Stealth Correction

“A correction is a reverse movement, usually negative, of at least 10 percent in a stock, bond, commodity or index to adjust for an overvaluation. The latest stock market correction occurred on February 8, 2018 as the DJIA and the S&P 500 fell more than 10 percent from their recent highs hit in late January 2018.” – Investopedia [i]

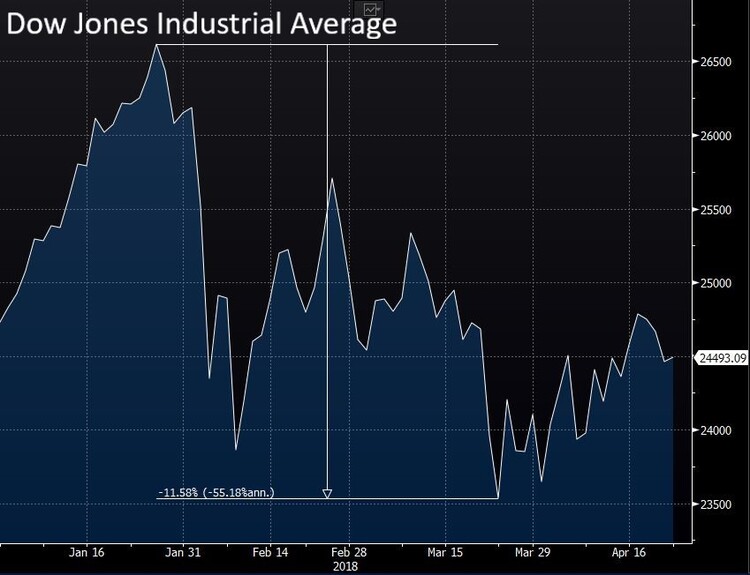

We certainly had that correction, not to mention a one-day drop of over 1,000 points on the Dow Jones Industrial Average. [ii]

What’s underway today is something different, and it’s a little unprecedented when it comes to corrections, in my opinion. Today we are seeing a correction in equity valuations without a significant movement in equity prices.

Let’s break down the classic valuation model of stock price compared to stock earnings, otherwise known as the P/E ratio.

Traditionally, in one variation of a correction or pull-back in equity prices, the P/E ratio adjusts downward driven by a drop in price, while earnings tend to remain constant.

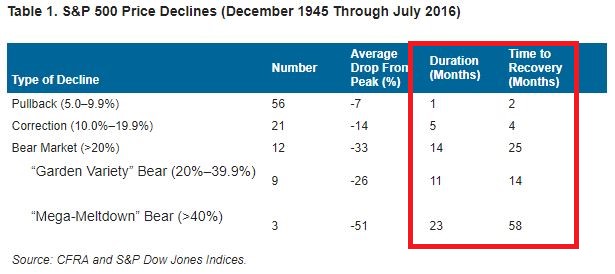

This can be a healthy part of any long-term bull market cycle. Lower valuations often stimulate buying in equities, which can drive prices back up. The price drop is generally temporary as earnings continue to support equity valuations, which also can drive prices higher. Just look at how long corrections and bear markets actually last. [iii]

In the current quarter, we are seeing a slight reversal of this trend. Prices are not dropping, and earnings are growing, creating what I call a valuation correction.

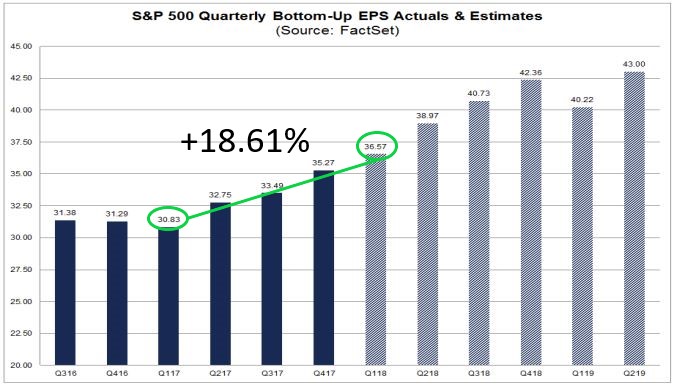

Let’s take a look at real data from Q1 earnings so far.

Earnings are on an explosive growth trend. [iv]

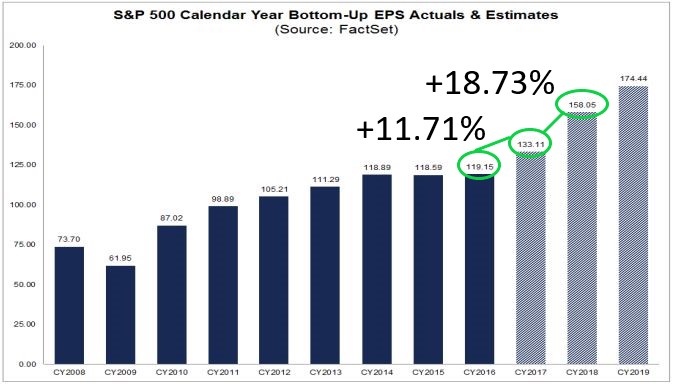

In fact, earnings per share is anticipated to grow throughout 2018. [iv]

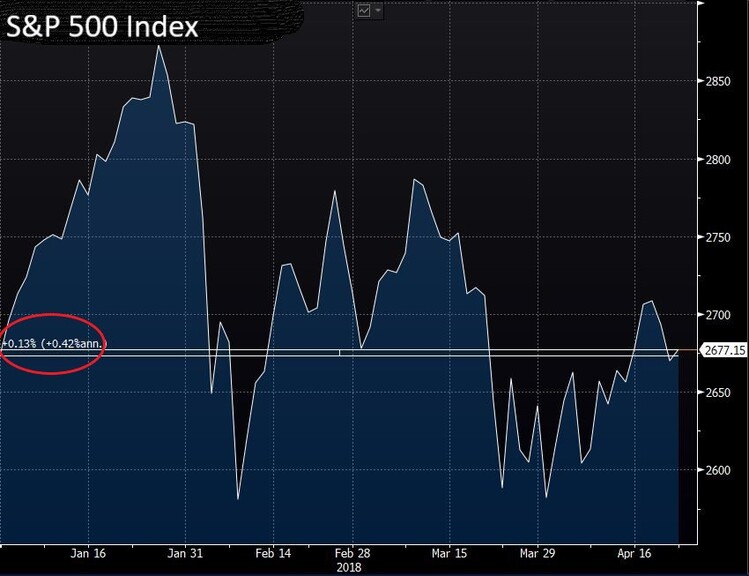

Simultaneously, despite the volatility, equity prices have not moved that much since the start of the year. [v]

Now look at what’s happened to forward P/E valuations. They have dropped considerably – over 15 percent. [v]

We are now trading much closer to normal valuations. Perhaps we might return to the average P/E valuation without any significant price corrections going forward. [v]

Without too much fanfare (albeit lots of volatility), we have now accomplished another correction, but this time it’s in valuation rather than price.

As an investor I would rather take a stealth valuation correction over a price correction any day.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Robert Dinelli, Investment Analyst, Phillips & Company

References:

i. https://www.investopedia.com/terms/c/correction.asp

ii. https://www.cnbc.com/2018/02/08/us-stock-futures-dow-data-earnings-fed-speeches-market-sell-off-and-politics-on-the-agenda.html

iii. http://www.aaii.com/journal/article/stock-market-retreats-and-recoveries.touch

iv. https://insight.factset.com/hubfs/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_042018.pdf

v. Bloomberg, L.P.