Slowing Down to Speed Up

The U.S. consumer has entered another soft patch. It’s a critical part of the cycle to allow the economy to cool, inflation to further decline, and helps restore a more neutral interest rate policy.

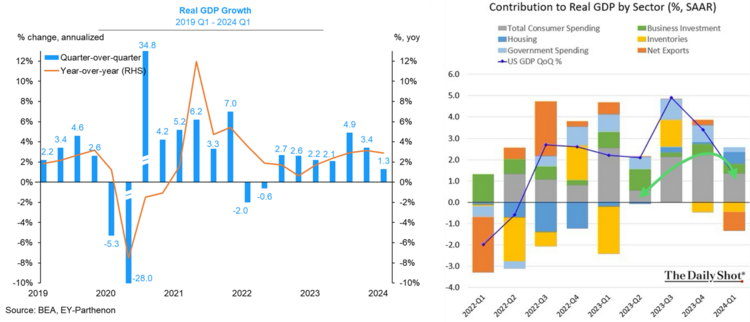

The recent Q1 GDP report showed that U.S. economic growth moderated to 1.3% from 3.4% in Q4 2023 and is on a much more sustainable path to allow for a lower Fed Funds interest rate profile. Importantly, the bulk of the slowdown came from the consumer sector, which is exactly what we need to see if we want lower interest rates going forward. 1 2

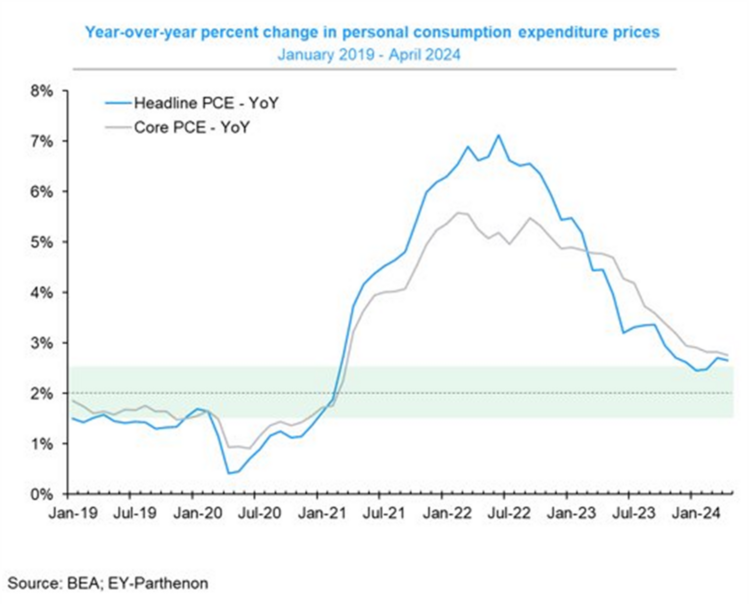

In tandem with the GDP report, the latest inflation data also points to moderation. The Federal Reserve's preferred inflation gauge came in as expected, showing flatlining inflation readings for both headline and core inflation (which excludes food and energy prices). This softening in inflation aligns with the pullback in consumer spending. 3

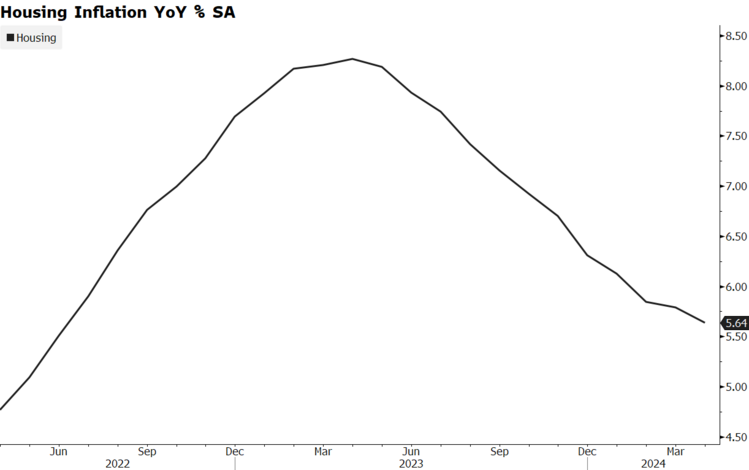

When you look at the most problematic area of consumption, housing inflation is starting to moderate. Housing inflation declined in April, with the rate of change not seen since the level a year ago. 4

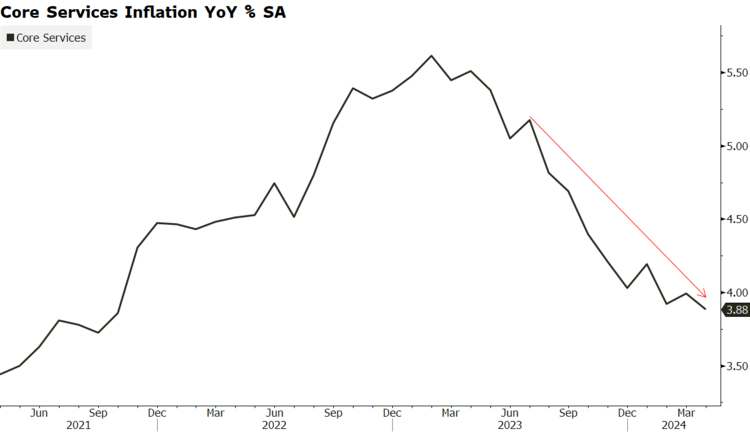

The ever-so-modest cooling in housing inflation in April is supporting a moderation in overall services inflation. 4

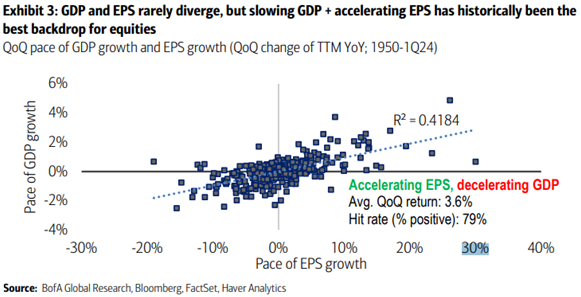

The path to lower interest rates lies squarely on the shoulders of the U.S. consumer to moderate their spending, and it appears they are doing just that. While it’s hard to predict the impact on the S&P 500, it’s a fact that corporate earnings growth is highly correlated to U.S. GDP growth. 5

That's exactly why we need the Fed to cut interest rates sooner rather than later. It's important to cool the consumer and at the same time, they have to protect the economy from the consumer contracting. 4

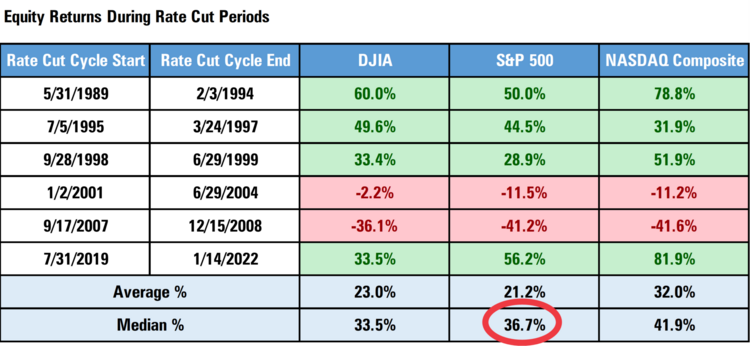

Rate cut cycles are generally positive for equities, but it also depends on when the Fed cuts. Slowing down to speed up is great as long as the consumer continues to earn and spend. Slowing down to stop would be an unwelcome event, with the Fed likely to return to near-zero interest rates to save the economy again.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: