unenviable position of trying to anticipate how high to push rates to maintain price stability. The Fed will need to walk a tight line that continuously raises interest rates high enough to moderate price increases but that also avoids pushing the U.S. economy into a recession.

We will be watching this juxtaposition closely as we manage portfolios across full market cycles. Perhaps, despite the incredible earnings growth we’ve seen thus far in 2018, it’s the uncertainty of how the Fed will walk such a tight line that is creating some drag on equity markets—beyond the drag that Trump trade tantrums have already created.

The good news is there are a couple of noteworthy trends.

First, it’s clear that President Trump understands what’s going on in the economy. He recently asked the Saudi government to increase oil production by two million barrels per day—although this was already scheduled. He did this to demonstrate his understanding of the effects of rising costs on the consumer. [vii]

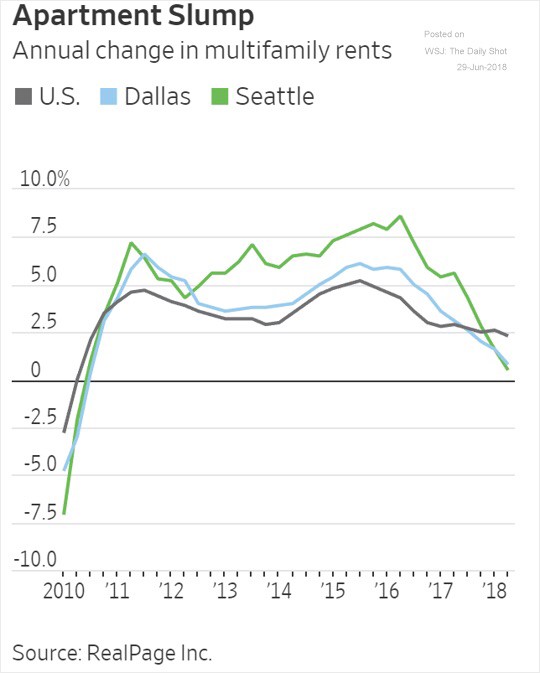

Second, we are seeing some moderation in rental prices with figures suggesting the slowest pace in eight years. Given that housing inflation is a large component of the overall inflation measurement, and considering rents are a useful proxy for this, any reduction is welcome news in these inflationary times. [viii] [ix]

How far the Fed can and will go to kill the U.S. economy is anyone’s guess. However, one thing I am confident in is the Fed’s inability to perfectly land this economy in a Goldilocks scenario without creating some turmoil along the way.

Rising rates are a go until we feel some pain—let’s just see how much pain we will have to feel.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can email Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Robert Dinelli, Investment Analyst, Phillips & Company

References:

i. https://fred.stlouisfed.org/series/CPIAUCSL#0

ii. https://fred.stlouisfed.org/series/CPILFESL

iii. https://www.federalreserve.gov/faqs/economy_14400.htm

iv. https://www.frbatlanta.org/cqer/research/gdpnow.aspx

v. https://fred.stlouisfed.org/series/UNRATE

vi. https://fred.stlouisfed.org/series/CES0500000003

vii. https://twitter.com/RealDonad_Trump/status/1013070980120444928

viii. https://thejanusobserver.com/

ix. https://www.realpage.com/news/realpage-reports-slowing-u-s-apartment-rent-growth/

x. https://www.cnbc.com/2018/06/29/the-fed-has-met-its-inflation-target-now-what.html