T.I.N.A. (THERE IS NO ALTERNATIVE) - Or Is There?

Last week, the Federal Reserve finally acknowledged that they can’t explain what's happening in the economy. Their long anticipated interest rate hikes, estimated to increase twice in 2016, has been marginalized by the voting members of the Federal Reserve Board.

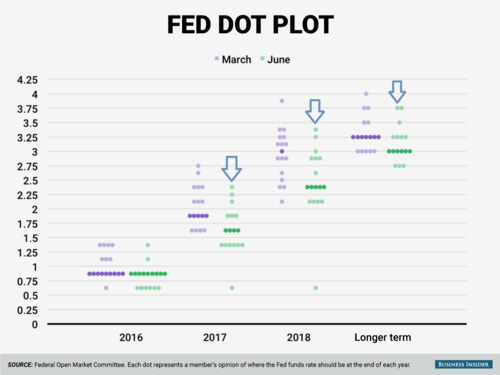

In fact, they published their expectations for interest rates for the next couple of years. The Fed’s so-called "Dot Plot" suggests that they expect interest rates to remain lower for longer than previously anticipated.

Compare last week's Dot Plot to the same one from just three months ago and you can see how drastically the expectations downshifted. [i]

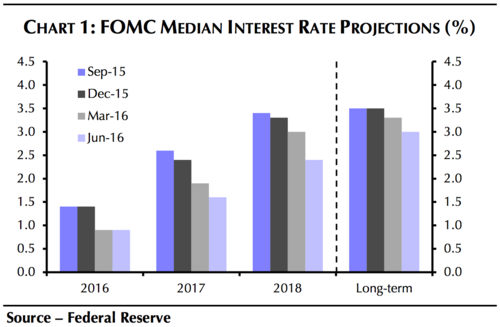

Taking a look at longer term Fed trends, one can see how the Fed plans to stay lower for longer as global economic conditions have made growth harder to achieve. [ii]

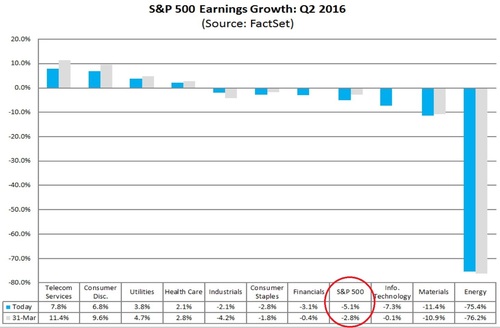

Could it be the all-knowing Fed is finally realizing that we are in the midst of a corporate earnings recession, for the past five consecutive quarters? Q2 S&P 500 earnings are expected to shrink by -5.1%. [iii]

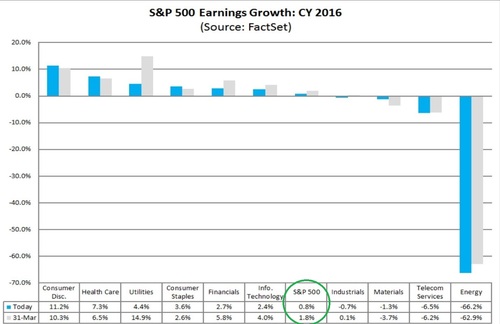

Investors have been delaying their earnings growth expectations for several quarters. In fact, if you look at the earnings growth expectations from this time last year, it was expected that we would emerge from our earnings recession during Q1 2016. [iv]

Now, it looks like 2016 will be one of the weakest earnings growth years on record. Currently, earnings are anticipated to grow by a paltry 0.08%. [v]

It's no wonder we are experiencing so much volatility in the equity markets. [vi]

Our expectation for earnings to recover in Q3 2016 is driven by a few factors:

1). There will be slightly easier comparisons in Q3, and much easier comparisons during in Q4. [vii]

2). Comparatively, a weaker dollar than last years will help those companies that are dependent on exports. (That's 31% of aggregate S&P 500 revenue). [viii]

3). Oil prices are stronger and have stabilized. As energy stocks represent 7.13% of the S&P 500, certainly they will benefit in Q3. [ix]

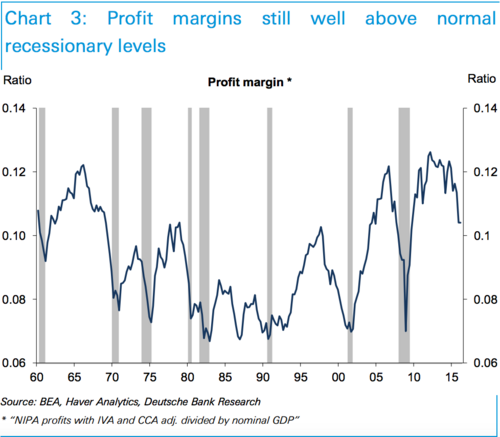

In the turmoil we are currently experiencing, one small fact eludes most market watchers: Profit margins are still well above recessionary levels. If we see any, or all, of the above catalysts materialize, we’ll see some serious revenue drop to the bottom line. [x]

Notwithstanding the cyclical issues above, no investor should look past the fact that portfolio returns are likely going to be muted for the coming year or so. We might see a burst of buying as the earnings recession ends but that may only be fleeting. Fighting near zero interest rates for the next year or so will make returns harder to achieve.

We are currently in the process of updating our capital markets expectations, which will be released at the beginning of Q3, available in our Q3 Look Ahead. I won't ruin the surprise but investors can expect to have to pay for returns with more risk; not an enviable position.

The famed British Prime Minister, Margaret Thatcher, coined the term “T.I.N.A.” - There is no alternative. This saying is fitting as the U.K. faces an existential vote on Thursday to determine whether to remain in the European Union. It's also fitting as so many of us face the simple fact that we need returns in our portfolios to meet our current and future obligations. Regardless if you are an individual, pension plan, or University endowment, you need the returns that in many cases, the markets can't currently deliver.

We will continue to work with you to manage risk, discuss new expectations, and help plan and prepare for a lower return environment. T.I.N.A. is not something we should live with unwillingly.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Chris Porter, Senior Investment Analyst – Phillips & Company

References:

[i] http://www.businessinsider.com/federal-reserve-regime-change-june-2016-2016-6

[ii] http://www.businessinsider.com/federal-reserve-regime-change-june-2016-2016-6

[iii] https://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_6.17.16

[iv] Bloomberg, LP

[v] https://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_6.17.16

[vi] https://www.google.com/finance

[vii] https://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_6.17.16

[viii] https://fred.stlouisfed.org/

[ix] http://www.nasdaq.com/markets/crude-oil.aspx?timeframe=18m

[x] http://www.haver.com/databaseprofiles.html