Spill Over

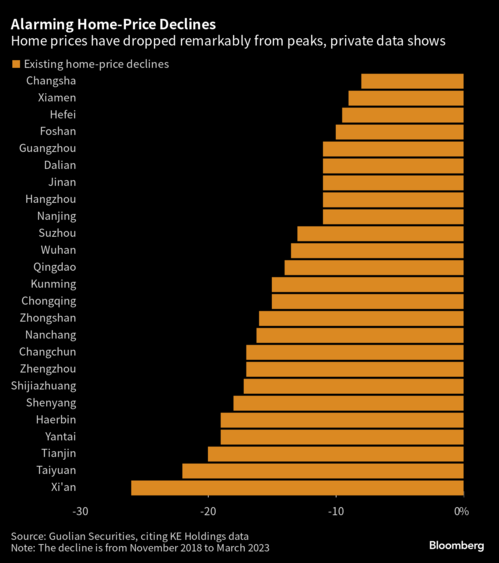

China is in an economic air pocket with the associated turbulence. The property market, which makes up over 60% of the wealth of the Chinese consumer, is in a deflationary spiral. Property prices in key markets have been dropping. 1

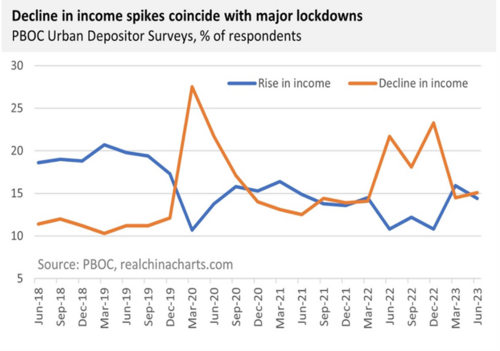

Wages have flattened, with income increases matching income decreases. 2

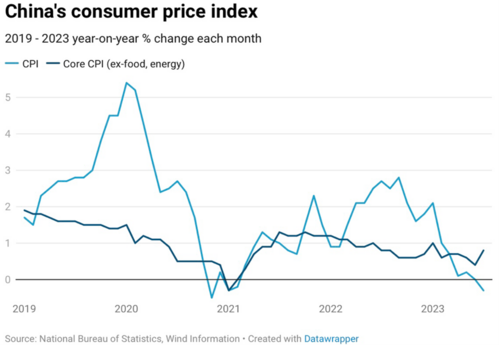

Inflation in China is non-existent and in fact they are flirting with some deflationary pressures on a headline basis. However, most of the deflation is from food prices, specifically pork prices, which have been on a decline. 2

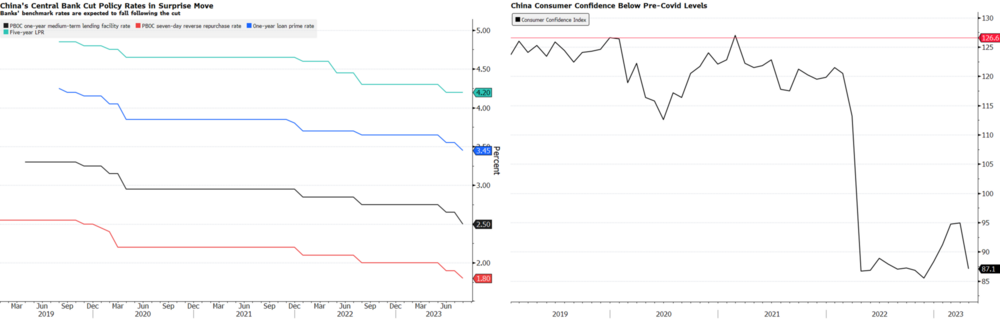

While interest rates have been cut to support lending and consumption, consumer confidence is low and that is creating a troubling soft spot in their economy. 3

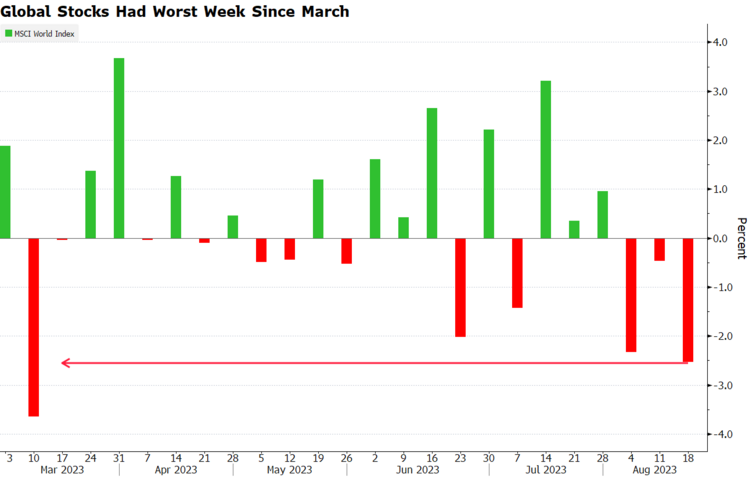

We have been migrating and trimming our China exposure to focus on key areas of special support from the government. However, without a strong China, global equity markets will experience equal turbulence. In fact, last week was one of the worst for global equites since March. 4

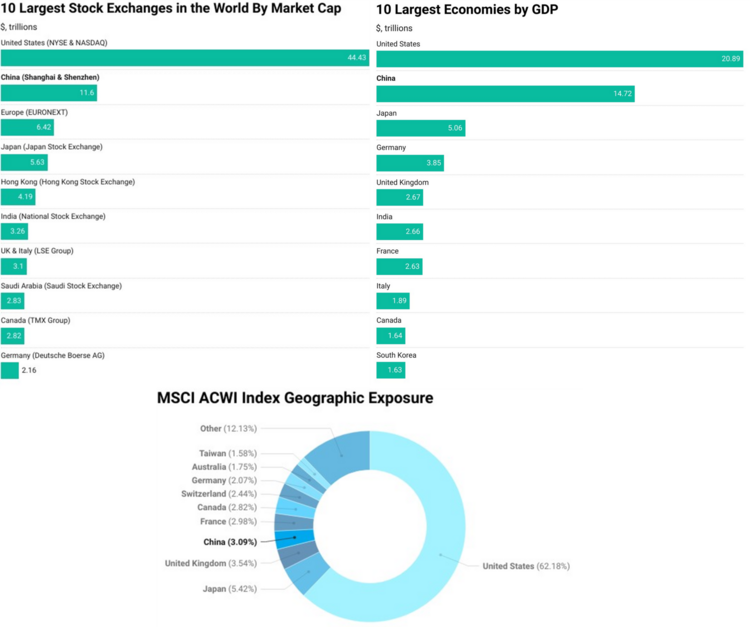

China is the second largest equity market and the second largest economy, as well as the fourth largest component of the MSCI All World Index. 5 6 7

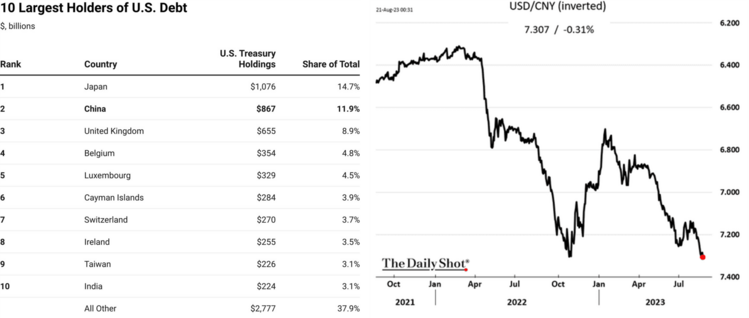

A weak China can have some spill over impact across the globe. If China needs to sell treasury bonds to defend their currency that could be the first sign of global trouble. 8 9

If a second order impact from the geopolitical competition with China is rising rates for U.S. treasuries, a lot will change in our posturing soon.

We expect China to provide more stimulus to support confidence and a recovery in the quarters ahead. They cannot allow for an economic air pocket to spill over into social unrest from a weakening economy.

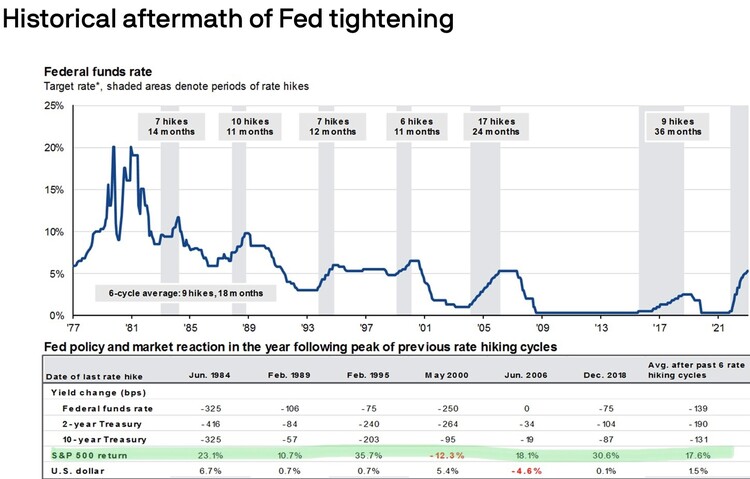

While the challenging news might be the air pocket in China right now, the Fed will factor that into their rate decisions. Perhaps we will hear a softer speaking Fed on Friday when Chair Powell speaks at the Jackson Hole conference. 9

U.S. equities tend to rally at the end of rate cycles. That might be the cure for some overseas turbulence.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.bloomberg.com/news/articles/2023-08-16/china-s-housing-slump-is-much-worse-than-official-data-shows

- https://www.realchinacharts.com/

- Bloomberg

- https://www.bloomberg.com/news/articles/2023-08-17/stock-market-today-dow-s-p-live-updates

- https://tradebrains.in/10-largest-stock-exchanges-in-the-world

- https://globalpeoservices.com/top-15-countries-by-gdp-in-2022

- https://www.ishares.com/us/products/239600/ishares-msci-acwi-etf

- https://www.visualcapitalist.com/which-countries-hold-the-most-us-debt

- https://dailyshotbrief.com