Risk = Pain = Unavoidable

It’s difficult to imagine risk these days when it comes to equity investing. Unlike an extreme skier or free solo climber, when an investor looks down, they can hardly see any exposure.

The last twelve months have been an epic time for U.S. equities. 1

Over the last three years, cumulative returns have been even more impressive, with one tiny blip. 1

The Covid correction lasted for only 123 days before recovering to pre-pandemic levels. It’s hard to imagine market risk these days as it’s been absent for so long and, if present, it’s been very abbreviated.

The list of risks in our economy are real, present, and ephemeral.

- Omicron

- Inflation

- Rising Rates

- US/China Global Competition

- Russia/Ukraine

- Federal Reserve Policy Errors

Yet, the pain from investing has been limited as of late and the risks from the Great Financial Crisis have long passed from investors memories.

My efforts to remind our clients and investors that risk is real and present might fall on deaf ears but, let me attempt to frame it for you anyway.

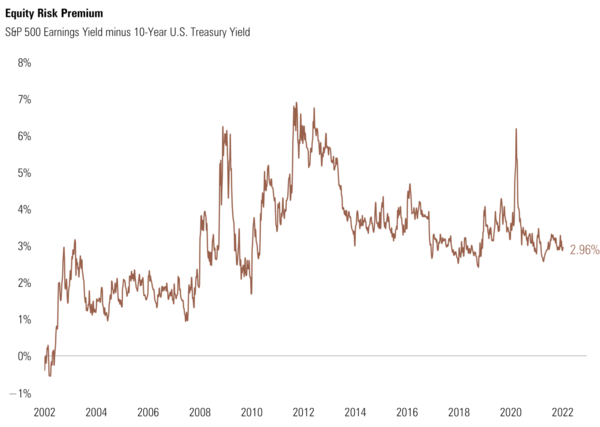

The simple reason stocks have better historic returns than bonds is because they have more risk (risk premium). Currently, you get paid about 3% more than a “risk free” asset like the 10-year Treasury bond. 2

The thing about taking a risk in stocks is not minding the risk. While I always think of risk in quantitative measures, my friend and author Morgan Housel helped me frame risk in a qualitative framework. Take a look at this quick video we did some time back.

The key to equity investing is not minding the pain that accompanies it.

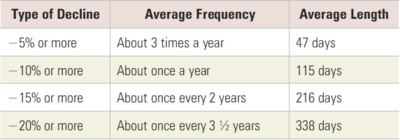

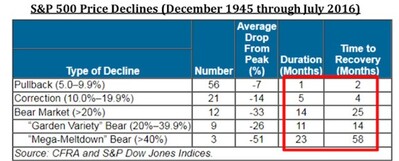

Here are the pain points we all need to spend time thinking about. In any normal market cycle, we will experience various levels of pain and for various lengths of time.

Framed another way and looking at bear markets (“garden variety” bear markets or “mega corrections”), your level of pain tolerance must be higher for longer.

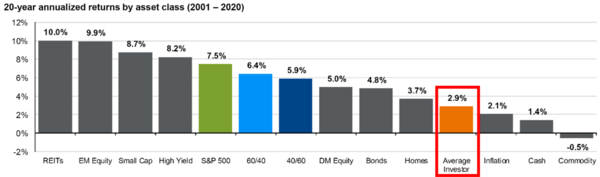

The thing about equity pain is if you can’t take it and react poorly at the wrong time, your outcomes are terrible. 3

In the chart above, you can see the typical investor returns are so terrible from trying to time markets that it’s hardly worth the risk.

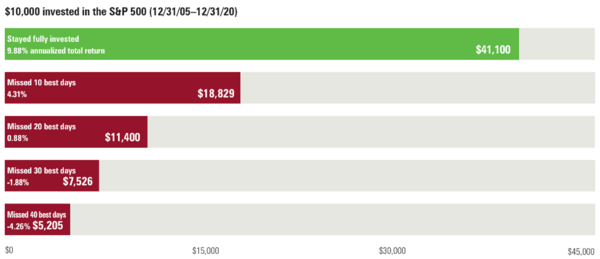

Put another way, if you react at the wrong time to your equity investing pain, you can miss all the benefits of equity investing. 4

By missing just 10 days over the course of 15 years, your returns can be cut by more than 50%. If you missed 20 days over a 15-year period, it could be down to almost no returns at all.

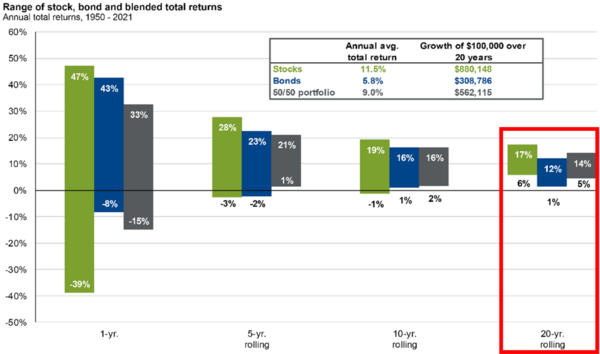

I’ve always said time shapes risk. If you can stand the pain and for the necessary period of time, your risk actually can go down. While it won’t feel like it in the middle of the pain, over a long period of time equity returns hardly have negative returns. 3

How much pain can you handle?

It might depend on the returns you need to meet your objective, like retirement. That is the quantitative approach and it’s a sound approach. However, without evaluating your qualitative pain points, the quantitative can get thrown out at the wrong time.

Ask yourself the following:

- Which is more important to you, meeting your goals or beating the market?

- What is your plan to survive a major economic setback?

- Have you ever lost serious money? Enough to affect your lifestyle?

- Is financial risk a loss of money, a drop in the value of your portfolio, or loss of opportunities? Which is the most important to you?

- If your portfolio were down 10% would that be of a concern? How about 20% or 30%?

- Which drops in your portfolio value cause you to feel anxiety, stress, or loss of sleep?

- How long could you tolerate being down 20%? 30 days, 6 months, 1 year, 2 years?

- What are the options if you have to return to work at your age and how would that feel?

- What if your assets, income, and expertise all lose value at the same time? How would you react?

There are so many more questions to ponder when considering your personal pain threshold but, these are a good start. Make sure we discuss these with you well before you have to feel the pain of a mark down in your portfolio. Visualizing that pain, practicing how you will react, and reminding yourself of the reality of risk is critical.

Pain is just part of the opportunity cost to collect higher returns.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

1. https://www.bloomberg.com/quote/SPX:IND

2. https://www.yardeni.com/pub/stockmktequityrisk.pdf

3. https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/guide-to-the-markets/

4. https://www.putnam.com/literature/pdf/II508-ec7166a52bb89b4621f3d2525199b64b.pdf