Tariff Tease 2.0: Trump’s Return to Trade Taunting

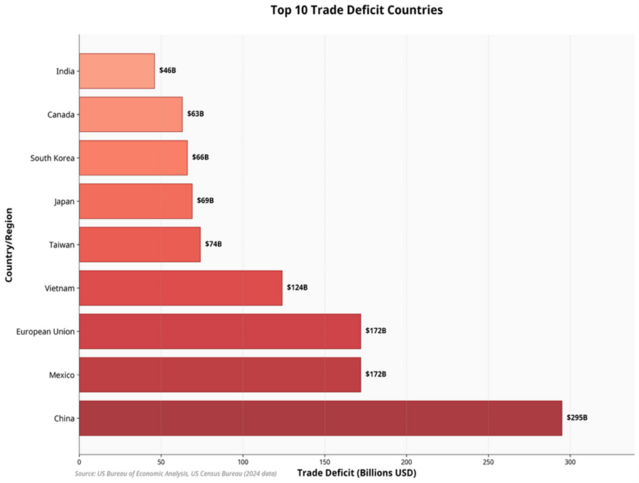

Just as equity markets hit all time highs after recovering from the tariff threats in April, we have tariff threats 2.0. This time it’s a 30% tariff on the European Union and Mexico, two of the countries we have large trade deficits with.

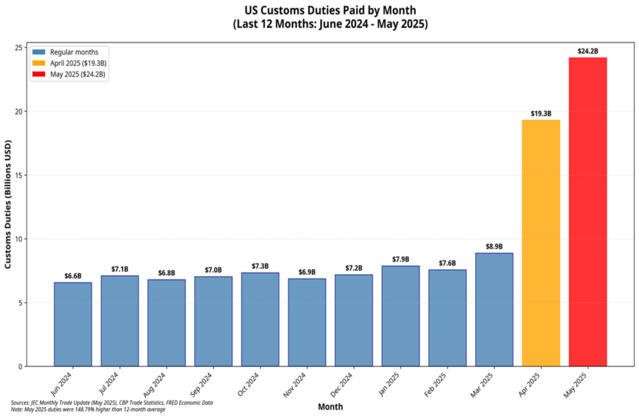

Oddly enough, the U.S. has been collecting custom duties to the tune of 300 billion, if you annualize May’s collections. That’s almost enough to pay for the recent passage of the tax bill.

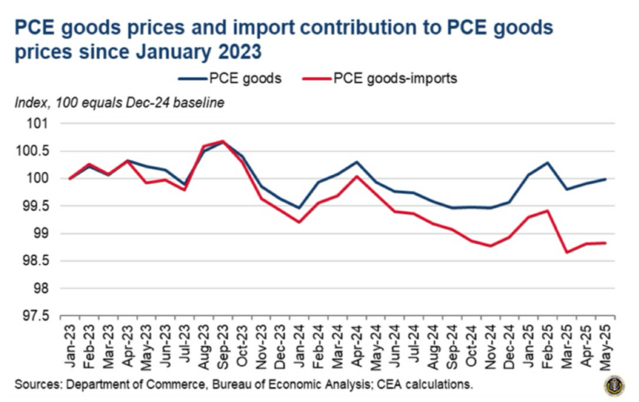

Simultaneously, we have not seen any real rise in prices for imported goods generated by the current tariff rates. In fact, the import prices on goods have declined compared to our domestic goods prices, according to the latest report by the Council of Economic Advisors (CEA).

Imported goods prices have been dropping since September of 2023 and, in spite of the tariffs or threats of tariffs, they continue to trend downward. It’s counterintuitive but it appears our largest trading partners are eating the tariffs.

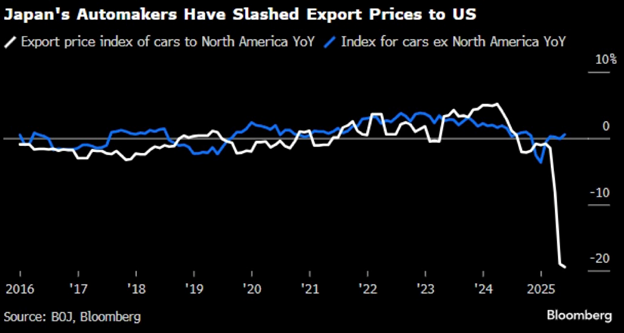

Take Japan as an example. Their car prices have been dropping this year to compensate for the tariffs. It appears that Honda and Toyota need U.S. consumers and don’t want to raise prices.

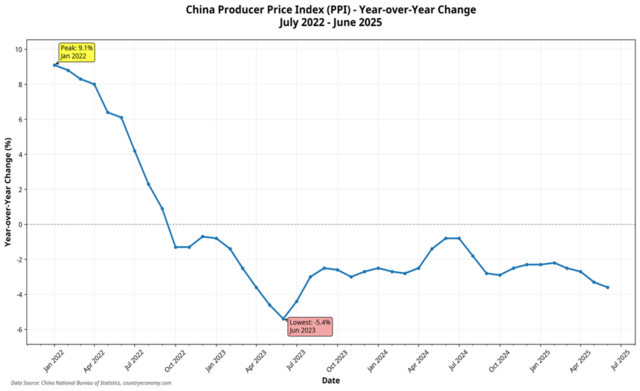

China is another fitting example, albeit for different reasons. Their producer prices are in a deflationary spiral. They drop their prices on exported goods to the United States because they need to keep manufacturing workers employed. In essence they are exporting their deflation to us.

That’s how in large part the United States can collect tariffs to the tune of 300 billion a year and not currently face inflationary pressures. So far, the producers are eating the tariffs one way or another.

However, all of that will quickly get lost in Trump’s tariff 2.0 trade taunts with Europe and Mexico.

The good news is that we start earnings season this week and that might just be enough to occupy Wall Street.

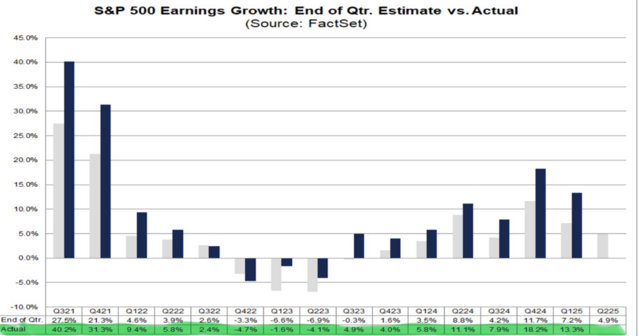

Current expectations are for S&P 500 earnings to grow at a paltry 4.9%, however companies have been beating those estimates by a long way. That is my expectation for this quarter as well.

Trump’s tariff tease 2.0 is making noise, but the strength of the U.S. consumer and corporate earnings may speak louder.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

The charts and data presented are sourced from a combination of public domain materials and licensed data providers. Their use is intended solely for educational and analytical commentary and falls within the scope of fair use. For a representative list of sources, please click here.

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.