Something’s Gotta Give

If you’re busy trying to enjoy your retirement, make a living, support your organization, or save for retirement, you’re likely confused by the confluence of global macro events. What are the outcomes going to be? Will I be ok? These are the questions we often get asked– now more than ever.

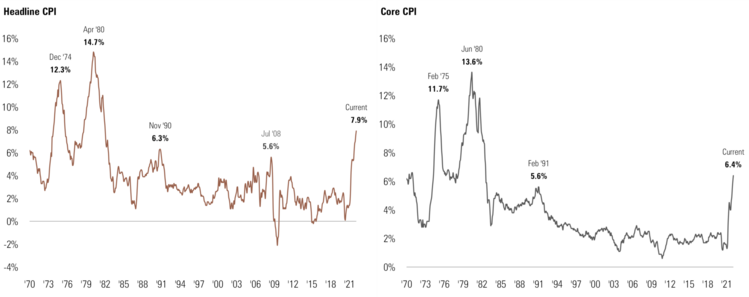

Inflation is running hot. The Consumer Price Index hit a 40 year high at the headline and Core CPI (ex-food & energy) is certainly elevated. 1

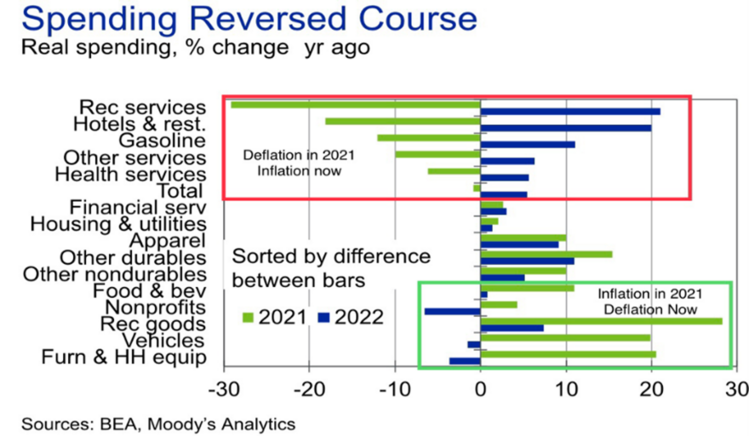

The base effect is still a contributing factor as you can see from the chart below. Those areas that were deflationary last year are showing strong inflationary trends and vice-a-versa. This should moderate in the months to come. 2

Yet, with the current trends in food and energy driven by the Russian invasion of Ukraine, it’s hard to know when headline inflation will abate.

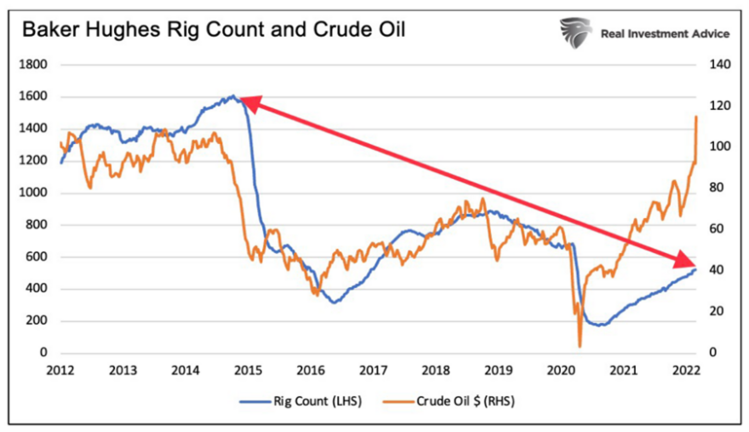

We know much of the world, especially Europe, is highly dependent on Russian energy and the United States still imports energy from overseas. The U.S. imported 73 million barrels of Russian oil in 2021. To replace that lost supply, it would take over 5 years to get our energy rig count up to meet our supply needs based on calculations by Goldman Sachs. 3

Crosscurrent #1: Higher gas prices and threats to our way of life

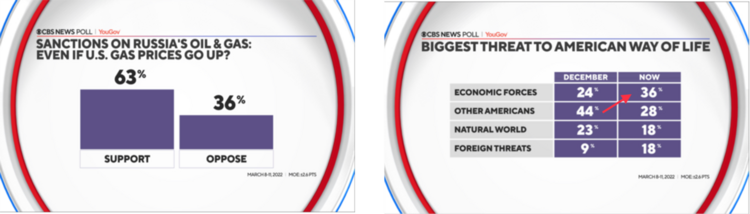

So far – and it’s very early in this current crisis – the U.S. consumer is willing to tolerate some pain at the pump. The most recent survey shows overwhelming support for higher gas prices if that means fighting Russian aggression. Yet, economic forces are now the biggest threat to the “American Way of Life” (AKA consumption). Here’s a link to the full survey, if you’re interested.

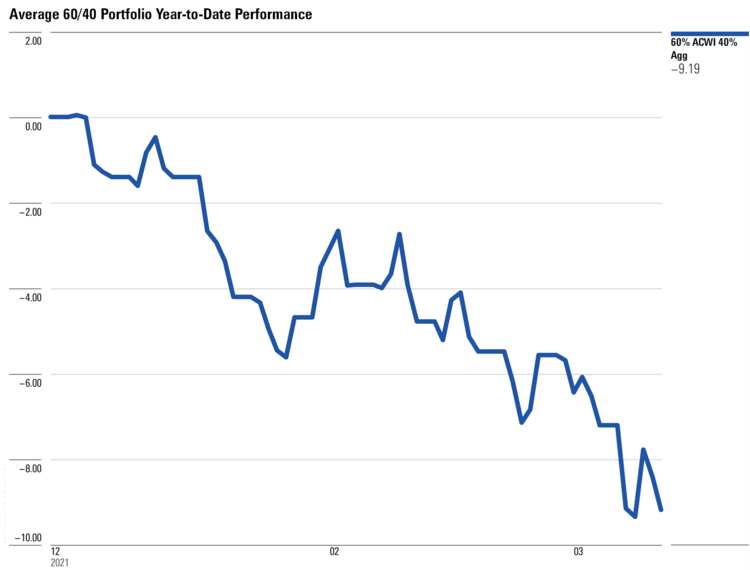

Crosscurrent #2: The pain at the portfolio

The average 60/40 (equity/fixed income) portfolio is down about 9% this year. 4

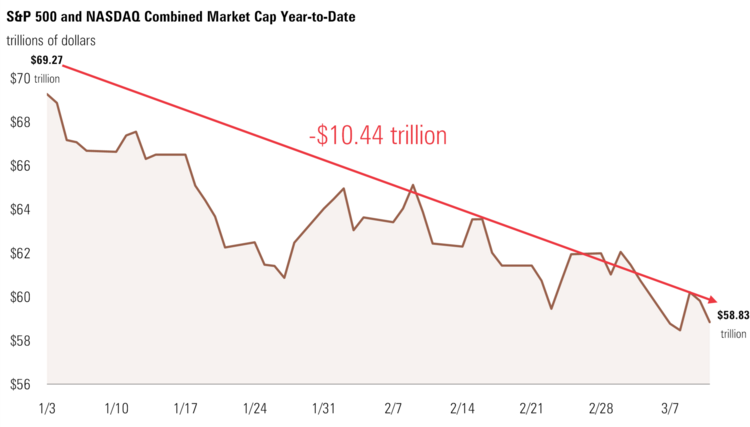

The S&P 500 and Nasdaq have suffered over $10 trillion in wealth destruction combined. 5

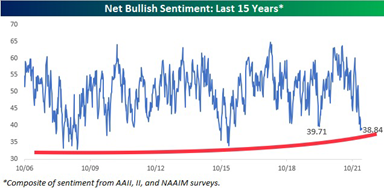

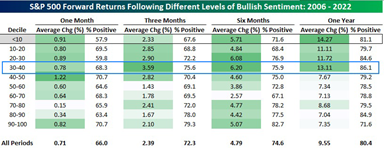

Investor sentiment is currently at the same low levels seen during the Covid-19 and the Great Financial Crisis drawdowns. 6

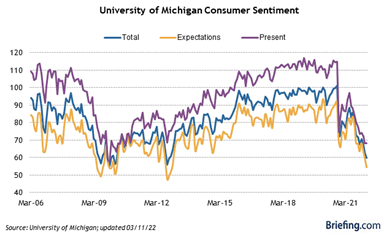

Consumer sentiment aligns with the painful portfolio numbers with similar dour readings. 7

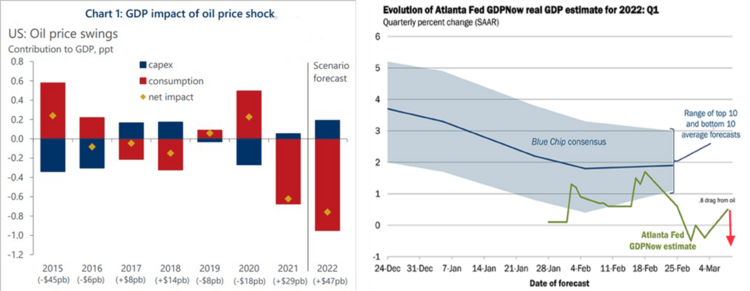

Crosscurrent #3 Oil will impact GDP growth

Q1 GDP, which is forecasted to be anemic, will downshift even further with higher energy prices based upon historic data. Is it possible we have a negative print on GDP for Q1? 8

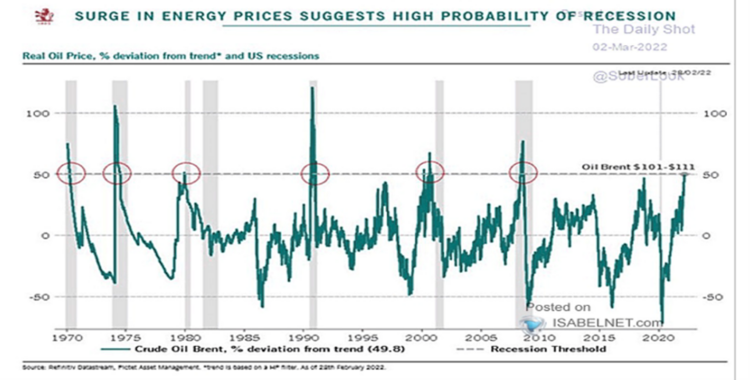

The risk of recession is elevated as oil prices climb well above growth trends. 9

How long will investors tolerate higher prices for food and energy, recession risk, and lower portfolio values before they turn sour on the energy embargo?

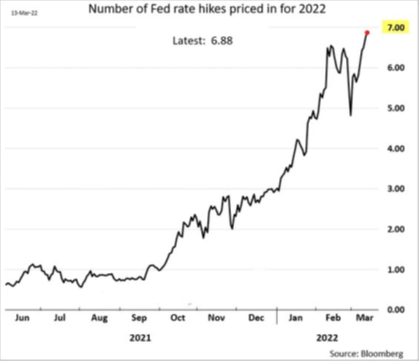

Crosscurrent #4. Markets anticipate 6-8 Federal Reserve rate increases in 2022

This is pure demand destruction—beyond what’s being crushed by higher energy and food costs. 5

Crosscurrents are hard to parse but, perhaps looking at what is and what isn’t baked into markets can help. The following is my opinion on what’s in and what’s not.

What’s baked into market expectations: (helps stabilize markets)

- Ongoing conflict in Ukraine, with Russia controlling the country

- Six or more rate hikes

- Elevated prices for energy for the foreseeable future

- Weaker than 4.8% Q1 earnings growth, driven by consumption headwinds

What’s not baked into markets:

- Expanded attacks on NATO countries and direct U.S. armed engagement

- Fewer than six rate hikes

- Better than 4.8% earnings per share growth

- Sanctions on China that could clobber the second largest and fastest growing economy in the world

- Nuclear War

- Russia negotiates a peace treaty that helps them restore some semblance of a path to recovery

In my experience over a long career of investing, the good news is that over time the many crosscurrents convalesce and can drive markets upward. Admittedly, I’ve not seen this many conflicting trends at one time.

When investor sentiment is this bad, strong investors rebalance, recommit, and continue to move forward. 86% of the time markets are at higher levels one year later. 6

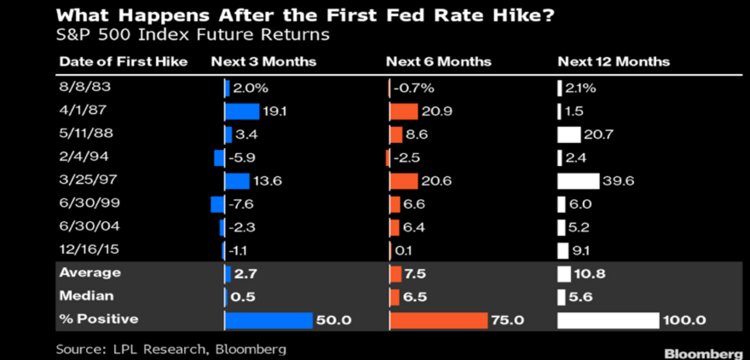

Factoring in rising rates, markets tend to perform very well. The S&P 500 was up an average of 10.8% and was in positive territory 100% of the time after the first rate increase. 5

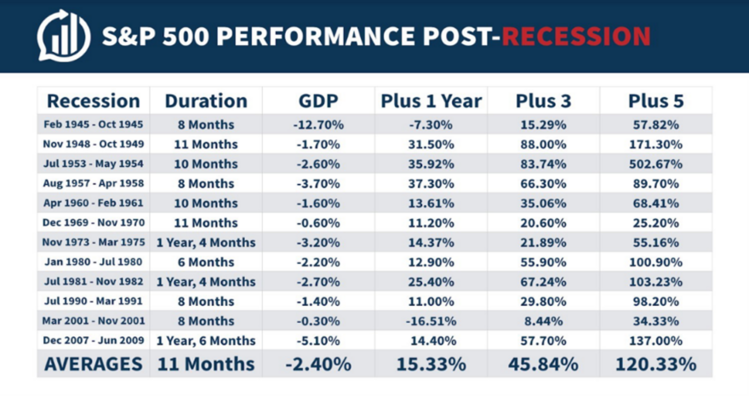

Even under threat of a recession, markets tend to move higher as clouds lift and the prospect of earnings growth become more apparent. 10

It’s just a matter of time to allow good policy to seep into our economy, make way for consumer’s animal spirits to continue, and for investors to rebalance to better valuations. Something’s gotta give and I suspect it will be reasonable actors stepping in when pain is at its worst.

Our thoughts and prayers continue to be with the people of Ukraine and the willingness of the people of Russia to take control of their destiny by removing an irrational actor.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.bls.gov/cpi/

- https://www.economy.com/

- https://realinvestmentadvice.com/high-gas-prices-and-recessions

- Morningstar Direct

- Bloomberg

- https://www.bespokepremium.com/interactive/research/think-big-blog/

- https://www.briefing.com/calendars/economic

- https://www.atlantafed.org/cqer/research/gdpnow

- https://dailyshotbrief.com/

- https://awealthofcommonsense.com/