Sidelines

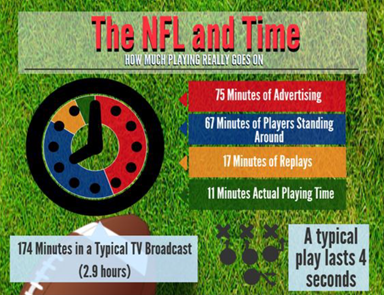

It was a great football weekend. Between the commercials and shots of players roaming around the sidelines, there was a small dose of exciting football. The football is so exciting, it likely distracts from what we really spend most of our time watching. In a recent study, a typical 3-hour game only offered about 11 minutes of actual playing time and over 1 hour of watching players standing around the sideline. 1

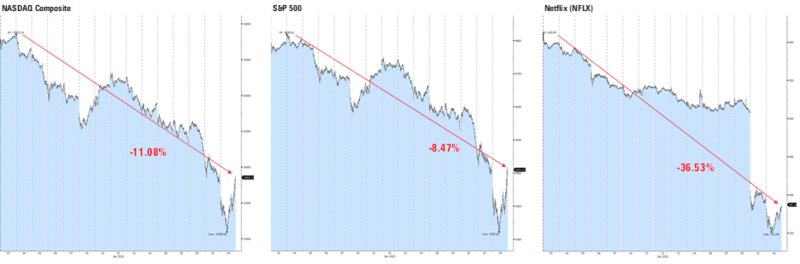

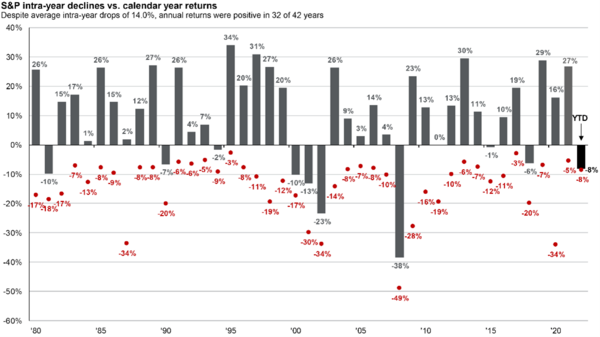

It was appropriately analogous to the markets last week as the NASDAQ slipped into correction territory and the S&P 500 was down almost 9% from peak. Netflix, the iconic recurring revenue play, fell 24% last week and is down over 36% from its year-to-date high. 2 3 4

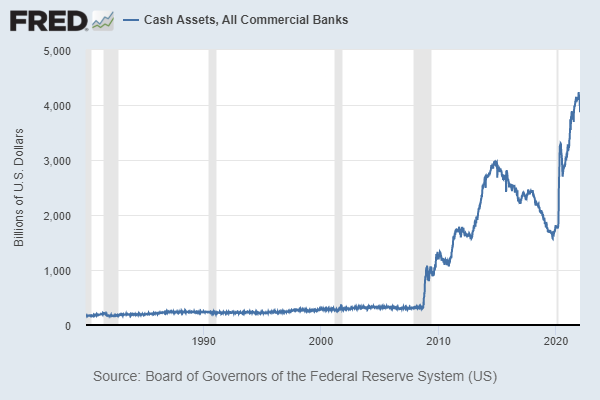

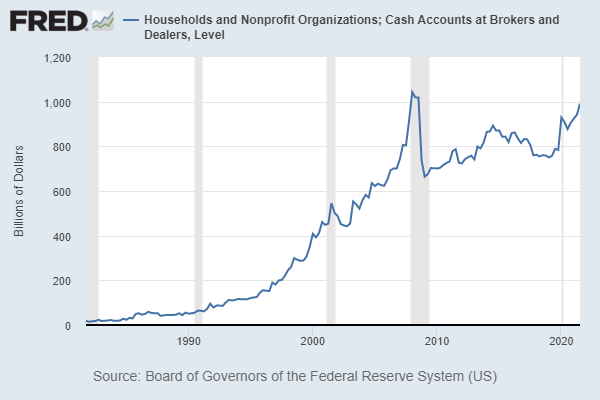

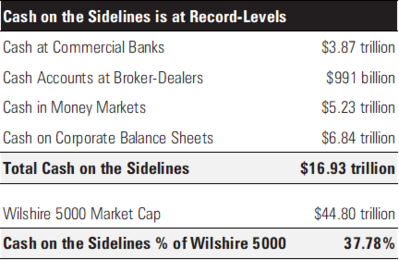

Yet, it’s the sidelines that we should take a look at. Currently, cash sitting on the sidelines of equity markets are at historic levels.

Cash at commercial banks is sitting at a whopping $3.8 trillion. 5

Cash at brokerages is also at a record $1 trillion. 6

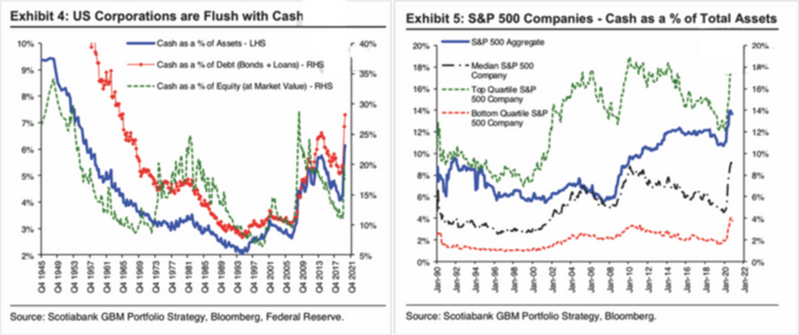

Cash as a percentage of assets, debt, and equity across all S&P 500 companies is at near record levels. 7

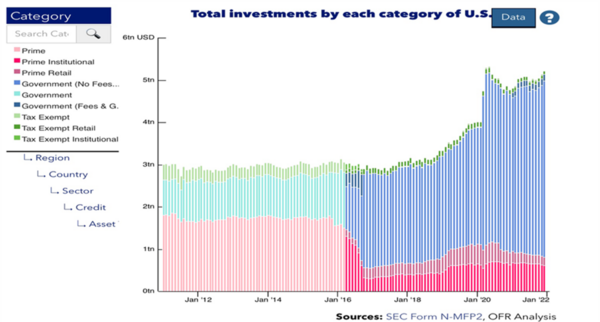

Further, cash in money markets is hovering near levels totaling $5.2 trillion. 8

The “investor sidelines” is likely where the action will come from in the coming weeks to rescue a flailing equity market.

Combined cash is at approximately $17 trillion and that represents about 38% of total U.S. market cap using the Wilshire 5000 as a proxy.

Perhaps, that is why we could see some massive buying in the coming weeks. It is likely the catalyst that could lead to some pretty quick recoveries when the S&P 500 hits an intra-year dip. 9

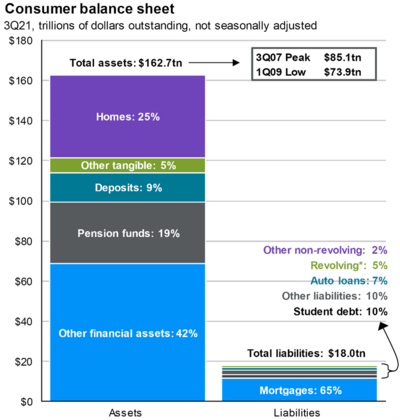

Some of that cash coming off the sidelines will be driven by the incredible strength in the U.S. Consumer balance sheet. Consumers are sitting on a whopping $162.7 trillion in assets—far surpassing the pre-financial crisis high of $85.1 trillion—with only $18 trillion in liabilities. 9

It’s hard to predict how far equity markets can drift but, one potential buffer is the enormous amount of cash sitting on the sidelines waiting to get in the game.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

1. https://medium.com/knowledge-stew/how-much-playing-really-goes-on-in-an-nfl-game-4d1db2731538

2. https://stockcharts.com/h-sc/ui?s=$COMPQ

3. https://stockcharts.com/h-sc/ui?s=$SPX

4. https://stockcharts.com/h-sc/ui?s=NFLX

5. https://fred.stlouisfed.org/series/CASACBW027SBOG

6. https://fred.stlouisfed.org/series/SCABSHNO

7. https://realinvestmentadvice.com/a-major-support-for-asset-prices-has-reversed/

8. https://www.financialresearch.gov/money-market-funds/us-mmfs-investments-by-fund-category/

9. https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/guide-to-the-markets/