Taking a Breather

With the NASDAQ down about 10% from the highs and other indexes off their respective highs it’s finally time to take a breath and reset. [i]

From a macroeconomic perspective, we are still on the recovery path. Just consider the following indicators:

Jobs continue to recover, with another 1 million plus jobs added in August. [ii]

Concurrently we have had a rapid drop in the unemployment rate, presently sitting below the 10% level. [iii]

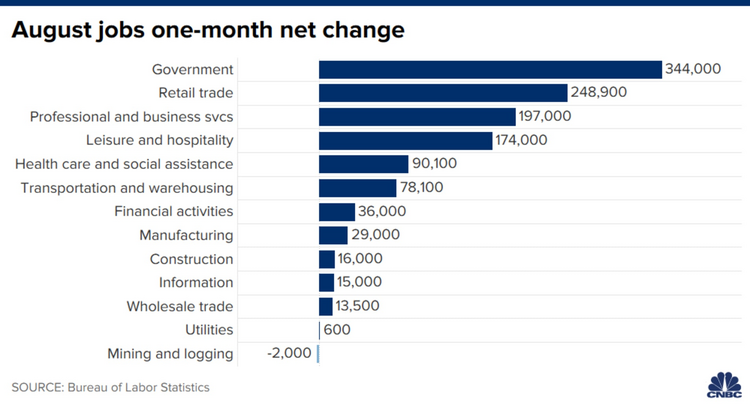

Jobs have recovered in key areas like Retail, Leisure and Hospitality, Health Care, and Transportation: [iv]

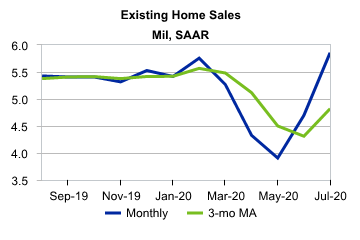

Existing home sales are showing incredible resilience with a gain of 24.7% from June to July and 8.7% year-over-year. [v]

Realize when people buy a home, they typically buy some things to go in that home. This incredible growth should lead to a boost in consumption in the coming months.

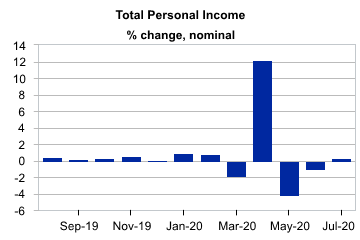

Follow all of that with a boost to personal income. While month-over-month growth was a meager 0.4% in August, a decline in government transfer payments of -1.7% was factored in. [vi]

As we all know the $600 per month supplemental pandemic unemployment benefit from the Federal government expired at the end of July, in turn creating a drag on total personal income growth.

I was as surprised as others with the failure by Congress to sign an extension of unemployment benefits in early August. While the President directed FEMA to use some of their resources to fill the gap, virtually none of that was deployed in August.

It is likely consumers used their savings to continue to spend. [vii]

The savings rate continues to drop from the pandemic peak in April, showing the extra consumption fuel in the tank for the U.S. Consumer. [viii]

As we work our way through this correction it is always important to recognize these periods are necessary parts of investing. I can’t publish the below chart enough to reminded investors corrections happen, and quite frequently. [ix]

While the equity markets take a breather, the macroeconomic recovery looks to be improving from the pandemic lows and moving back towards a pre-pandemic trajectory in some areas of our economy.

Phillips & Co. Event

Discussion with Kevin Xu

September 15 at 10:00 a.m. Pacific

Join us for an in-depth discussion with our CEO, Tim Phillips, and Kevin Xu about the U.S. vs. China Tech Cold War, what’s at stake, and how to navigate its complexities.

Click Here to Register

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.bloomberg.com/quote/CCMP:IND

ii. https://fred.stlouisfed.org/series/PAYEMS

iii. https://fred.stlouisfed.org/series/UNRATE

iv. https://www.cnbc.com/2020/09/04/heres-where-the-jobs-are-for-august-2020-in-one-chart.html

v. https://fred.stlouisfed.org/series/EXHOSLUSM495S

vi. https://fred.stlouisfed.org/series/PI

vii. https://fred.stlouisfed.org/series/PSAVERT

viii. https://fred.stlouisfed.org/graph/?g=voz3

ix. https://www.capitalgroup.com/advisor/tools/guide-to-market-volatility/articles/what-past-market-declines-teach-us.html