Taking a Growth Breather

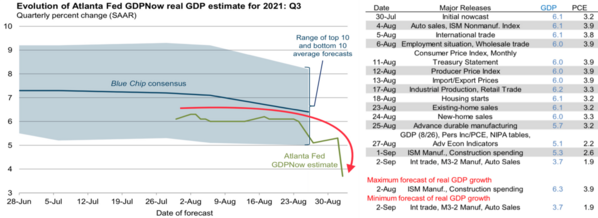

U.S. GDP is on a trajectory that suggests Q3 growth will come in significantly lower rate than when we started the quarter. Going from an expected 6.1% growth rate to 3.7% is a 40% reduction—which is no small matter. [i]

The component parts of GDP have been weakening throughout the quarter and much of that is likely attributable to the caution around the Delta variant, supply chain pressures, and Hurricane Ida.

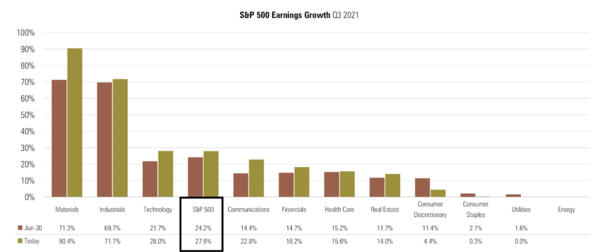

Manufacturing, trade, and auto sales are major contributors to the deceleration. Contrast this with corporate earnings growth expectations for Q3. Estimates have been revised upward since June 30th. [ii]

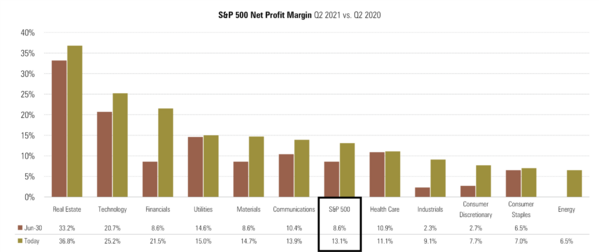

In fact, if earnings growth comes in at 27.9%, it will mark one of the best earnings periods since 2010. Net profit margins are hovering around record levels not seen since 2008. [ii]

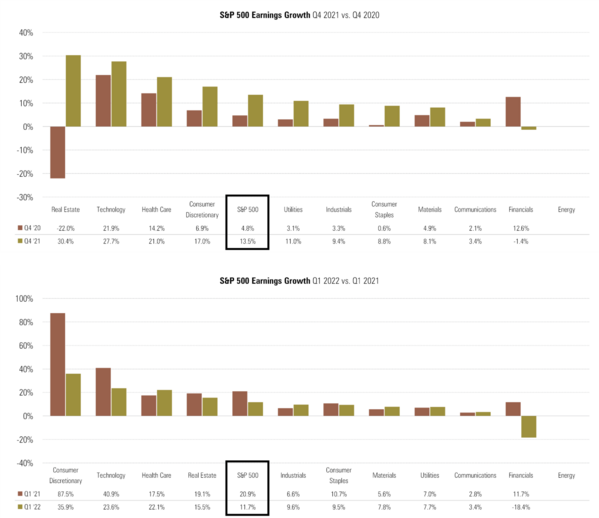

Now looking at Q4 2021 and Q1 2022 corporate earnings, growth still looks very robust.

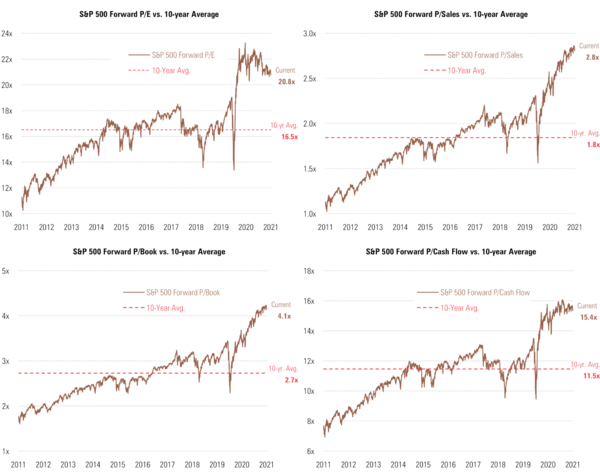

While I recognize valuations across several metrics are very high, corporate earnings should reinforce current prices to some extent. [iii]

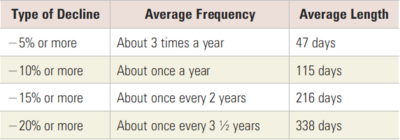

“To some extent” is the cautionary phrase, recognizing corrections happen all the time. I’m sure I sound like a broken record with the slide below but, I don’t think I can emphasize the point enough; corrections do happen.

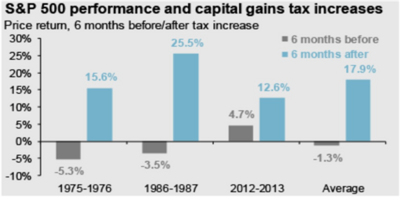

Counterintuitively, the upcoming discussion on capital gains tax rates could lead to a very nice outcome. The period of time leading up to a final decision creates some drag in equity returns which could be followed by some very nice gains six months after. [iv]

Drawdowns of between -1.3% and -5.3% during past capital gains increases were followed by returns averaging 17.3%. This sends a clear message: Investors favor certainty.

The clarion call right now is for concern and corrections. Even though we are in a macroeconomic growth breather, corporate earnings growth might just save the day.

8/11 (it’s not a typo)

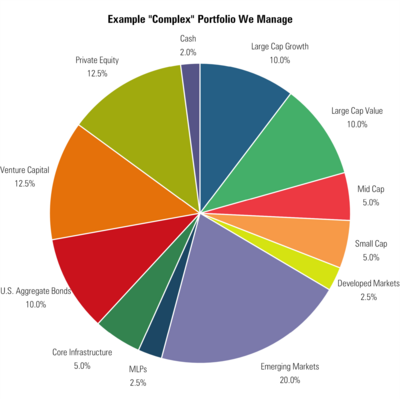

The last 25 years of my 35+ year professional career as an investor and advisor have taken me to many places in the world in my search for some of the best investment managers. Places as near as Portland, Oregon and as far as Ulaanbaatar, Mongolia. At any given time, we manage 8-12 asset classes on behalf of all our clients.

Trying to pick the best managers goes far beyond evaluating numbers, returns, and risk statistics; you can do that from any desk. I have always believed seeing managers in person, learning about their culture, business, people, and process drives the numbers. I want to figure out who our managers are and what makes them tick.

On August 11, 2001, I was fortunate enough to visit a star in the small-cap asset management space; Alger and their CEO, David Alger. His office was on the 92nd floor of the North Tower of the World Trade Center. He was transparent, kind, and reflected a great deal of humility—which was uncommon for Wall Street at that time. He was proud of his family business. He took me around their magnificent office with incredible views of the city and introduced me to his team. All were very proud of the family nature of the business and the results they generated for the people that hired them.

30 days later, almost to the hour from my visit, David and 35 of his colleagues perished. I don’t forget the blessings of all the people I get to meet that try and help us try and help you.

David Alger

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.atlantafed.org/cqer/research/gdpnow

ii. https://www.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_091021.pdf

iii. https://www.spglobal.com/spdji/en/indices/equity/sp-500/#data

iv. https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/