Strategy not Prediction

“No amount of sophistication is going to allay the fact that all of your knowledge is about the past and all your decisions are about the future.”

Ian E. Wilson (former Chairman of GE)

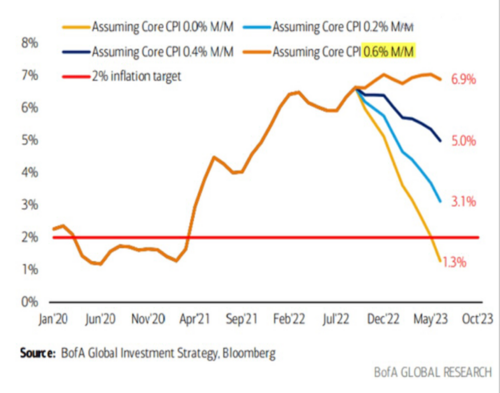

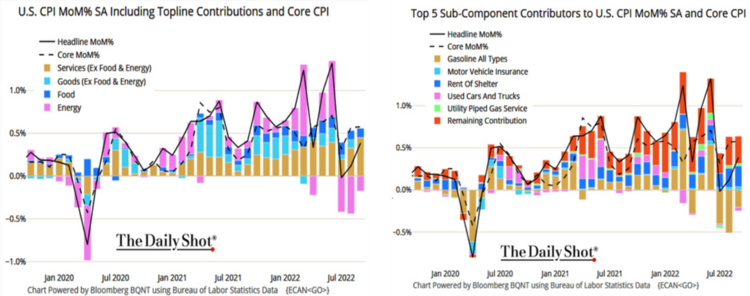

Last week’s inflation data dealt a crushing blow to any hope of avoiding the full measure of Fed’s rate increases. Consumer price data rose 8.2% on an annual basis and core consumer prices (ex-food and energy) rose 0.6% on a month-over-month. 1

While most inflation was driven by services, very few sub-segments, other than energy showed abatement. 2

At this trajectory inflation could get very sticky, and consumers will likely adjust their spending behavior to reflect this. There was nothing in the data that reflected any real easing by the consumer, even after the Fed Funds rate rose from 0% to 4% currently.

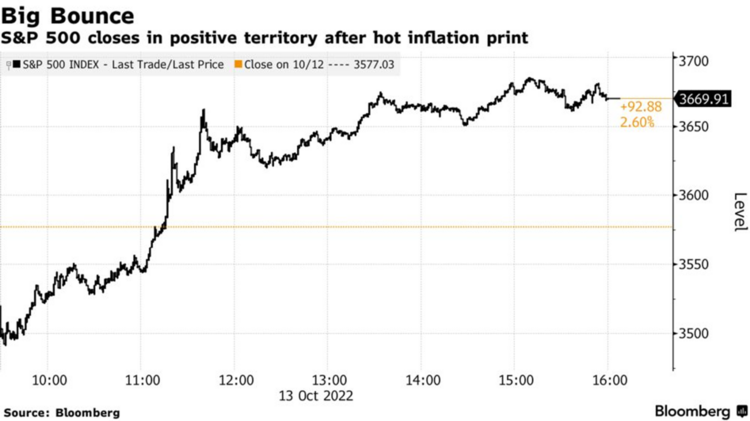

It would also appear market participants may have discounted the worst possible scenario (higher inflation, higher interest rates, and a recession) as equity markets rallied counterintuitive on the inflation data. 3

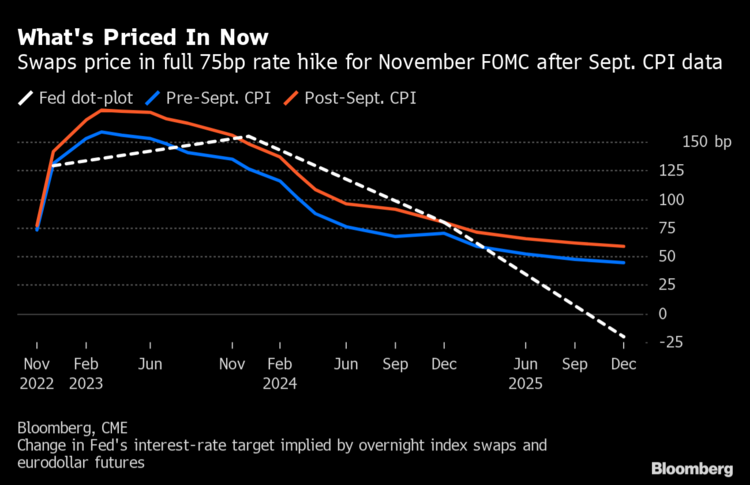

Currently the Fed Funds terminal rate is just above 4.75% and expectations are for that to arrive sometime in early Q1 2023. 4

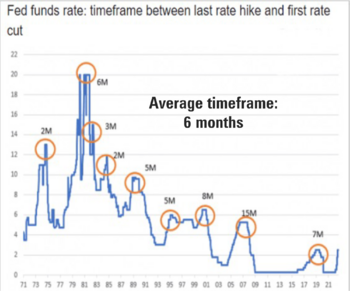

If the past holds true as soon as we get to the last rate increase, we are only a short period of time until the first rate cut. 2

Why such a quick timeframe for rate cuts from last rate hike? It’s probably pretty straight forward. Rate hikes are designed to cause consumer pain and pessimism. That pessimism gives way to a contraction in consumption, and perhaps that gives birth to deflationary trends.

I know one thing; central bankers have plenty of firepower to curb consumer demand (inflation), but no tools to combat deflation once it seeps into the consumer mindset. Lower prices tomorrow delay consumption today. That’s very bad!

Just look at the mess Japan got themselves into when they entered a deflationary cycle. 5

Every central banker has or should study these charts.

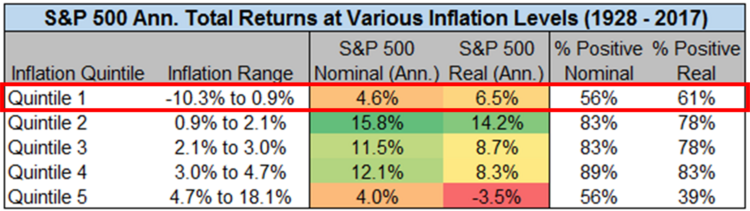

It’s also not hard to see what happens to risk assets like equites in deflationary cycles. 6

Talk about policy errors! Waiting too long to raise interest rates is one thing, but not cutting interest rates fast enough once consumer demand destruction sets in is an entirely different animal.

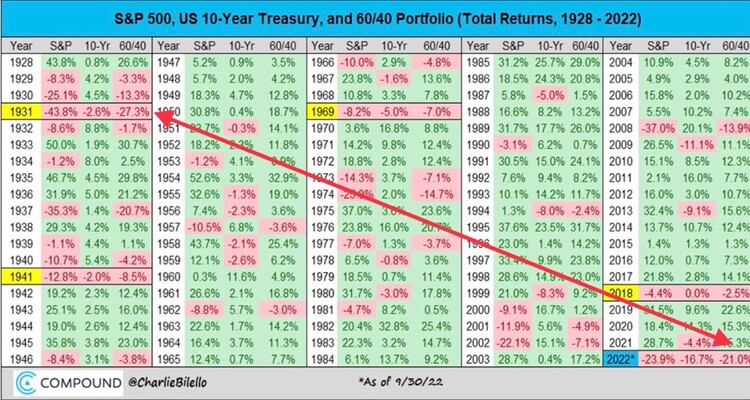

In light of the worst year for a balanced portfolio (60% equity/40% fixed income) since 1931, even the smallest chance of any deflationary pressures taking hold after the last Fed hike requires a review of all investment strategies. 7

Bullet and Barbell

For a balanced portfolio that typically is targeting 5%-6% return there are some opportunities in the chaos:

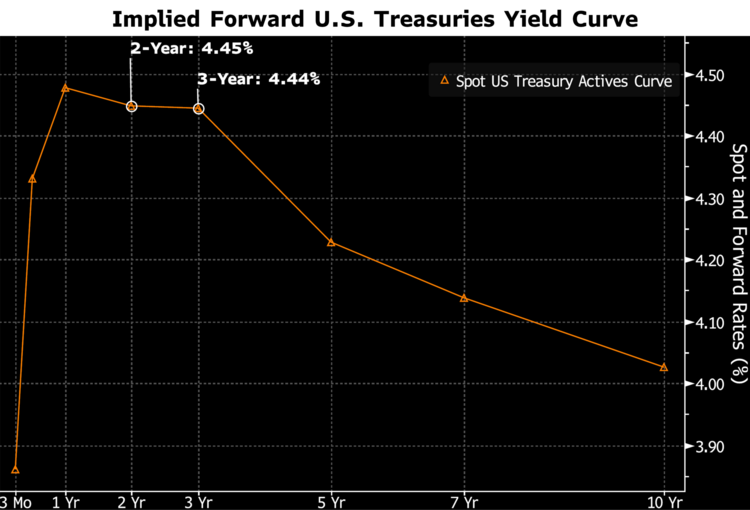

- Bulleting fixed income using 2- and 3-year Treasuries yielding close to 4.5% goes a long way to having 40% of your portfolio getting almost 90% of the needed returns. 5

- Barbelling U.S. equities, which will make up a substantial portion of the 60% equity side of a balanced portfolio, using growth equites to hedge against inflation and capture the rate decline period. For the other end of the barbell, use consumer defensive equities to hedge possible deflationary pressures.

Just Spend Less

If you don’t like that financial strategy, you can always invest like our friend and financial literacy partner Morgan Housel said in his best-selling book Psychology of Money.

“The best financial plan – and I think this extends beyond finance – is to save like a pessimist and invest like an optimist.”

Take a look at the latest video he did for our clients and share with your friends and family. I always believe if you underspend you can oversleep.

The China Strategy

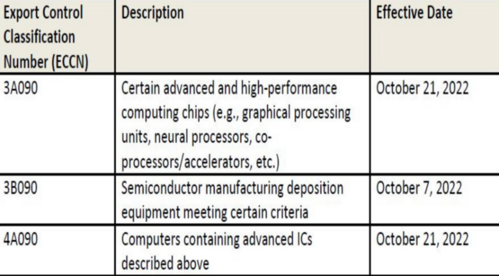

China is in the midst of renominating President Xi to a historic third term just as the Biden administration made a major policy announcement. The U.S. wants to suppress China’s growth by putting export controls on the vital microchip industry; limiting China’s ability to buy critical chips and tools from the United States. The policy stated these tools advanced areas that “helped to transform the world and holds great commercial promise across a wide variety of industries and applications, including communications, health care, and transportation.” 8

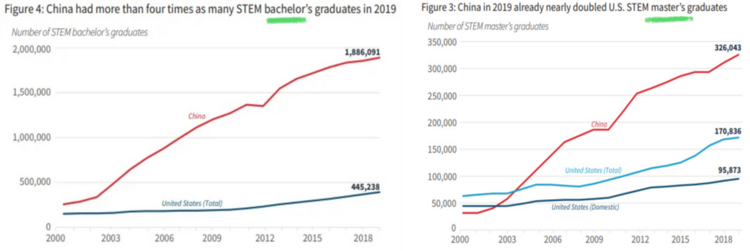

Here’s the challenge for the U.S. and the opportunity for China; China can likely produce, in short order, what they need without our technology industry with their vast amount of science and engineering graduates. 9

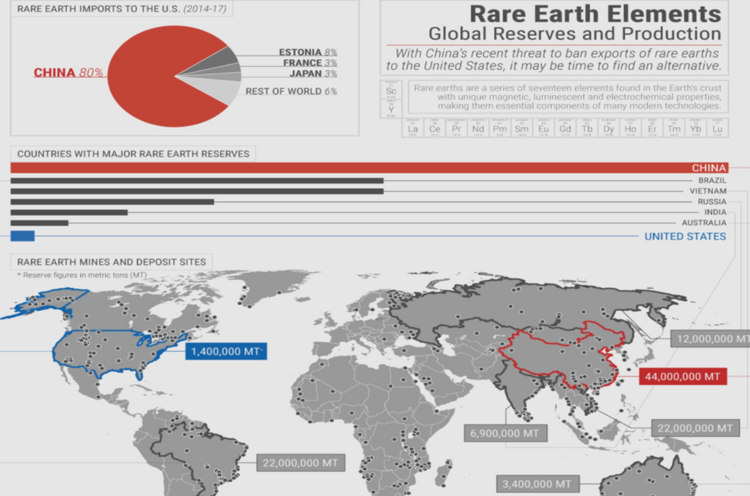

Needless to say, China will respond and that could shift the entire geopolitical situation. If China retaliates with export controls on rare earth metals, consumer goods, or electronic component parts, we might be in for a significant challenge. Remember, rare earth metals are used in most advanced technologies including electric cars, solar panels, military aircraft, and other vital goods. 10

If we have entered the next phase of a trade war (mutual export controls), we could see a complete decoupling of the two largest economies. That could drive up inflation, eliminate one of the largest buyers of U.S. debt, and damage large swaths of the U.S. economy – from agriculture and medicine to technology. Another investment strategy rethink will be in order.

Strategies can be used as preparation for unknowable future outcomes.

“Those who have knowledge don’t predict; those who predict don’t have knowledge.”

Lao Tzu

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.bls.gov/cpi/

- https://dailyshotbrief.com/

- https://www.bloomberg.com/news/articles/2022-10-12/global-stocks-under-pressure-ahead-of-us-cpi-markets-wrap

- https://www.bloomberg.com/news/articles/2022-10-13/fed-swaps-fully-price-three-quarter-point-rate-hike-in-november

- Bloomberg

- https://seekingalpha.com/article/4147540-inflation-deflation-and-stock-market-returns

- https://compoundadvisors.com/blog

- https://www.emsnow.com/pillsbury-law-group-analysis-of-recent-u-s-commerce-china-related-export-controls/

- https://cset.georgetown.edu/wp-content/uploads/China-is-Fast-Outpacing-U.S.-STEM-PhD-Growth.pdf

- https://geopoliticalfutures.com/rare-earth-elements-global-reserves-and-production/