Slowing, Stalling or Deflating

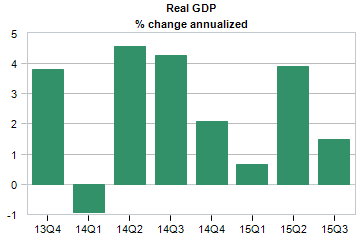

The economy slowed in Q3 from its growth trajectory in Q2.

Overall U.S. GDP only grew at a 1.49% pace down from 3.92% growth in Q2. The good news is the consumer continued to show very strong performance. [i]

Consumption, which makes up about 70% of the US economy expanded by 2.19%. Much of the overall drag in growth occurred due to a reduction in inventories which shrank by -1.44% reflecting continued caution by businesses. [ii]

Earnings Recession Continues…

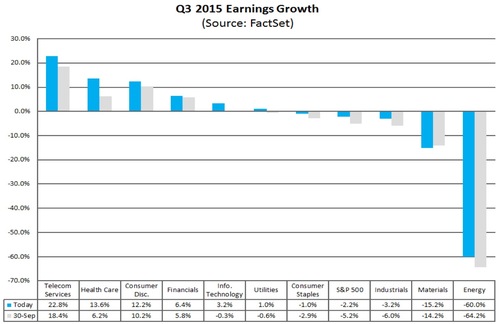

Earnings continue to trend toward two consecutive quarters of negative growth. 340 of the 500 companies from the S&P 500, have thus far, reported earnings shrunk by -2.2%.

While companies are beating their estimates, we still don’t have earnings growth which could be a drag on equity markets. [iii]

Although you wouldn't expect it based upon the performance of equity markets in October; the S&P 500 was up 8.21% for the month. [iv]

S&P 500 October, 2015

Currently beating expectations matters more to investors in the short run that actual earnings growth. However, markets and investors cannot escape reality for too long. We should see a return to normalized corporate profit growth by mid-2016.

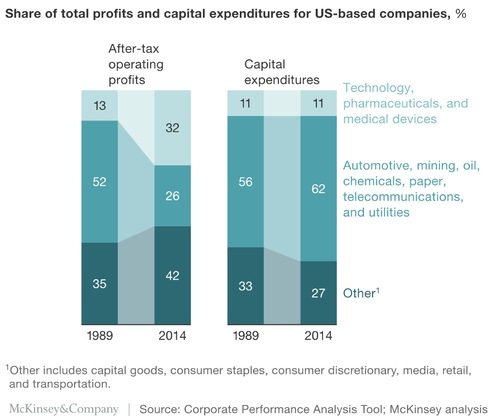

Between the slowdown in US GDP and the ongoing contraction in corporate earnings, it's possible we can see some deflationary pressures. Particularly when you look at what sectors have been growing profits compared to sectors that have seen profits shrink. [v]

According to a recent McKinsey paper, technology, pharmaceuticals and medical devices have been able to hold their capital expenditures steady while increasing their profits from 13% in 1989 to 32% in 2014. The trend is opposite in autos, mining, energy, utilities, and telecom which have seen capital expenses increased 6% and their share of profits shrink 26% over the same 25-year period.

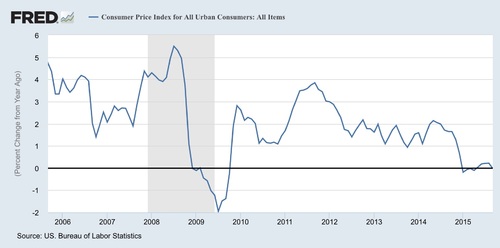

This development is very good for shareholders but maybe not so good for workers, wages and inflation. Perhaps the long-term downtrend in inflation is more than cyclical. [vi]

When you combine no cap ex growth in the most profitable sectors with tepid growth in the economy and earnings continuing to come in at a sub-par pace; it's fair to question if we are simply slowing, stalling or deflating.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Chris Porter, Senior Investment Analyst – Phillips & Company

References:

[i] U.S. Bureau of Economic Analysis

[ii] https://research.stlouisfed.org

[iii] http://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_10.30.15

[iv] Bloomberg terminal, SPX October, 2015

[v] http://www.mckinsey.com/insights/corporate_finance/are_share_buybacks_jeopardizing_future_growth

[vi] https://research.stlouisfed.org