Special Panic Edition: Silver Linings

When I wrote the post, “And Now for the Bad News” on February 24th, I was anticipating some discounting by investors to earnings adjustments and dire macro-economic news related to the Coronavirus outbreak.

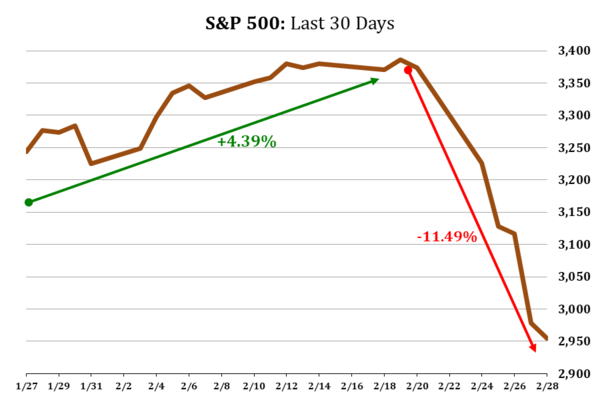

Candidly, I didn’t expect to have the worst week for equities since the Great Financial Crisis and the quickest 10%+ drop in the history of the market on the heels of hitting all-time highs. [i]

Clearly, investors did not reasonably discount the implications of the virus and minimized the implications when we ran to all-time highs.

Market participants are now attempting to discount the negative news and uncertainty around earnings. [ii]

With little in the way of hard data to rely on, as it relates to earnings adjustments, discounting future cashflows becomes extremely hard. That’s how you end up with high-conviction selling and short-term panic selling.

Let’s ground ourselves in some reality.

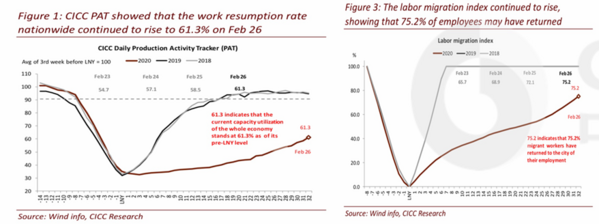

China—the second largest economy in the world—is coming back online. Both production and the return to work of the millions of migrant workers are showing immediate improvement according to our China research partner, CICC. [iii]

Production is back to 61% and labor migration is back to 75%. In addition, Starbucks announced they had reopened 85% of their cafes across China and Apple CEO Tim Cook stated that the company’s contract manufacturers in China are beginning to come back online. While production levels are still below prior levels, progress is being made and risks are being mitigated.

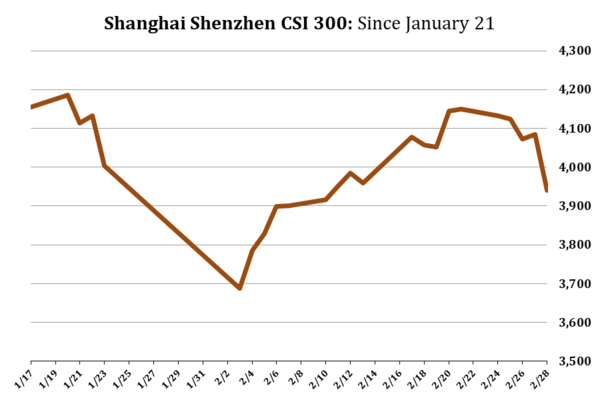

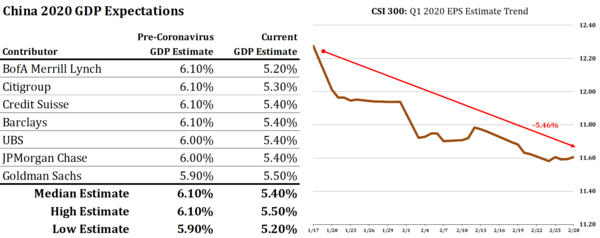

Surprisingly China’s domestic market is only down 5.2% since the first reports of the virus on January 21st. [iv]

We completely expect both macro China GDP growth and Q1 earnings growth to be muted in China and those expectations are being widely digested within their local markets. [v] [vi]

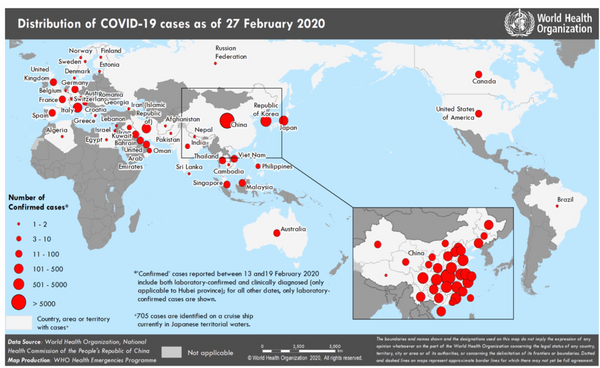

Pivoting to the rest of the world, the coronavirus has spread quickly country by country; however, the cases in almost all countries are limited. [vii]

This is precisely the value-discounting market participants are struggling with. They are taking a short-term view on the earnings growth and selling indiscriminately.

Allow me to remind our clients and readers of some simple facts we summarized in our presentation, “5 Rules for Equity Investors”: The most important rule right now is to realize that time shapes risk. [viii]

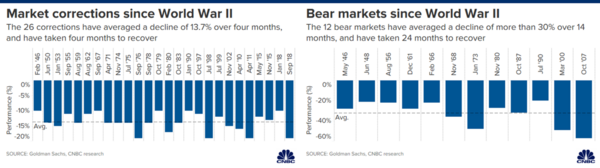

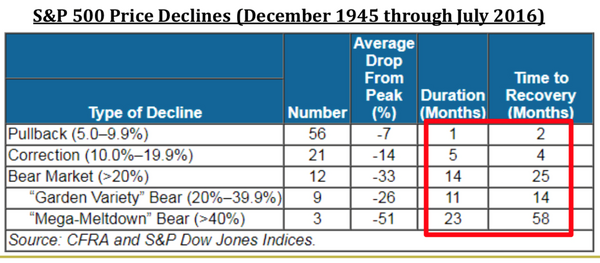

As you can see above, of the 26 market corrections since World War II the average decline has been 13.7% and have taken about 4 months to recover. Of the 12 bear markets since World War II, the average decline has been more than 30% and has taken about 24 months to recover.

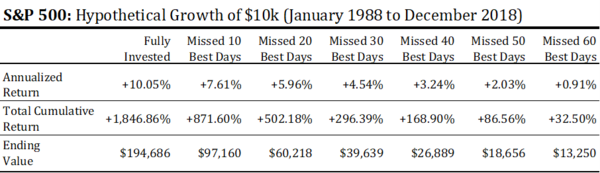

The most critical point for investors to realize—and perhaps they do now— is that markets move in brief bursts and it is very hard to time the upside. Consequently, if you miss just a few upside bursts, you lose all your advantage. [ix]

As you can see in the chart above, if you miss just the 20 best days over a 30-year period, you lose almost half the annualized returns. That’s such a small number of days over a long period of time but, the punishment is brutal.

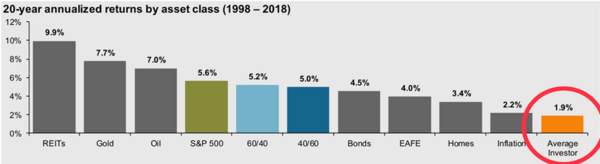

That leads to a specific outcome, which JP Morgan has published. [x]

When investors attempt to time markets, they must do two things: pick a time to sell and pick a time to buy, precisely. The consequences are very high.

The general lesson here is simple, don’t invest in equities if you don’t have the time to weather any storm. Generally, it can be about 14 months to recover from a typical bear market. If it’s a credit driven financial crisis, it can take even more time—perhaps even a couple of years to find a bottom. [xi]

The point being, when investing in equities anything can happen and usually does.

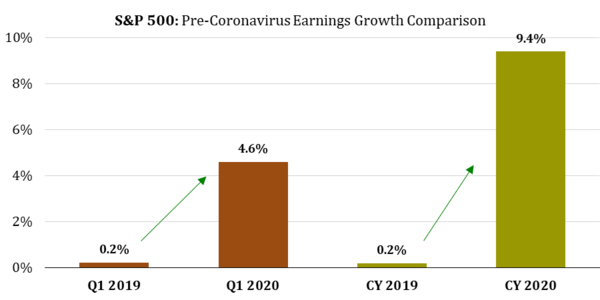

Here is the silver lining in all of this bad news: We are entering a year with easy year-over-year earnings comparisons. Investors typically like to see percentage growth over the prior year, and this makes 2020 an ideal year for earnings growth. Prior to the virus impacting Q1 2020 and full-year 2020 earnings, year-over-year growth expectations looked like this: [xii]

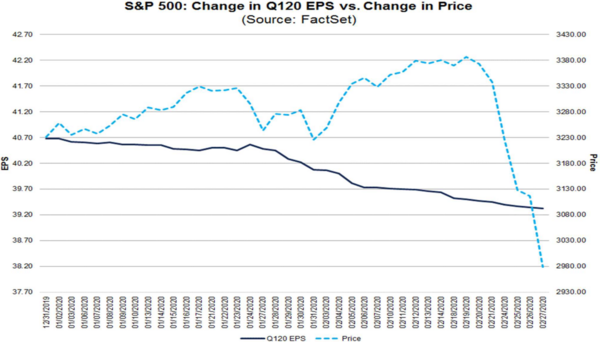

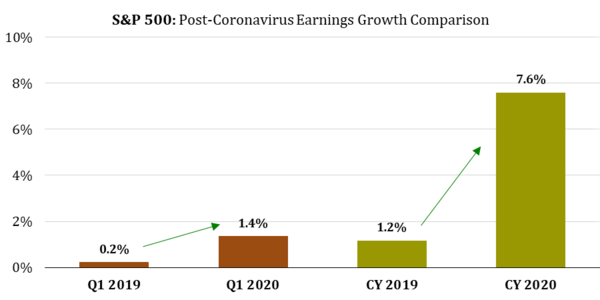

Even with significant downward earnings revisions, the latest data suggests we will still have favorable Q1 and full-year 2020 year-over-year comparisons, as shown below in the latest S&P 500 earnings growth estimates from FactSet: [ii]

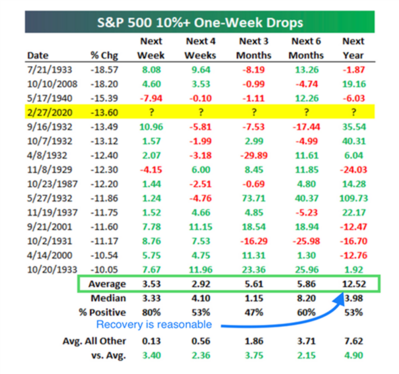

Conviction matters. Patience matters. Putting the best odds in your favor matters. Most importantly, time is paramount in equity investing. One more look at time, this is from our friends at Bespoke Investment Group: [xiii]

Sudden drops typically lead to strong gains. The theory being that investors overreact to events in the short run.

There is always a sliver lining if you have time on your side.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.bloomberg.com/quote/SPX:IND

ii. https://www.factset.com/hubfs/Resources Section/Research Desk/Earnings Insight/EarningsInsight_022820.pdf

iii. https://research.cicc.com

iv. https://www.bloomberg.com/quote/SHSZ300:IND

v. https://www.bloomberg.com/quote/CNGDPYOY:IND

vi. https://www.ceicdata.com/en/china/china-securities-index--pe-and-pb-ratio-daily/cn-pe-ratio-csi-300-index

vii. https://experience.arcgis.com/experience/685d0ace521648f8a5beeeee1b9125cd

viii. https://www.cnbc.com/2020/02/27/heres-how-long-stock-market-corrections-last-and-how-bad-they-can-get.html

ix. https://www.zacksim.com/perils-moving-investments-cash/

x. https://am.jpmorgan.com/us/en/asset-management/gim/adv/insights/guide-to-the-markets

xi. https://www.cfraresearch.com/latest-content/research/

xii. https://www.factset.com/hubfs/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_030119.pdf

xiii. https://www.bespokepremium.com/interactive/