“Sapere Vedere” – Leonardo da Vinci

“Knowing how to see"

“Knowing how to see"

The negativity in the United States is palpable. I make a point of traveling often for the purpose of seeing what’s going on in our economy. Since most of our economy is driven by consumption it’s not too difficult to get a bird’s-eye view of what’s really happening.

When you look at the headlines you are bound to sour on the direction of America, our political state, and the economy. It’s completely understandable when you consider the major themes adrift in the atmosphere:

• The impending “so-called” recession

• U.S. debt default

• Partisan politics

• The hollowing out of major cities

• Bank defaults

• Mass shootings, crime, and lawlessness

• War in Europe

• Threats of geopolitical instability with China

That’s what we hear.

Here’s what I see:

• Consumption is strong in almost all categories (food, beverage, lodging, retail)

• Demand for houses in rural and suburban areas is still strong regardless of higher interest rates

• Help wanted signs still posted on most businesses

• Airports and airlines are packed

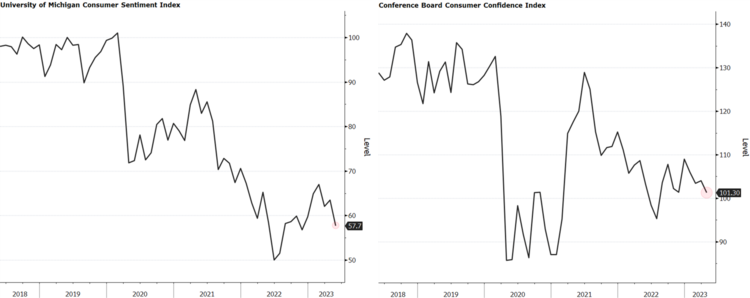

It’s easy to get confused between sentiment and reality. Look at the most recent consumer sentiment surveys. They reflect what we all hear. 1 2

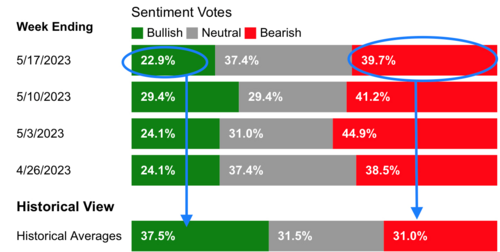

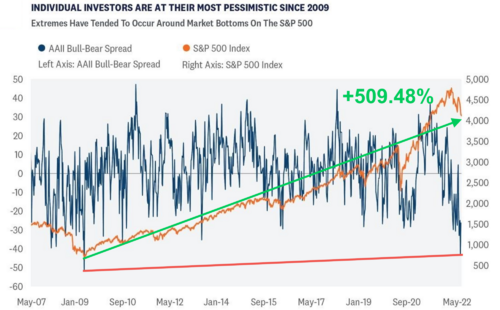

What we hear is also reflected in most investors’ sentiment. The AAII (American Association of Individual Investors) survey on investor sentiment is in pretty bearish territory while the bulls are few and far between. 3

This is where it gets tricky between what we hear and what we see when applying our gut. Your gut should tell you to run for cover, bury your cash in the backyard, stock up on a year’s worth of food, and hide. This is where the gut is often wrong, and your counterintuitive senses need to kick in.

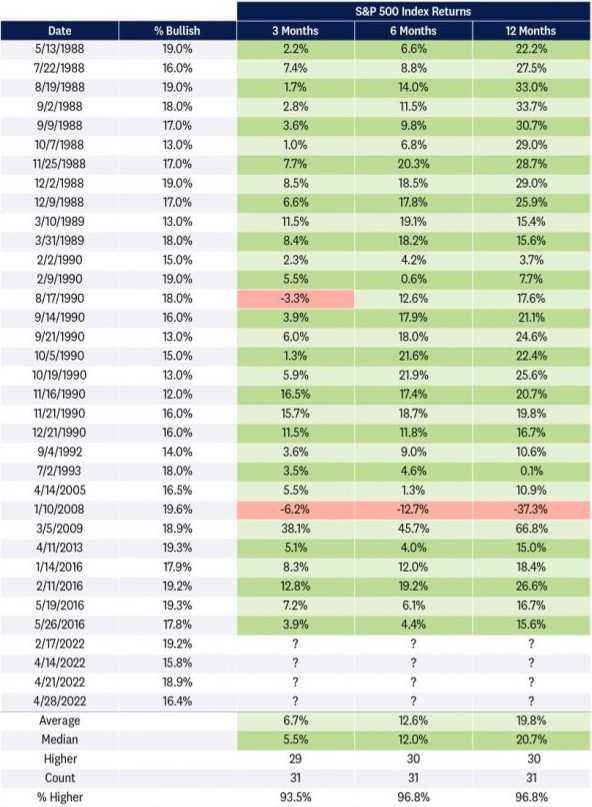

Stocks tend to rally around recessions. 4

When we are at the most negative (bearish) or least positive (bullish), stocks tend to rally – and by a bunch. 5

Since we are near 2009 bearish sentiment levels, it might surprise you to see that was the start of one of the greatest bull markets in history. 5

It’s hard to hear things and not believe them. It’s easier to see things and believe your eyes. It’s especially hard to apply the difference between what you hear and what you see to the counterintuitive nature of investing.

Learning how to see is an art to investing.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: