September’s Curse, Liquidity’s Cure

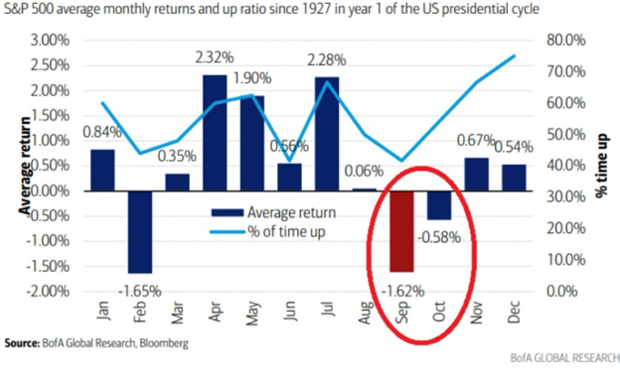

September has a long history of testing investors’ nerves. Going back to 1927, the first year of a presidential cycle has produced an average S&P 500 decline of -1.62% in September, with the index falling more than half the time. On seasonals alone, this September may be no different.

But seasonality doesn’t exist in a vacuum. Today’s macro backdrop offers several powerful offsets.

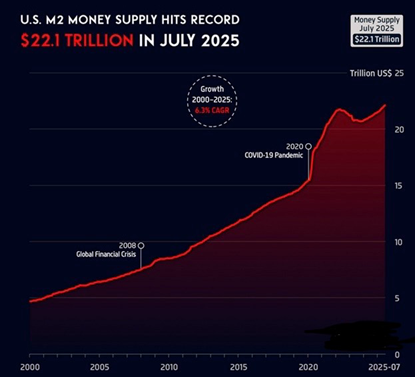

Liquidity Still Abundant

The U.S. money supply (M2) just hit a record $22.1 trillion in July 2025. Liquidity injections have historically fueled sustained rallies:

- 1975 post-recession,

- 1982 Volcker pivot,

- 2009 post-GFC QE, and

- 2020 COVID bazooka.

Each was followed by multi-year bull markets. Today’s M2 trend, combined with upcoming Fed easing, suggests we may be setting up for a similar extension.

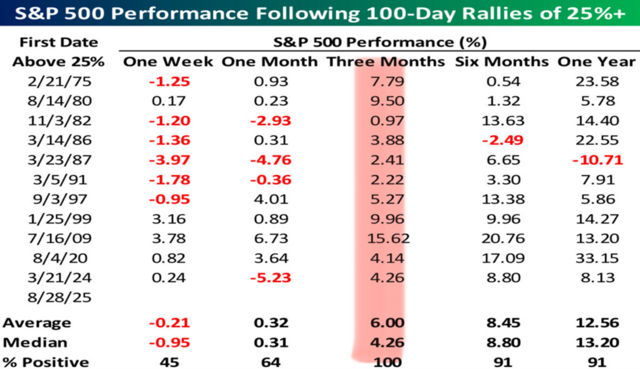

100-Day Rallies: Usually the Beginning, Not the End

The S&P has again delivered a 25%+ rally over 100 days. History shows that’s typically followed by more gains — an average +6% in three months and +12.5% at one year.

Crucially, the strong extensions occurred when liquidity and policy aligned. With M2 elevated, the passage of the recent tax cut package, and the Fed nearing cuts, this cycle looks more like 1982, 2009, or 2020 than 1987 or 1999.

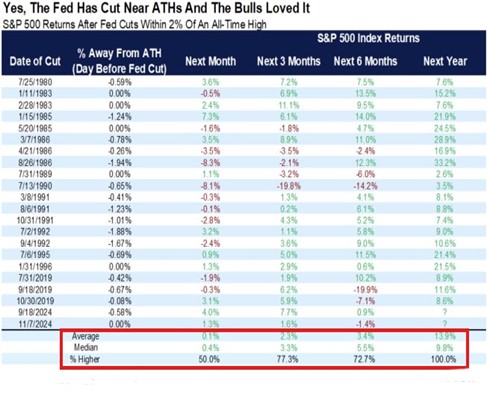

Rate Cuts are Coming

The Fed is on the cusp of cutting rates. Past cuts near all-time highs have often been met with strong forward performance.

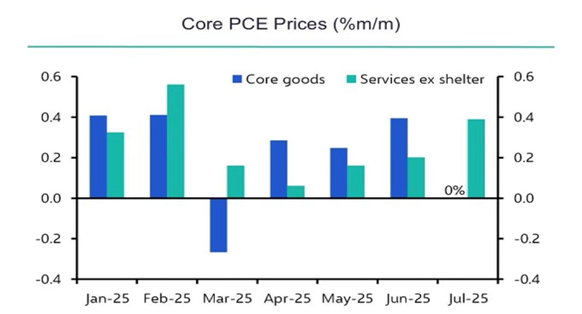

July’s Core PCE report shows that goods inflation remains muted and services inflation (excluding shelter) is manageable. Coupled with a softening labor market, this gives the Fed room to ease policy without stoking a rebound in inflation.

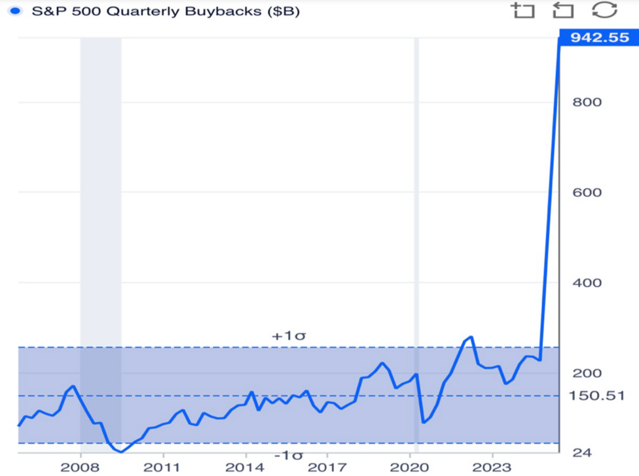

Record Buybacks: Corporate America Shrinks the Float

There is also a little bit of a pull back reinsurance policy in play in the form of corporate buybacks.

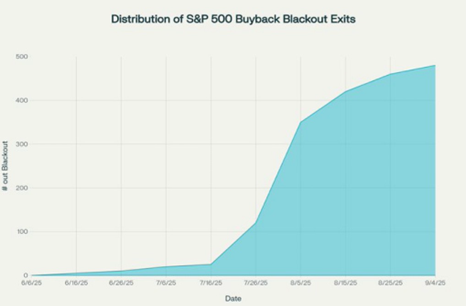

Buybacks are at record highs and their window to buy is lifting. By September 4th almost all S&P 500 companies can buy back their stock.

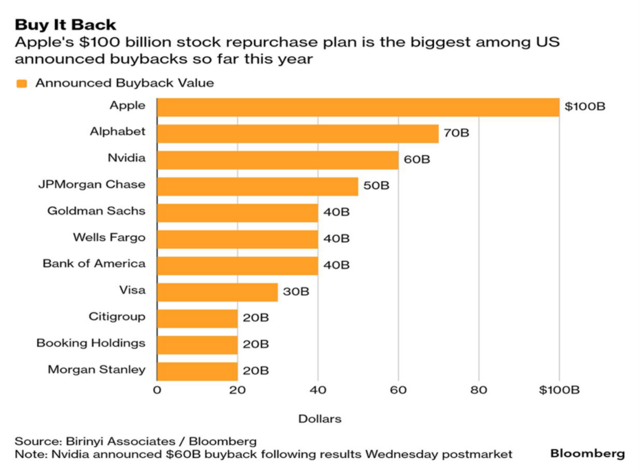

Corporate America is aggressively shrinking the float:

- Apple $100B,

- Alphabet $70B,

- Nvidia $60B, and

- $943B in total S&P 500 buybacks in Q2 2025 — a record.

Buybacks act as a structural buyer in periods of weakness. In September, when retail and institutional flows can wobble, corporate demand can stabilize the tape.

A Cure for the Curse?

Yes, September is historically a dangerous month for equities. But history also shows that when liquidity is abundant, policy is easing, and buybacks are record-high, 100-day rallies don’t die — they extend.

September's curse might find a cure.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

The charts and data presented are sourced from a combination of public domain materials and licensed data providers. Their use is intended solely for educational and analytical commentary and falls within the scope of fair use. For a representative list of sources, please click here.

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.