Sap the Life Out of You

It might surprise many of you to know I ran for U.S. Congress once on a platform made up of a Wasteful Spending Commission. That was 20 years ago, and at that time voters didn’t care about $1.5 million to study dog fighting or the $500,000 Congress gave to Alaska Airlines to paint a Chinook Salmon on the side of a plane. 1

Today, wasteful spending, fraud, and abuse are finally making headlines—though perhaps it’s just the billionaire leading the commission: Elon Musk at the "Department of Government Efficiency" (DOGE), a nongovernmental commission.

The Federal Budget is 195% larger than in 2004, and the deficit – the amount we need to borrow to fund government spending each year – is over 325% larger. There are a lot of wasteful paint jobs buried somewhere in the spending.

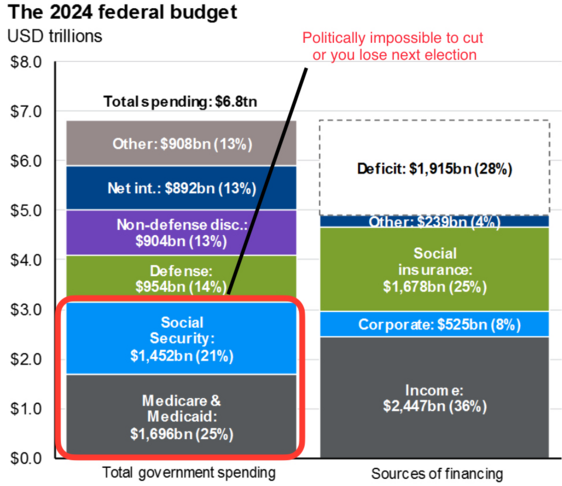

First, let’s review what can be cut and what will not be cut. 2

46% of spending is likely off limits for anyone’s political survival.

That leaves us with just a few areas that make for easier targets.

Without getting into the politics of what is good or bad spending, Americans – and that’s all of us – have some component of waste in our budgets. Is it safe to assume there is some waste in Federal spending?

I know I can easily trim 2% from my spending without sacrificing any personal priorities, and the Federal government can do the same.

If the DOGE trims 2% of Federal discretionary spending (Defense, Non-Defense, and Other), that’s $55 billion per year in savings. According to the Committee on Responsible Federal Budget, here’s what those savings could fund:

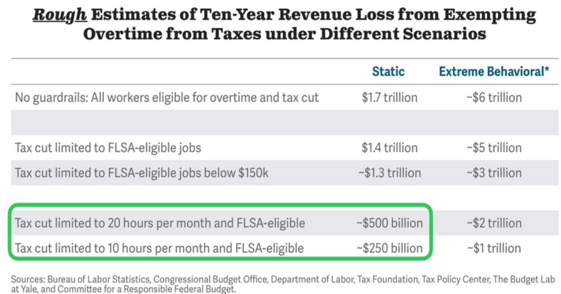

No tax on some overtime pay ($25 billion to $50 billion per year): 3

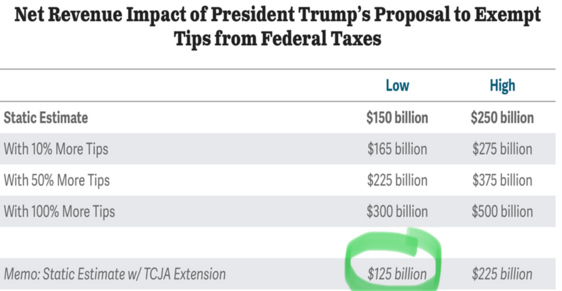

It could pay for no tax on tips for service workers ($12.5 billion per year): 4

Or you could put the dollars into expanding the Child Tax Credit to help working families at a cost of just $33.5 billion per year. Not a bad use of funds.

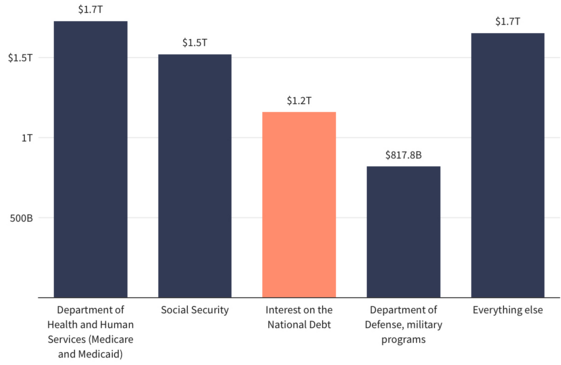

Perhaps the simpler solution is to reduce the U.S. Government’s financing costs by lowering the interest rate on its debt, which has become enormous. Without action, it will literally swallow everything else we need and want from our government. 5

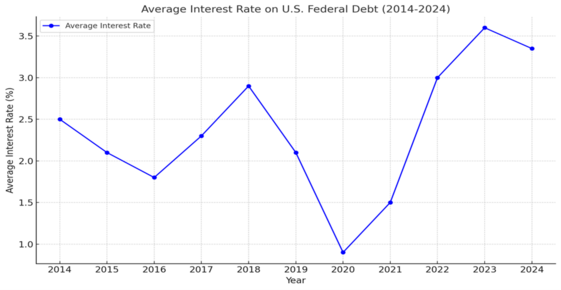

Right now, we pay nearly double the interest rate on our debt compared to 2021. 6

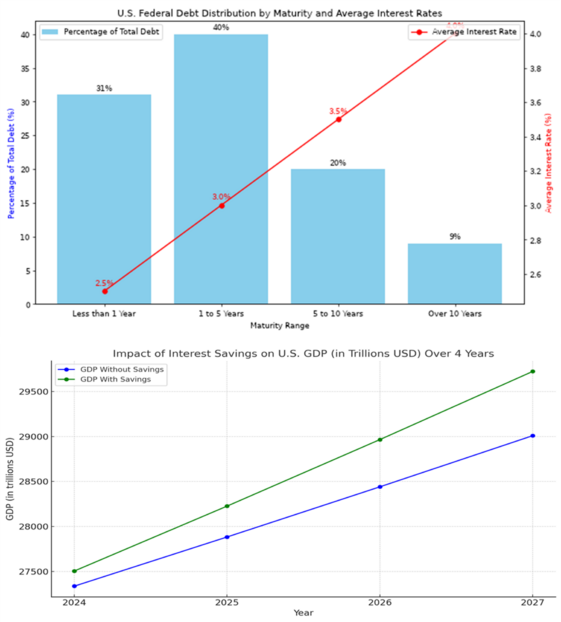

If we were to just shave ½% off the current average rate of 3.3%, that would save another $165 billion per year. However, that simple math is not how the debt matures.

The maturity of the debt matters a lot. In fact, the short-term debt of less than 1 year has an incredibly low rate of 2.5%. In the current rate environment, refinancing the short end of our debt is going to cost more, not less. Rates have to get lower soon (that’s a topic for another blog). 6

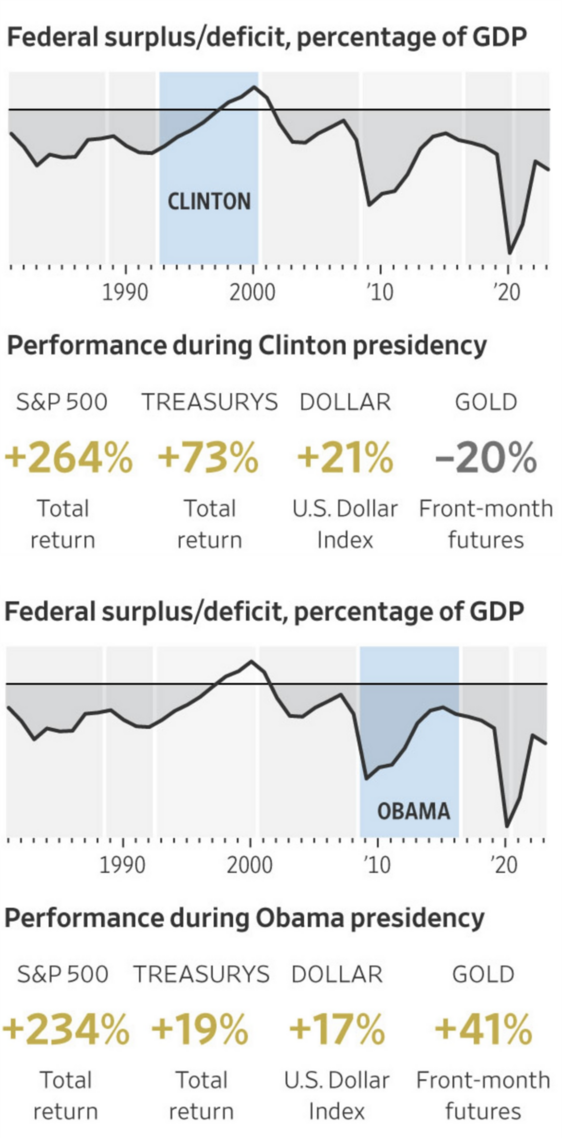

The savings could add trillions to our growth over the intermediate term. Cutting deficits is a really good thing for equity markets. Think about those that did it. 7

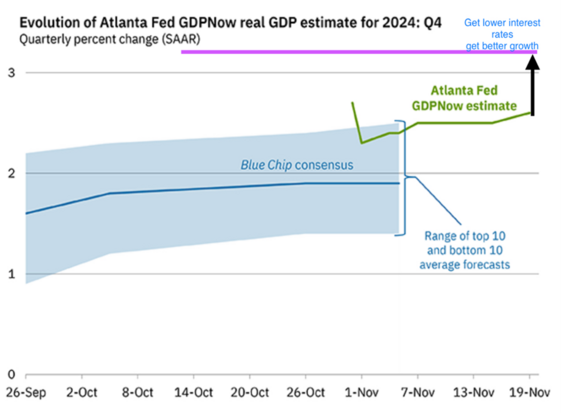

Such savings would elevate U.S. GDP growth from its current trajectory (blue line in the chart) to a whole new level (purple line). Paying interest, as we all know, is a waste of money and a lot goes outside our economic system (China, Japan, South Korea) unless we can generate growth. 8

We all have wasteful spending, which is manageable if you’re not borrowing to fund it. If you are borrowing, you must either refinance at a lower interest rate or reduce wasteful spending – otherwise, it can sap the life out of you.

On behalf of the entire team at Phillips & Company Advisors, we wish you and your family a happy Thanksgiving.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.seattletimes.com/seattle-news/any-way-you-slice-it-the-salmon-plane-is-pork/

- https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/guide-to-the-markets/?slideId=economy/gtm-fedfinances

- https://www.crfb.org/blogs/donald-trumps-proposal-end-taxes-overtime

- https://www.crfb.org/blogs/donald-trumps-proposal-exempt-tip-income-federal-taxes

- https://finance.yahoo.com/news/record-1-2-trillion-interest-194844790.html

- Bloomberg

- https://www.wsj.com/finance/investing/us-deficit-stock-market-presidents-compared-2013d93c

- https://www.atlantafed.org/cqer/research/gdpnow

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.