Sputtering Before the Sprint

Last week I highlighted what I believe will be an exceptional year for U.S. equity investors. It’s worth taking another read. I certainly don’t want to be Pollyannish about what stands between us and that optimistic forecast but, as long-term investors and asset allocators we tend to look past some of the immediate stresses and focus on longer-term trends. However, we face some challenges in the coming weeks that might be bone-jarring for investors beyond the COVID-19 news.

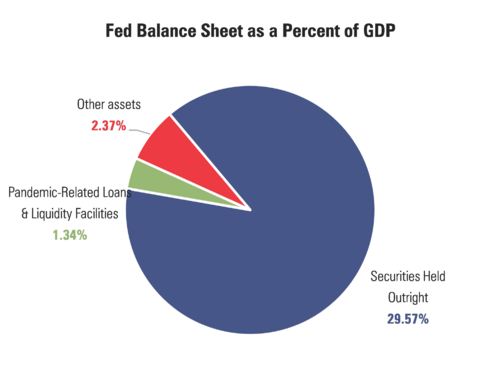

Much of the uncertainty will revolve around government interventions in our economy. That’s no small matter as the government, via Federal Reserve expansion and congressional emergency stimulus, now stands at approximately 33% of nominal GDP in 2020. [i]

First, much of the fiscal support for workers will expire at the end of the year. The various programs supporting the more than 10 million out-of-work Americans is no small matter:

COVID-19 Support Programs Expiring at the end of the year:

• Pandemic Unemployment Assistance, which provides benefits to gig workers, freelancers, and the self-employed who are not eligible for traditional state benefits

• Pandemic Emergency Unemployment Compensation Program, which provides an extra 13 weeks of benefits to people who exhaust their state benefits

• The eligibility window for tax credits for businesses to cover paid employee sick and family leave

• Penalty-free early withdrawals from 401(k)s and IRAs

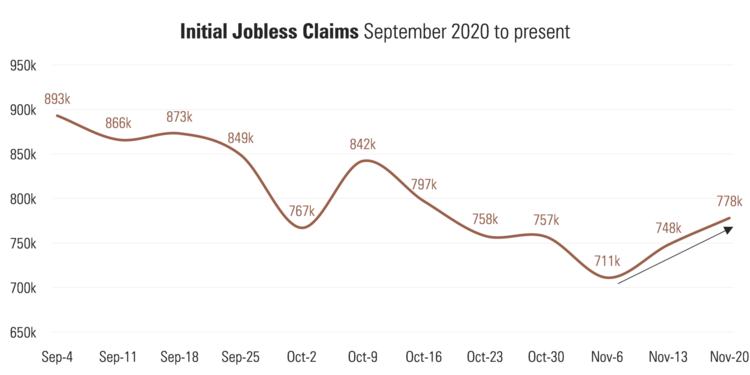

Second, with the current COVID-19 outbreak forcing more rolling shutdowns; we are seeing some uptick in initial claims for unemployment benefits. [ii]

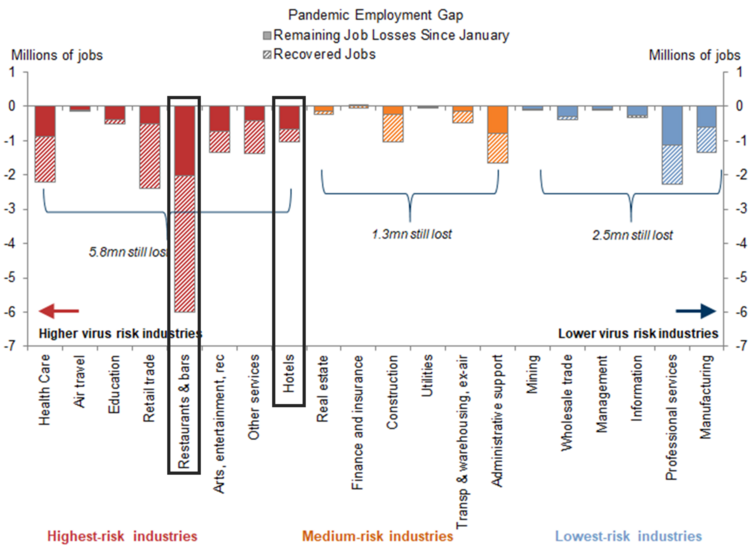

Further, workers in the travel and leisure industries face more employment uncertainty. [iii]

The airline industry announced they would be facing another round of layoffs if additional fiscal support from congress was not forthcoming. Disney finally buckled and announced over 35,000 layoffs, mostly from their theme parks and hospitality businesses.

What is also tragic is most of those facing cuts are those at the lower end of the income bracket.

Not only will those that are receiving unemployment benefits face significant reductions if no support is approved, recent analysis by global advisory firm Stout Risius Ross estimates as many as 34 million Americans may be at risk of evictions. [iv] Both tenants and property owners should receive support without question.

Third, we face looming uncertainty around more fiscal support from Congress. While it is almost certain we will see something, it is a matter of timing. Will it occur before year-end with this administration or will it occur after the Biden inauguration? Juxtapose this delay with the immediate needs of those currently unemployed and you can see very little light at the end of this particular tunnel.

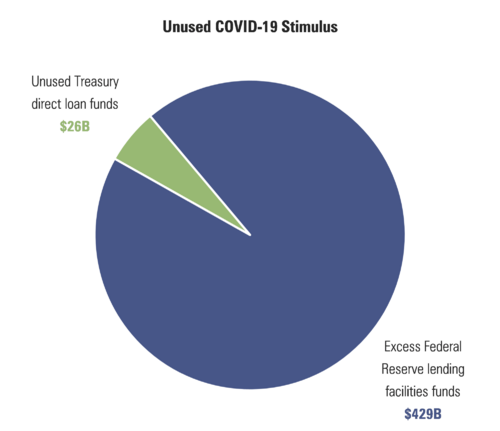

If there had been a glimmer of light, Treasury Secretary Mnuchin flipped that switch off with his desire to pull back any excess firepower from the Federal Reserve. There is approximately $455 billion in excess funding sitting at the Fed that he wants to send back to congress before he leaves. [iv]

That’s no small sum and represents possible support for small and medium businesses that might need it depending on the length of this most recent shutdown.

Fourth, the typical year-end tax breaks congress generally approves with some wrangling takes on even more significance this year. Two such tax-extenders deal with health care insurance tax credits, whereby eligible taxpayers are allowed a refundable tax credit of 72.5% of health insurance premiums paid for themselves or their families, and mortgage credits for emergency responders allowing forgiveness or rebate of local property taxes. While most extenders are corporate giveaways, this year is especially critical in the age of COVID-19.

Further, we just concluded Q3 earnings season which was fairly strong. However, absent positive earnings news, this leaves the short-term investor class fretting about all the immediate bad headlines. In fact, markets tend to be generally weak during these earnings blackout periods.

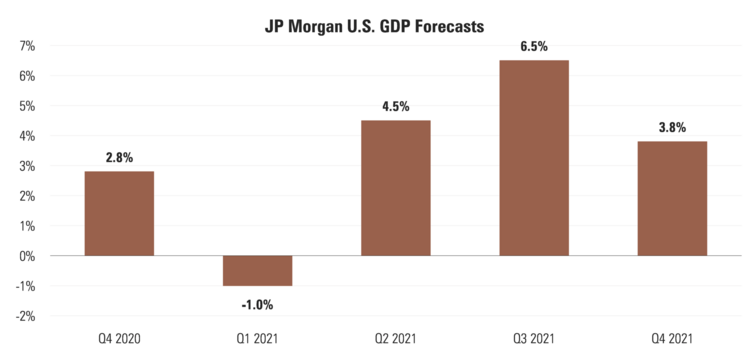

Finally, all of this is leading to an immediate downshift in expectations for GDP growth in Q1 2021. In fact, JPMorgan just issued a GDP guidance warning. [vi]

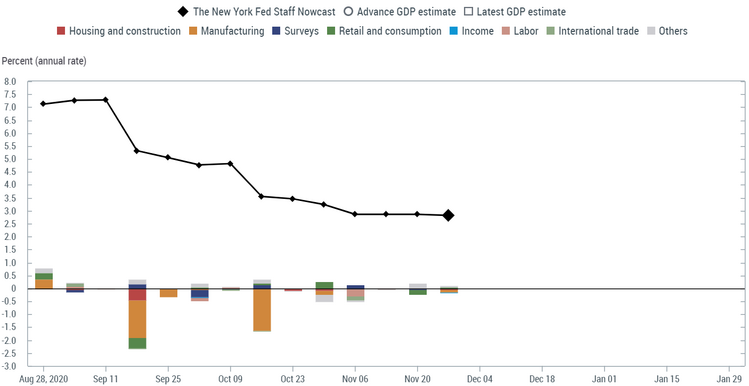

Additionally, the current Fed NowCast by the New York Fed shows a downward shift in Q4. [vii]

For our investors it is critical we look beyond the immediate and anticipate better outcomes in mid to late 2021. While we believe there are sunny skies ahead, we’ve got to wade through some choppy surf to get there.

*Upcoming Phillips & Co. Webinar: Q&A with Morgan Housel*

Join us on December 10th at 10:00 a.m. Pacific

Tim will interview Morgan on his new book, "The Psychology of Money"

They will explore topics like: Luck & Risk, Compounding, Getting Wealthy & Staying Wealth

Click here to Register

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.federalreserve.gov/publications/files/balance_sheet_developments_report_202008.pdf.pdf

ii. https://fred.stlouisfed.org/series/ICSA

iii. https://research.gs.com/

iv. https://www.ncsha.org/wp-content/uploads/Analysis-of-Current-and-Expected-Rental-Shortfall-and-Potential-Evictions-in-the-US_Stout_FINAL.pdf

v. https://home.treasury.gov/news/press-releases/sm1190

vi. https://www.cnbc.com/2020/11/20/jp-morgan-says-first-quarter-gdp-will-decline-because-of-rising-covid-cases-and-restrictions.html

vii. https://www.newyorkfed.org/research/policy/nowcast.html