Soybean Politics

The trade war rhetoric has heated up, although we continue to maintain our view that this is more of a food fight than an actual fight.

With trade war tensions dominating news headlines for the better part of 2018, the U.S. large-cap indices have shown low- to slightly-negative returns, whereas the indices in China—Hang Seng and Shanghai Composite—have reacted far more negatively given the circumstances. [i]

While the U.S. markets are without a doubt affected by all of this, speaking strictly from a market perspective, the ongoing threats of an all-out trade war appear to be doing more harm to China’s market, despite U.S. stocks falling 1.5 to 2.5 percent [i] at the time of writing (depending on which index you’re looking at), in part due to the latest trade war headlines:

Trump tariffs backfire as EU retaliation will force American icon Harley-Davidson to build overseas – CNBC [ii]

Trump Plans New Curbs on Chinese Investment, Tech Exports to China– Wall Street Journal [iii]

US STOCKS—Wall Street pummeled by escalating trade row – Reuters [iv]

Europe Retaliates Against Trump Tariffs – New York Times [v]

Chinese retaliatory tariffs aim to hit Trump in his electoral base – The Guardian [vi]

Europe’s Retaliation Takes U.S. Trade Tensions to the Next Level – Bloomberg [vii]

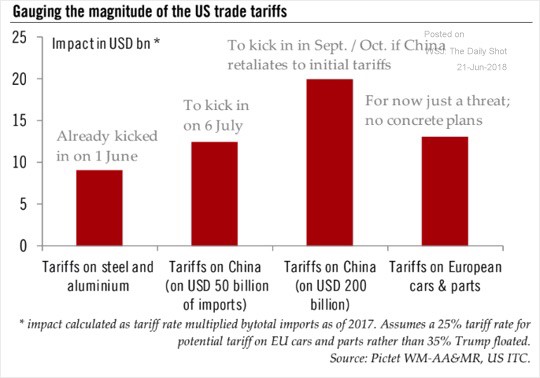

In fact, all these headlines from the past week are driving an escalation that, in my opinion, isn’t necessary. The fact of the matter is the actual implications of the various tariffs being imposed are scheduled to take place in phases over the next couple of quarters, leaving ample time for things to de-escalate and come to a resolution. [viii]

While many may question our view that this is mere posturing, when you consider the retaliation on U.S. industries, you get a more realistic picture of the severity of all this.

Take soybeans, for instance. The simple facts tell one story, whereas the political facts tell another. For starters, soybean exports to China were suffering long before any potential tariff retaliation because of cheap supply coming from Brazil. Not to mention, the amount of protein in each soybean has been on a steady decline for many years, which has been another leading detractor to the U.S. market for quite some time [ix]. While it’s true that the potential tariffs on soybeans could raise the price-per-bushel by $100 per ton, the U.S. is experimenting with ways to increase the concentration of protein within soybeans, which would likely make them more valuable to cattle farmers (China being one of the largest) and thus reduce the long-term economic impact from soybean tariffs, but not in the short-term. [x]

When you look at the states that are affected, many of them are in the heart of the Trump voter base. [xi]

Given that these states make up a large part of Trump’s overall voter support, it’s likely that, despite Trump’s politics, he will not want to alienate his voters and we’ll start to see tensions de-escalate, as a result of already hard times for soybean farmers.

Just consider the potential contagion from these states that could affect all the other states dominated by Republican voters during the last election. [xii]

Furthermore, look at the top ten U.S. imports from China. [xiii]

These items have a significant impact to not only the Trump voters but the overall U.S. consumer which happens to be driving much of U.S. GDP growth at this point.

That’s why in my opinion Trump won’t want to alienate his investor base and China won’t want to see more of its country’s wealth disappear because of declining local markets. These considerations could bring a de-escalation that quiets tensions sooner rather than later. For that reason, I believe the “Trump Trade Tantrum” may be overplayed in our equity markets.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Robert Dinelli, Investment Analyst, Phillips & Company

References:

i. Bloomberg, L.P.

ii. https://www.cnbc.com/2018/06/25/trump-tariffs-backfire-on-harley-davidson-after-eu-retaliates.html

iii. https://www.wsj.com/articles/trump-plans-new-curbs-on-chinese-investment-tech-exports-to-china-1529883988

iv. https://www.reuters.com/article/us-usa-stocks/wall-street-pummeled-by-escalating-trade-row-idUSKBN1JL1BE

v. https://www.nytimes.com/2018/06/21/business/economy/europe-tariffs-trump-trade.html

vi. https://www.theguardian.com/business/2018/jun/24/tariffs-trump-china-red-states-retaliation

vii. https://www.bloomberg.com/news/articles/2018-06-22/europe-s-retaliation-takes-u-s-trade-tensions-to-the-next-level

viii. https://blogs.wsj.com/dailyshot/2018/06/20/the-daily-shot-u-s-china-trade-spat-rips-through-commodities-markets/ - Wall Street Journal (Subscription)

ix. https://www.reuters.com/article/us-usa-soybeans-china/u-s-soybean-exports-scrapped-as-china-shifts-to-brazilian-beans-idUSKCN1IJ2SG

x. https://www.reuters.com/article/us-usa-soybeans-protein-insight/protein-plight-brazil-steals-u-s-soybean-share-in-china-idUSKBN1FE0FM

xi. https://www.statista.com/statistics/192076/top-10-soybean-producing-us-states/

xii. https://www.nytimes.com/elections/results/president

xiii. https://www.census.gov/foreign-trade/statistics/product/enduse/imports/c5700.html