Spring Has Always Followed Winter

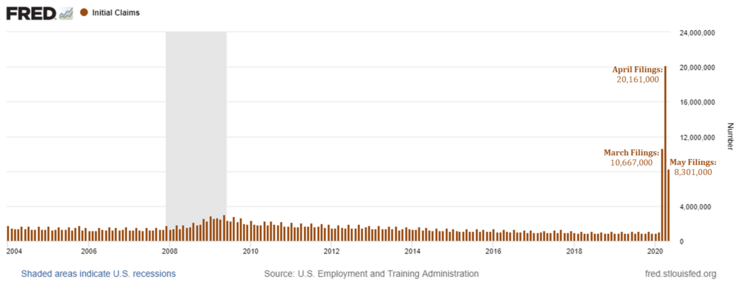

As we continue to thaw from the worst economic freeze in the history of our country, it is easy to get caught up in the sheer magnitude of our losses. With close to 40 million jobs lost since February, it is hard to envision any reasonable way back. [i]

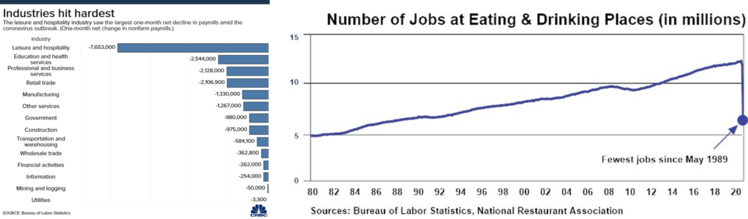

When we dissect who lost those jobs, workers in the food and beverage industry (a subcategory of leisure and hospitality) have borne the brunt of this medically-induced economic coma. [ii] [iii]

It certainly makes me contemplate what type of recovery we are likely to have.

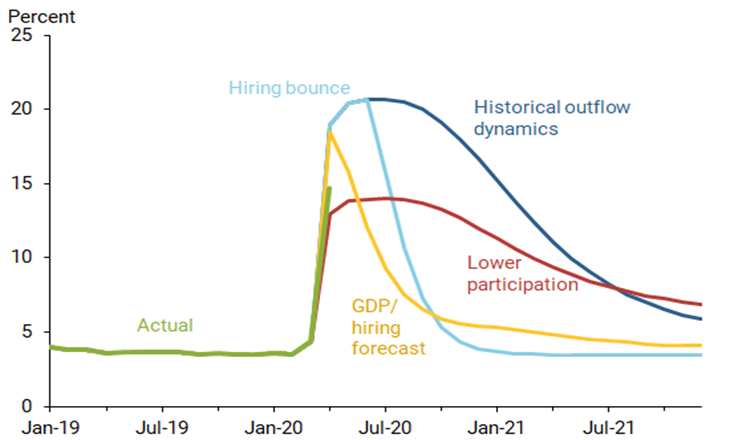

A recent Federal Reserve study considered various paths back to pre-Covid employment levels based on various rates of job recovery. The first path (dark blue) reflects a typical jobs recovery after a recession. The second path (light blue) reflects an immediate hiring bounce. In this scenario, an immediate rehire occurs after a post-Covid opening in July. The third possible path (yellow) reflects a traditional relationship between GDP growth and employment. [iv]

Clearly, a historical recovery (dark blue line) could be extremely detrimental to our economy and leave us with deep economic scars. This would be an almost flat line recovery, taking many years to get back to pre-Covid levels. Equity markets are certainly not anticipating this type of recovery.

I don’t believe the historical recovery path is preordained for this circumstance. In a traditional economic recovery from a recession, many jobseekers end up with part-time or temporary work before they find permanent employment. In our current circumstance, many of those that lost jobs will likely return to their place of employment.

My view is we are likely to encounter one of the other two trajectories in the chart above—GDP/Hiring (yellow line) or Hiring Bounce Back (light blue line) when it comes to a recovery in jobs.

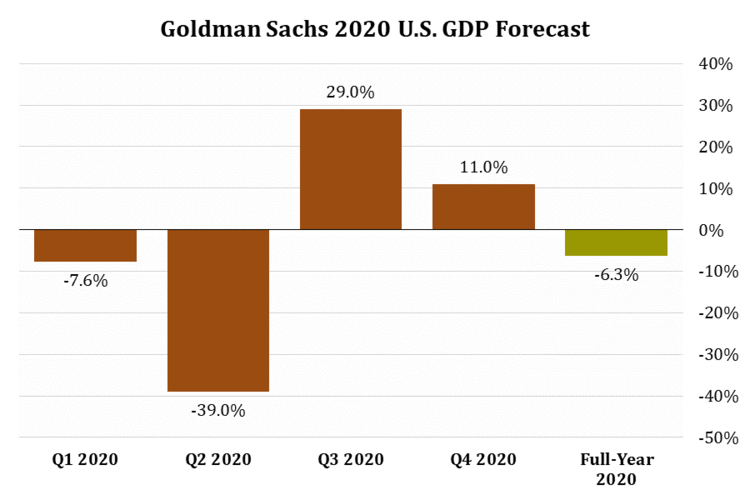

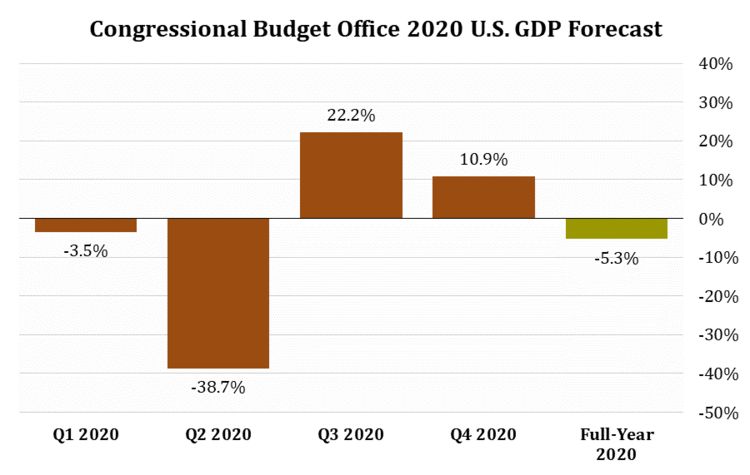

As you look at various GDP recovery expectations, you can see almost all look for a strong recovery in the second half of 2020. [v]

Even the current Congressional Budget Office model anticipates that type of recovery. [vi]

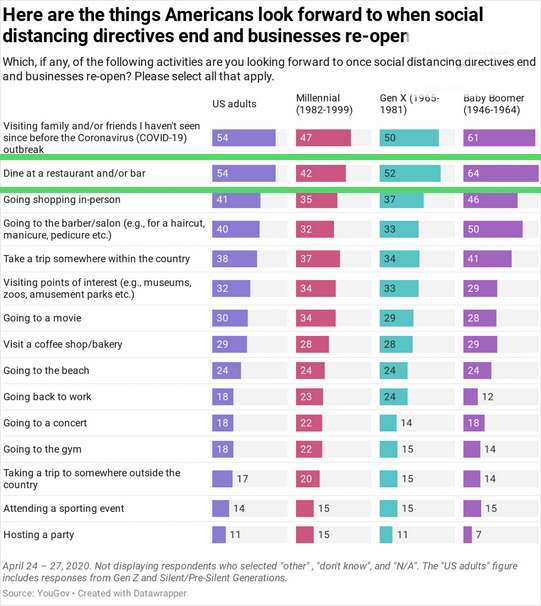

While I think the “GDP/Hiring” forecast is likely, we might have a realistic chance at the quicker “Hiring Bounce” model. There is very little data currently to support that belief but, when looking at what consumers want to do the most on a return-to-normal basis, it’s all about going out to eat and drink. Across most age cohorts, Americans want to dine out as much or more than visiting family and friends. [vii]

If this survey comes to fruition, we could see most of those 8 million jobs in the food and beverage industry come roaring back. Although we would need more than just food and beverage workers to make a complete recovery, that 8 million would be a great start. It might become an issue of supply rather than demand that could be the obstacle and that would be a welcome relief.

Just as Spring has always followed Winter, consumers will dine out, jobs will return, and our GDP will recover. Equity markets may have already discounted the recovery, in which case we might find ourselves in a short-term trading range until we get further into the economic spring.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://fred.stlouisfed.org/series/ICSA

ii. https://www.cnbc.com/2020/05/08/these-industries-suffered-the-biggest-job-losses-in-april-2020.html

iii. https://restaurant.org/Articles/News/Three-decades-of-restaurant-jobs-were-lost

iv. https://www.frbsf.org/economic-research/publications/economic-letter/2020/may/unemployment-crisis-after-onset-covid-19/

v. https://research.gs.com/content/research/themes/homepage-default.html

vi. https://www.cbo.gov/publication/56351

vii. https://today.yougov.com/topics/consumer/articles-reports/2020/04/30/video-games-baking-and-naps-how-america-passing-ti