Self-Inflicted Economic Pain

Inflation is finally abating according to last week’s Consumer Price Inflation report. Headline inflation came down to 4.9%, the 10th consecutive monthly decline. Is it too soon to use the word transitory again? 1

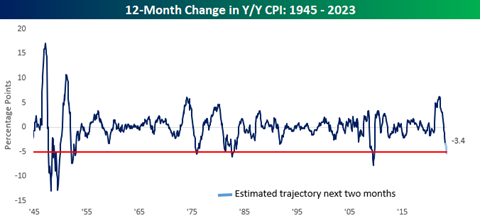

On a percentage change basis, it’s one of the more rapid drops since 1945. 2

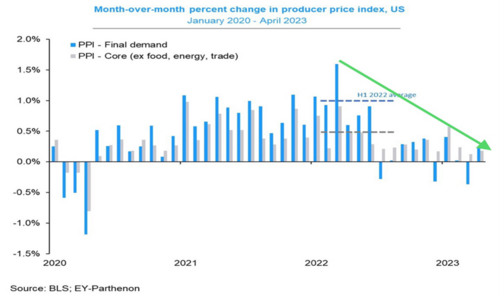

Confirming the long-anticipated reduction in inflationary pressures is Producer Prices. These are the input costs associated with producing goods. 3

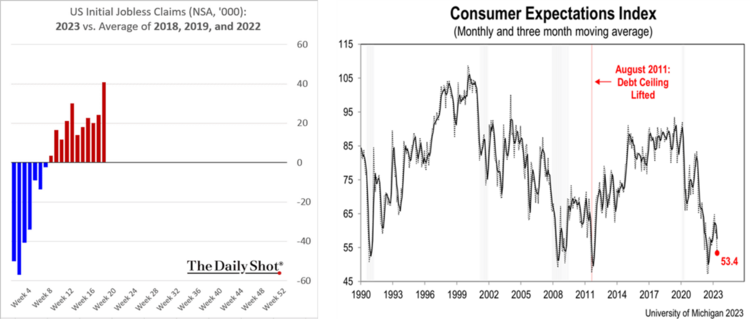

Inflationary pressures are easing because the economy is slowing. It’s just that simple. Consumer sentiment is reflecting a pretty nervous consumer mood and those applying for jobless benefits are increasing. It’s probably not surprising that the most recent sentiment low point was in June of last year, associated with very high inflation readings. Prior to that it was the last debt ceiling major showdown in 2011. 4 5

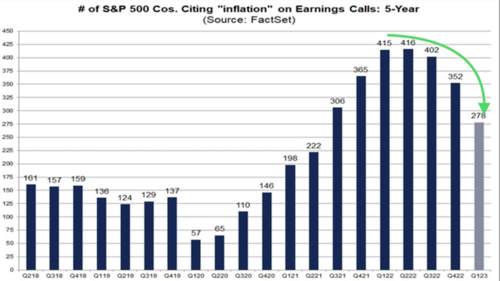

In fact, during corporate earnings calls, inflation is not being raised as much as in prior quarters. 6

It’s no time to play games with a fragile economy that has required the Fed to to raise rates at one of the fastest paces in history. Yet, that is exactly what is going on with the political class today. We are stumbling our way into a debt ceiling showdown that threatens our economy, investments, and global standing in the world. 5

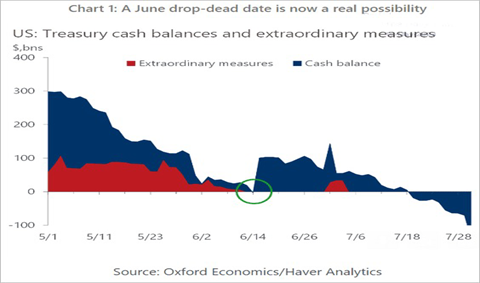

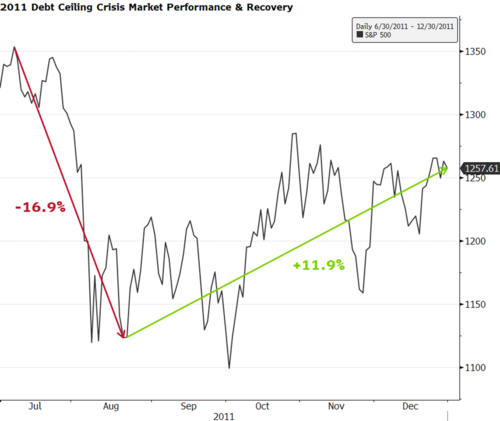

It looks like Congress and the President have until mid-June for the first inflection point on the debt ceiling. I suspect they will get something done before then. Especially when you look at how markets reacted during the last major debt ceiling showdown. From June 2011 to the lows of August 2011 the S&P 500 was down over 16% before recovering almost 12% by the end of the year. 7

Perhaps we are walking equity prices down now before we approach the mid-June pinch point. If tax receipts come in during the quarterly estimates period on June 14th, maybe we get to mid-July. Equity markets won’t like that either.

Just remember the political class invests in stocks too. Perhaps they want to avoid the self-inflicted economic pain.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: