Serious Financial Engineering

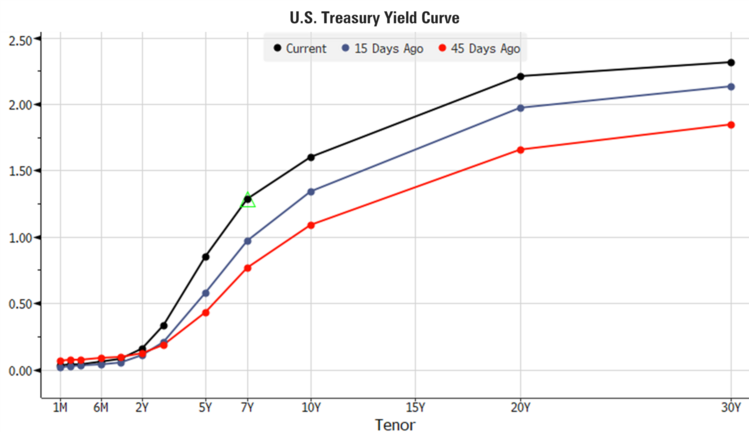

In an effort to put a label on what is going on with credit markets, U.S. investors are in a quandary. The yield curve has steepened over the last 45 days. [i]

The U.S. 7-year Treasury auction had an anemic showing on February 25th, with only 2 buyers for every dollar offered. That spiked the yield on the 7-year by 20 basis points. [i]

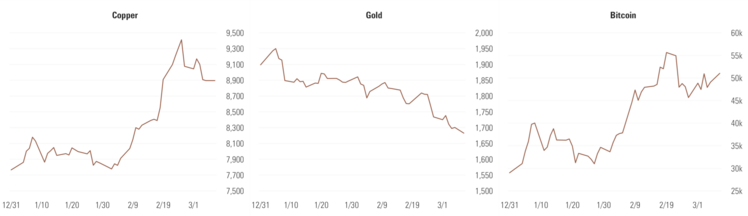

The common reprise is a call for inflation. Yet Copper, Gold, and Bitcoin prices all dropped and those are seen by many as hedges against inflation. [ii] [iii]

However, while inflation might be coming, Fed Chair Powell suggested in comments last week that inflation may be “transitory”: [iv]

“If we do see what we believe is likely a transitory increase in inflation, I expect that we will be patient. There’s a difference between a one-time surge in prices and ongoing inflation.” – Jerome Powell (March 4, 2021)

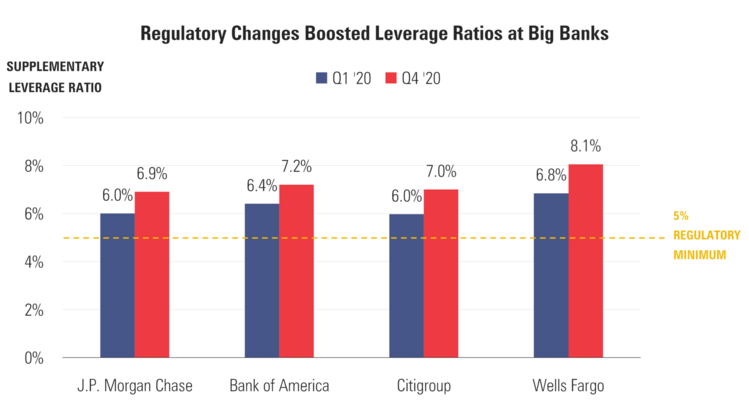

There might be some financial engineering going on behind the scenes to drive treasury prices higher. There is a little-known bank ratio called SLR (Supplementary Leverage Ratio) that is—in simple terms—designed to encourage banks not to take on too much risk. When the pandemic hit, the Fed allowed the largest banks to simply not count U.S. Treasuries or deposits at the Fed towards leverage exposure, boosting the SLRs at all four big banks.

That exemption is expiring at the end of March and one remedy is for the big banks to sell treasuries. I believe that is happening now as they grow worried the Fed will not extend the exemption.

This financial engineering is having an adverse impact on credit markets.

We are about to experience another financial engineering sleight of hand. The Senate passed a $1.9 trillion pandemic relief and stimulus bill that is widely expected to go back to the House for easy passage. The bill will not contain a direct minimum wage increase; however, it does have an implied wage increase.

The bill contains a supplemental $300/week in federal unemployment benefits. If you add that $300 to the average existing benefits provided at the state level ($474/week), you get $747/week or $19.35/hour. [v]

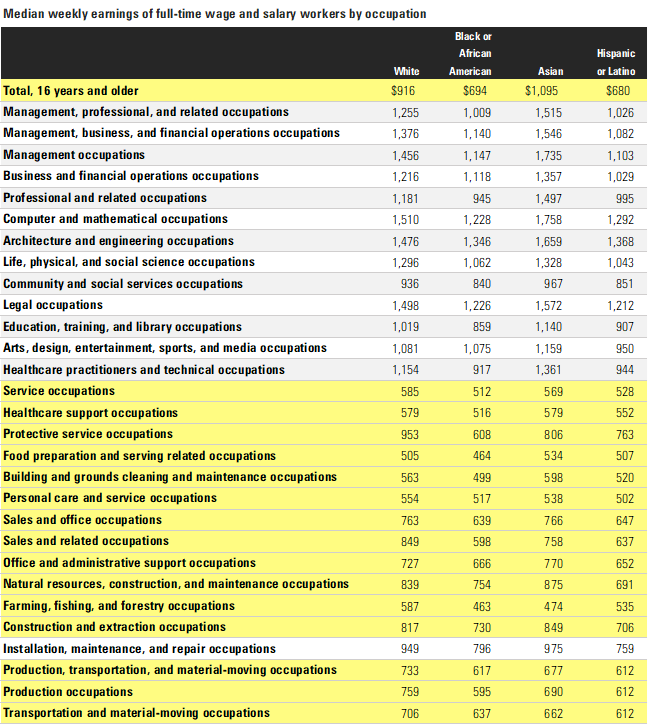

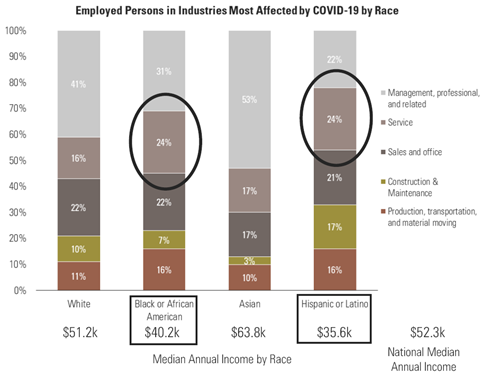

In order to get the lower income worker back to work, employers are going to have to exceed that wage rate. In areas like food and beverage, hospitality, travel, and leisure, that is a nice lift in wages. [vi]

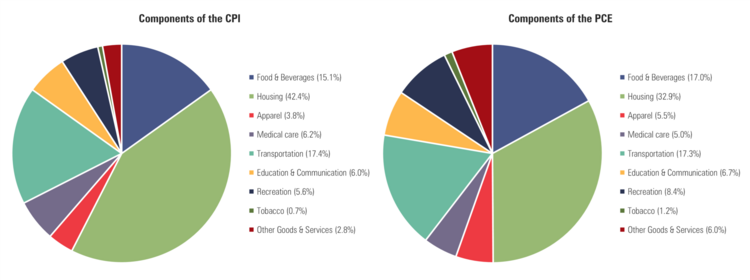

While rising wages are an input cost, they are not directly measured in the common inflation indexes. [vii]

Prices will certainly rise in the most dislocated areas post the pandemic: restaurant workers and travel and hospitality-related workers. Those areas will likely be inflationary but, they are not the largest contributors to inflation from an index perspective – housing is.

Further, we know the Fed has clearly stated they would like to have an accommodative policy that lifts those at the bottom-end of the earnings spectrum, especially since there is an overweight of minority workers. [viii]

Here’s what is likely going to be impacted beyond wages and cost inputs:

• Money market funds will likely drop to negative yields

• The Fed will either extend the SLR to ease pressure on treasuries or institute a form of yield curve control

• Supply chain disruptions will lead to temporarily higher prices

• Equity prices will test the nerves of even the most seasoned investors

The unwinding of pandemic financial engineering will be uneven, disruptive to supply chains, will increase wages, might dampen some select industry profits, and could cause some transitory inflation. However, we don’t anticipate prolonged, persistently widespread inflationary pressures throughout the economy. Financial engineering is also transitory—or at least we hope it is.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

ii. https://www.bloomberg.com/markets/commodities

iii. https://www.coindesk.com/price/bitcoin

iv. https://www.nytimes.com/2021/03/04/business/economy/federal-reserve-powell-economy.html

v. https://fileunemployment.org/dataview/

vi. https://www.bls.gov/opub/reports/race-and-ethnicity/2018/home.htm

vii. https://www.bls.gov/news.release/cpi.nr0.htm

viii. https://www.bls.gov/data/tools.htm