Special Pain Edition: “It Damn Well Hurts”

As the economy is muddling through a reopening, fits and starts to supply and demand should be the only expectation.

While volatility has been declining as we have been working our way to an economic reopening, investors should get used to living with volatility. [i]

Unfortunately, it is in our nature to consider things that are volatile as risky and painful. In the real-world volatility is risk, risk is pain, and avoiding pain is essential to sustain life.

However, volatility is the necessary ingredient to investing. Our friend Morgan Housel, author of Psychology of Money, helps us think about volatility and pain in this short video: Click on this link to watch.

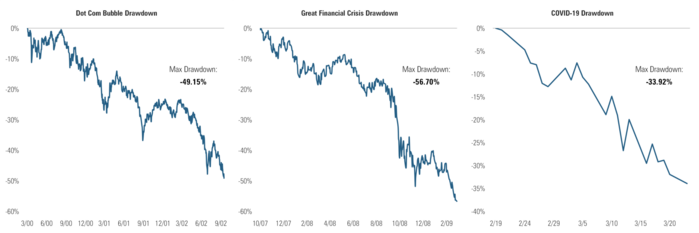

In fact, when you think about the largest drawdowns on the S&P 500 on major life events, it looks incredibly painful. [ii]

Those were incredibly volatile moments and painful times for investors.

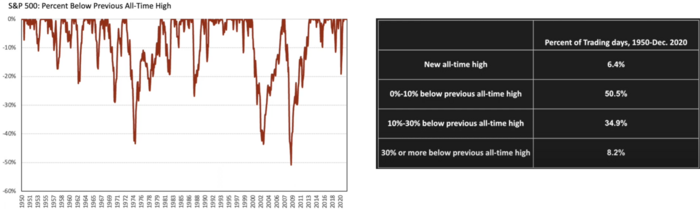

Investing is a world of volatility. You can see from the charts below the market has spent approximately 6 times as many days “10% or more below” its previous all-time high than it has at a “new all-time-high.” [iii]

Morgan makes a great point about pain and the movie Lawrence of Arabia as it applies to investing, click here to catch this great story.

Today, we face a once in 100-year event: restarting an economy that was frozen solid. Who knows how the day-to-day or month-to-month economic permutations will work? All we do know is that we are likely in store for more volatility – a painful yet necessary ingredient to returns.

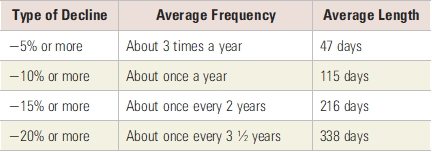

Normal drawdowns in equity investing look something like this:

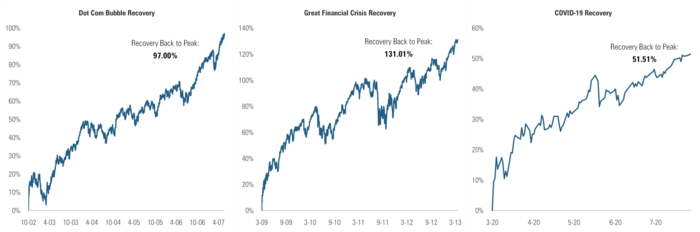

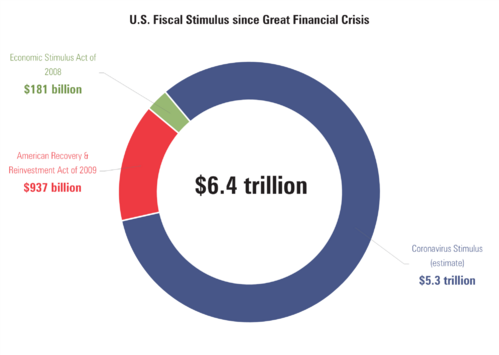

Here’s the good news: It generally gets better. Let’s go back to the drawdown charts for those painful events. Now, look at the recoveries before experiencing the next drawdown. [ii]

What is even more compelling is the speed of the recoveries. [ii]

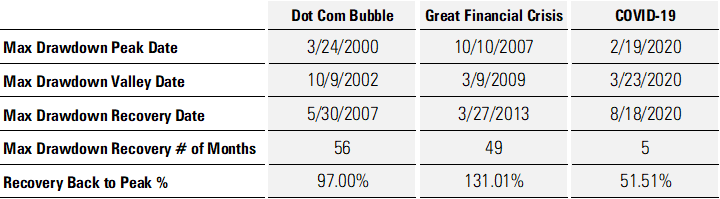

The most recent two events, the Great Financial Crisis and COVID-19 had something in common: incredibly accommodative fiscal and monetary policy. [iv]

The Federal Reserve alone pumped $4.3 trillion into the economy over these two events. That’s 19.4% of GDP in current dollars.

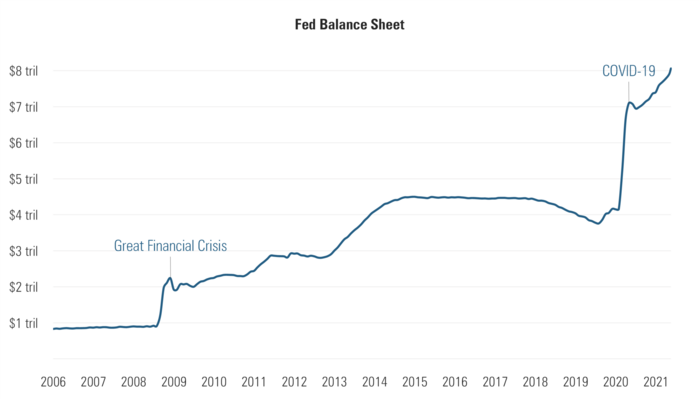

Now, add in our highly dysfunctional congress which seems to get its act together with just-in-time fiscal support. [v]

That’s another 29% of GDP in current terms.

It’s my view that after $10.7 trillion in fiscal and monetary policy worked to arrest near-economic-catastrophe in the last two painful events, we can expect those tools to alleviate some of the pain if another event occurs. Again, the goal is reducing the pain felt or at least providing some limitations on the pain inflicted by economic events. After all, politicians and bureaucrats will use what’s worked in this past before they try new things.

While painful for potentially long periods, economic gyrations are necessary to create the environment for returns. As our friend Morgan Housel points out in the video here, there is a “cost to investing…a price for admission to investing.” Pain might be that price.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.cboe.com/tradable_products/vix/

ii. https://www.bloomberg.com/quote/SPX:IND

iii. https://www.youtube.com/watch?v=dwvyM7kkD6g

iv. https://fred.stlouisfed.org/series/WALCL

v. https://www.pgpf.org/blog/2021/03/heres-everything-congress-has-done-to-respond-to-the-coronavirus-so-far