Supply Chain Disruption, Input Costs, & Inflation: The Transitory Cycle

Supply chain disruptions have remained near record-high levels for the last five months. Those disruptions partially reflect congestion at U.S. ports, to which the media has increasingly called attention.

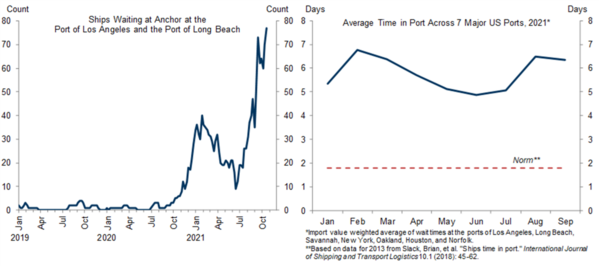

A specific focus has been on the number of vessels anchored outside of the ports of Los Angeles and Long Beach. However, the backlog of ships has not just been limited to southern California. Per analysis by Goldman Sachs, the time it takes loaded ships to make it through major U.S. ports is now three times longer than historical norms. [i]

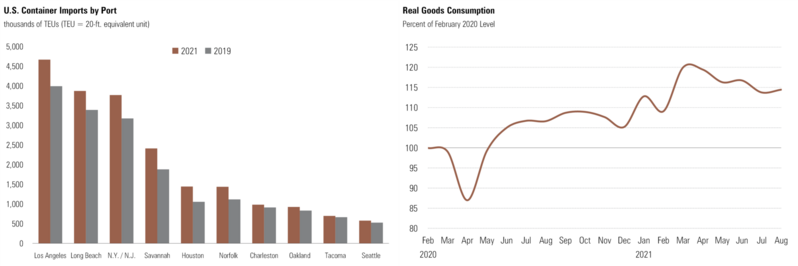

The current shipping backlog, in part, reflects elevated demand: Port utilization has increased by ~20% at the largest U.S. ports in order to keep pace with goods consumption ~14% above pre-pandemic levels. [ii] [iii]

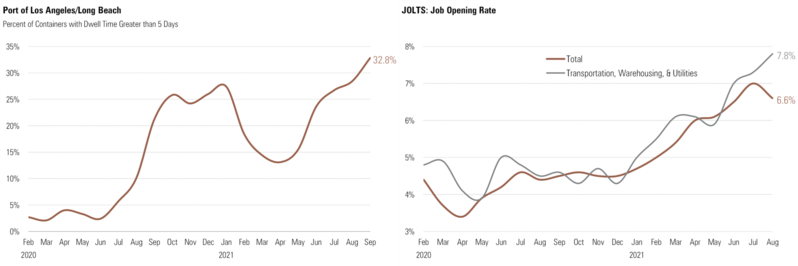

With record inbound volume, ports are struggling to handle containers after they are unloaded, with officials citing labor shortages, warehouse space, and equipment as the main obstacles. In September, roughly a third of containers at the ports of Los Angeles and Long Beach sat for more than five days before being transported out of the port—well above the low-single digit share seen before the pandemic. [iv] [v]

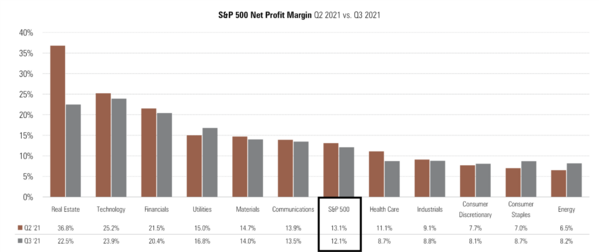

Supply chain disruptions, input costs, and inflation have also been a focus of corporate executives on earnings calls during third quarter earnings season. These concerns help explain why the consensus came into earnings season expecting S&P 500 profit margins to compress by nearly 100 basis points in Q3 relative to Q2 numbers, something we discussed in our Q4 Look Ahead. [vi]

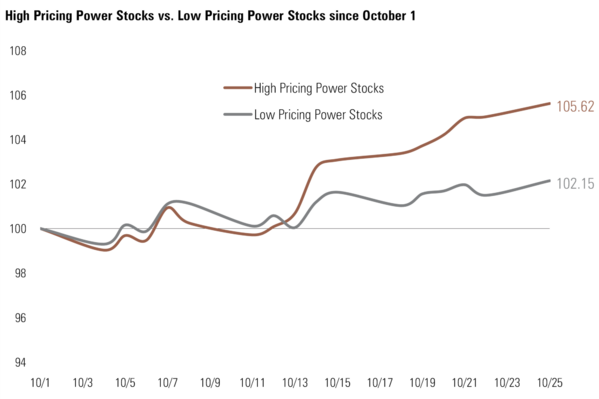

Early third quarter management commentary has also repeatedly cited the ability of companies to protect margins by raising prices. It seems equity investors are listening– over the past three weeks, a basket of stocks with high pricing power has outperformed lower pricing power stocks by almost 350 basis points. [i]

Compared to the corporate consensus regarding raising prices, there appears to be little agreement as to when supply chains will normalize and input cost pressures will lessen. The continually shifting outlooks for inflation and supply chains mean most equity investors should focus on the trends that will remain after “transitory” impacts have passed. For example, although the likely impact of supply chain issues on 2022 earnings remains hazy, eventually the supply chain should stabilize and restore the supply/demand balance.

As a result, the news flow around the timing of that normalization could continue to generate volatility within equity markets but should have only minor impact on investors with medium- to long-term investment horizons.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://research.gs.com

ii. https://www.datamyne.com/

iii. https://fred.stlouisfed.org/series/DGDSRX1

iv. https://www.pmsaship.com/wp-content/uploads/2021/10/West-Coast-Trade-Report-October-2021.pdf

v. https://www.bls.gov/jlt/

vi. https://PHILLIPSANDCO.COM/files/3016/3339/4412/Quarterly_Look_Ahead_-_Q4_2021_-_Final.pdf