Take Your Investor Strong Pills

When I wrote two weeks ago in Inflation, Rising Rates, War and Volatility:

So, will there be a war between Ukraine and Russia? I’m doubtful. Russian aggression would jeopardize the certification of Nord Stream 2 by Germany and eliminate Russia’s negotiating power over transporting gas through Ukraine.

My assumption that Putin was a rational actor was at the base of that premise. Clearly, he is not acting in his or his country’s best economic interest. Sanctioning Nord Stream 2 was a first, quick response to his military actions last week.

The Russian invasion of Ukraine will be a colossal disaster. Lives are being lost, property destroyed, and innocent people forced into refugee status. The tragedy cannot be underestimated or minimized.

My effort in this post is to bring 35 years of professional investing experience to bear on your reactions.

Take Your Investor Strong Pills

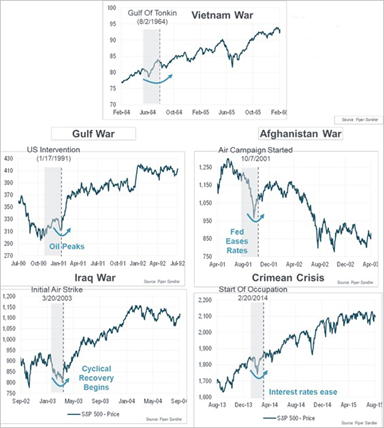

While wars are terrible in every regard, they provide long-term buying opportunities. Maximum risk gives rise to opportunity. Investors need discipline and conviction in their strategy during these times.

The saying, “buy the invasion” has merit. 1

In almost every instance, buying the dip during geographically limited regional wars has proved to be timely. Even when you consider World War II, the Dow increased by nearly 10% on the first day Hitler invaded Poland. From 1939 to 1945, the Dow increased on average about 6%. 2

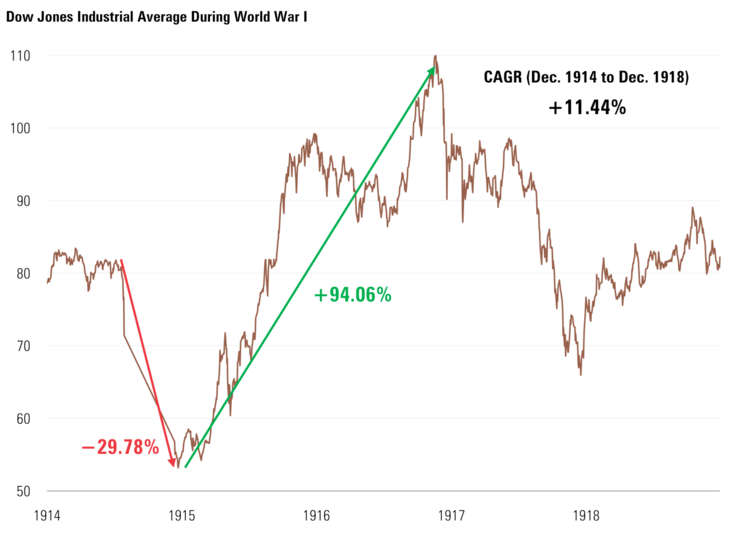

World War I was much more dramatic, but the long-term outcome was similar. The Dow fell by about 30% and markets were closed for about 6 months. However, when markets opened in 1915, the Dow rallied by more than 94%. From December 1914 to December 1918, the Dow averaged about 11.44%. 2

I am certainly not suggesting anything like a global war played out in Europe, but Putin is acting against his and his country’s best economic interest. It’s not to say he doesn’t value blocking NATO, their missiles, and troops from expanding closer to his border. Russia has maintained this general position since the fall of the Soviet empire.

It’s not surprising that war acts as a rally cry for investors. Regional war is typically accompanied by massive central bank and fiscal debt financing to support the economy and consumers without crowding out other spending. Further, defense spending acts as another stimulant to GDP growth.

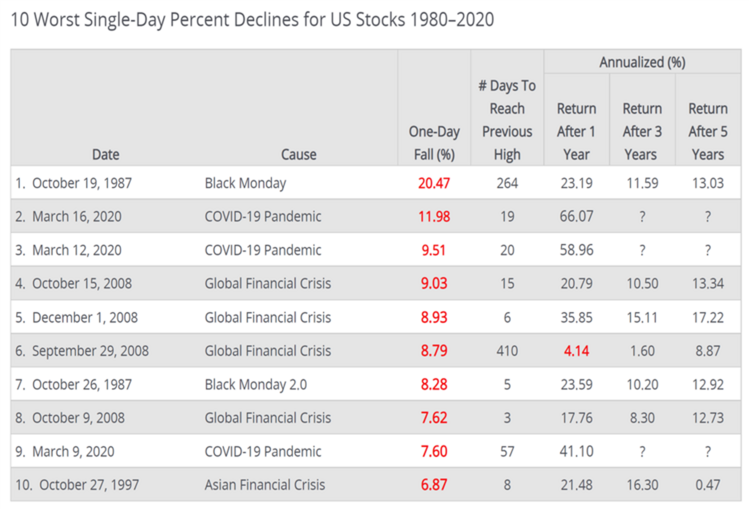

Even when faced with the worst single day market reactions, equities almost always provided positive returns one year later. I have personally experienced each of these “10 worst days”, they felt terrible going through them, but turned out just fine for investors that had conviction in the long-term strength of the U.S. economy. 3

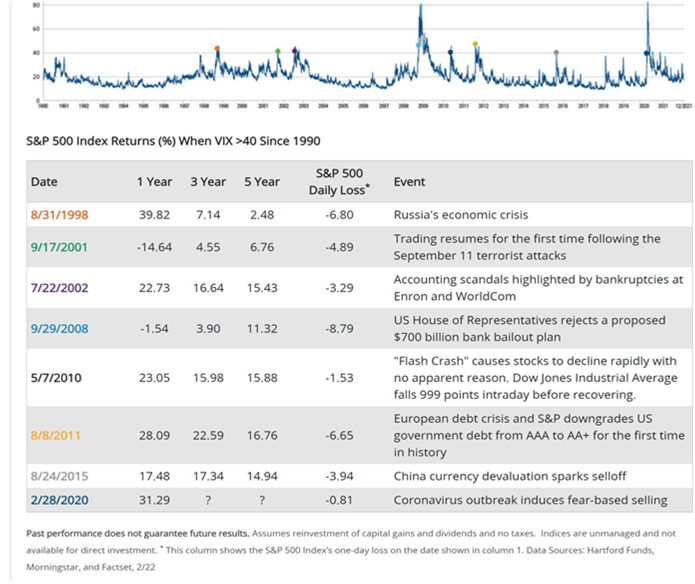

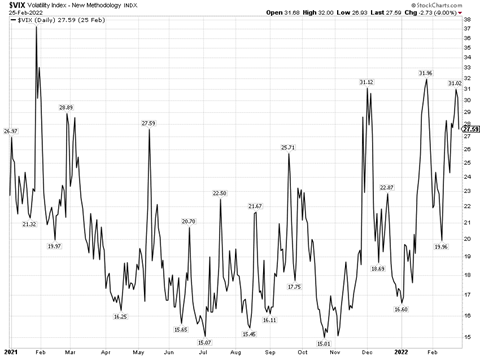

As one of my colleagues reminded me, “when fear runs high, it’s time to buy.” When the VIX (volatility index) spikes dramatically, it’s a great buying window one, two, and five years later.

Currently, the VIX index is spiking. 4

One almost certain consequence will be rising energy prices. Russia provides Europe with about 40% of their oil and gas needs and 10% to the entire world. While current sanctions are designed to avoid the impact on energy exports from Russia, the most recent blockade of Russia on international banking systems (SWIFT) will have certain unintended consequences. Blocking the Central Bank of Russia will have even further untold implications. Banking is a complex web of interacting relationships with hard-to-find dark pockets of money (yes, even here in the United States).

The Ruble will continue its collapse and Russian equity markets will crater. A likely run on banks could occur and might have begun at the time of this publishing. 5 6

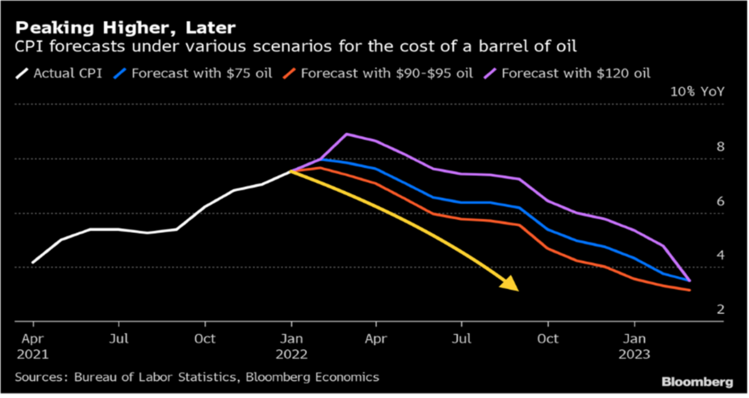

Rising energy prices will likely expand the timeline for inflation to moderate, depending on the price per barrel. (My base case prior to the invasion is in yellow) 7

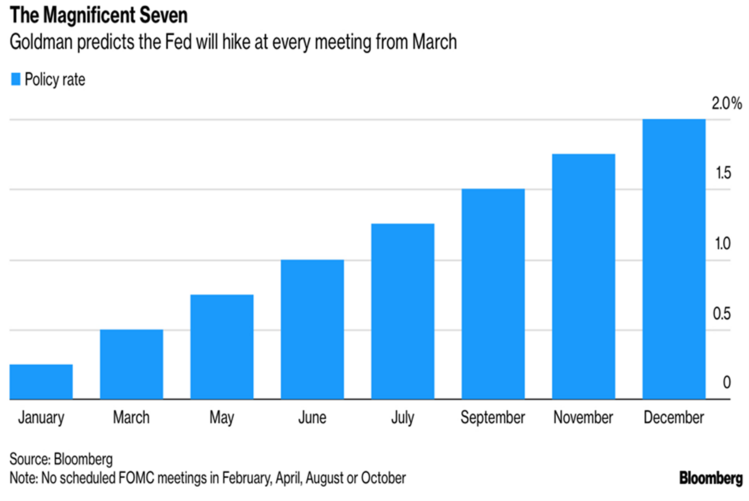

Higher prices paid at the pump will act as a drag on the consumer and could moderate inflation without the need for seven rate hikes by the Fed. 8

Just remember, it’s hard to raise rates so many times in a declining economic cycle. That is especially the case when you consider a modest contraction driven by the uncertainty associated with war.

While Putin is clearly not following his economic best interest, you should follow yours. Stay the course and take your investor strong pills.

What we should do:

- Examine and reaffirm your strategy and allocation

- Continue to add industrial metals as a part of your portfolio

- For those not ESG-constrained, continue to add MLPs

- Average in for growth investors

- Stay in regular contact with you as our clients and friends

My thoughts and prayers are with the people of Ukraine.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://dailyshotbrief.com/

- https://stockcharts.com/freecharts/historical/marketindexes.html

- https://intelligent.schwab.com/article/stock-market-corrections-not-uncommon

- https://schrts.co/eZkwQuwe

- https://www.bloomberg.com/quote/USDRUB:CUR

- https://www.bloomberg.com/quote/MOEX:RM

- https://www.bloomberg.com/news/articles/2022-02-26/charting-the-global-economy-war-driving-inflation-growth-risks

- https://www.bloomberg.com/news/articles/2022-02-11/goldman-sachs-now-predicts-fed-to-hike-seven-times-in-2022