Saved by the Virtuous Cycle

A plethora of economic data was released last week that helped to provide a recovery rally in U.S. equity markets.

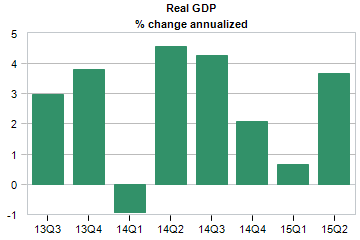

First, U.S. GDP for Q2 was revised much higher than estimated on the first report. U.S. GDP grew by 3.7% up from Q1 growth of .6% and Q2 first estimate of 2.3%. [I]

Growth was widespread in the economy and especially true with the U.S. consumer. 2.1 percentage points of the 3.7% GDP growth came from the consumer. Being that 70% of the U.S. economy is driven by consumption, it's a remarkable number.

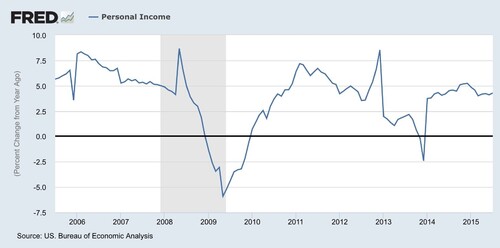

Second, disposable personal income grew by .5% which is the fastest growth since 2014. While faster growth is always welcome, personal income holding steady and improving slightly has a restorative impact on consumer confidence. [II]

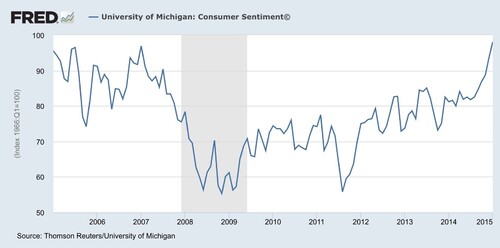

Indeed (and the third data point reported last week) Consumer Confidence came booming back to levels we haven't seen in almost a decade. The data does not reflect the impact of current market volatility. A short lived correction will likely have little impact on improving confidence by the consumer. [III]

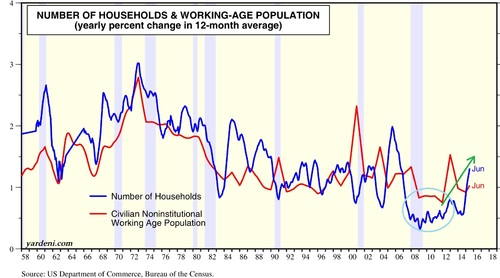

It appears the virtuous cycle of improving incomes, driving more consumption and fueling confidence is in full swing. The acid test of the cycle, in my opinion, is household formations. People form more households when they feel confident about the direction they are headed in regards to their income, employment, and future growth opportunities. When households are formed, they tend to spend more than their single counterparts.

New household formations are seeing dramatic improvements, recently crossing over the 1 million mark heading back to the 2 million mark in the coming years. This is a first since the financial crisis induced a stall in household formations. [IV]

I can only conclude this cycle will lead to improving corporate earnings growth in the coming quarters. That should stabilize our equity markets and have them once again moving forward. Considering the year-over-year comparisons seem pretty easy to beat in Q4 of this year and Q1 2016, we can likely see a rebound to 8-plus% EPS growth rates. [V]

Of course, the strong dollar, financial bubbles popping, or China can derail our confidence and that is anything but virtuous.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

References:

[I] U.S. Bureau of Economic Analysis

[II] U.S. Bureau of Economic Analysis, St. Louis Fed

[III] Thomson Reuters/University of Michigan, St. Louis Fed

[IV] U.S. Dept of Commerce, Bureau of the Census

[V] Bloomberg Terminal, S&P 500 Index Historical Trends