Tariffs – What are the Impacts?

This weekend, President Trump announced broad-reaching tariffs against Canada, Mexico, and China. The measures include a 25% tariff on almost all goods from Canada (excluding energy resources) and Mexico, along with an additional 10% tariff on goods from China. Canada has already announced retaliatory measures, and Mexico indicated they will make an announcement soon.

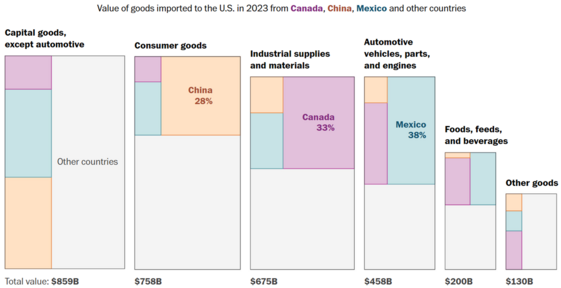

Here's how trade with each of those countries breaks down: 1

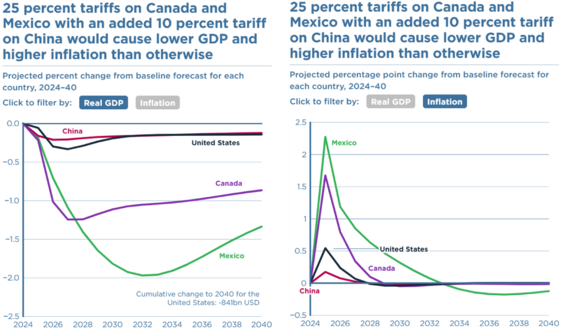

The first-order implications, according to the Peterson Institute, are as follows: 2

With equal retaliatory tariffs from China, Mexico, and Canada, the U.S. would experience both a drag on GDP growth and a bump to inflation later this year.

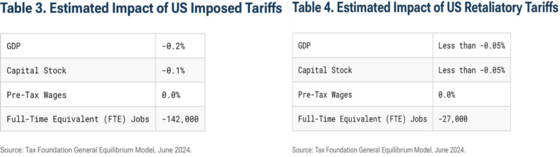

According to the Tax Foundation, the tariffs and retaliatory measures by the other countries will cause some minimal job losses. 3

Losing 142,000 jobs and another 27,000 jobs from the retaliatory measures is no small matter and certainly not part of putting the American worker first. However, these studies suggest a potential mitigating factor: the strength of the U.S. Dollar. A strong dollar can reduce import costs for U.S. consumers, potentially offsetting some effects of the tariffs.

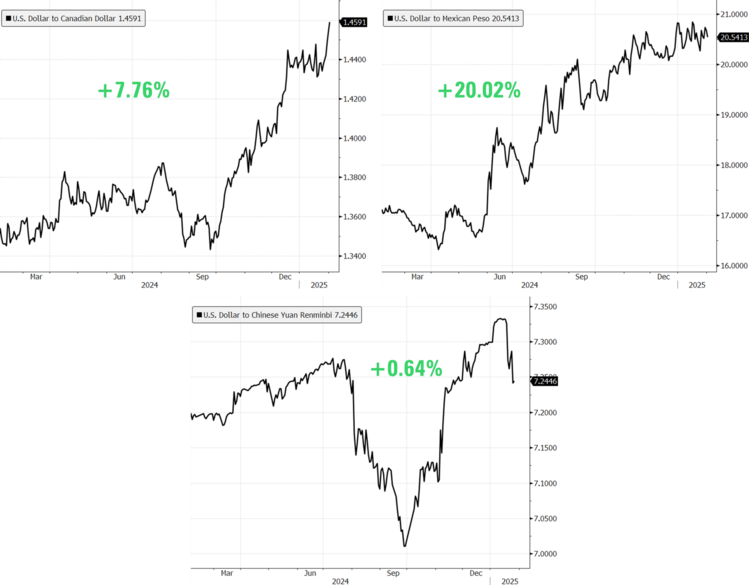

The U.S. Dollar trades in pairs, i.e., the U.S. Dollar vs. another country’s currency. Here are the dollar pairs with Canada, Mexico, and China. 4

While not a perfect offset, there is some price pressure release from the tariffs due to the strength of the dollar. Especially when you consider the U.S. Dollar is 20% stronger than the Mexican Peso. That’s a large offset to tariffs. The reason why our dollar is so strong globally is the strength of our economy and consumer.

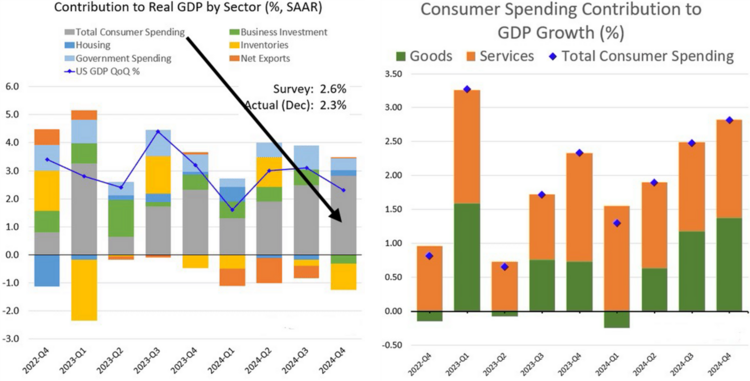

Our consumer is the whole game. We are the driving force for U.S. growth according to the latest report on the U.S. economy. The U.S. economy grew at a stout pace of 2.3% in Q4 2024, with the consumer contributing the bulk of that growth. The reason the tariff impact on our economy may not be as detrimental is due to our heavy consumption of services. 5

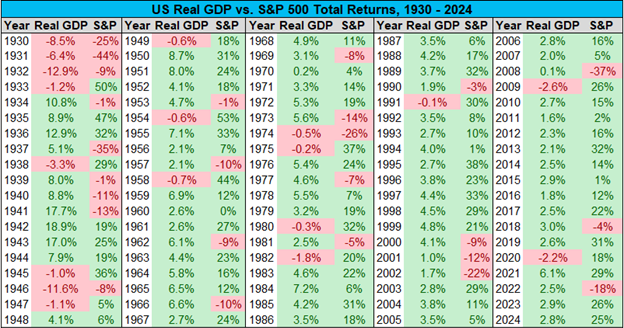

While I expect markets to react to the uncertainty, the bigger picture needs to be kept in mind. Companies will raise prices to protect their profits, as crude as that sounds. Further, U.S. GDP growth is not highly correlated to stock market returns. 6

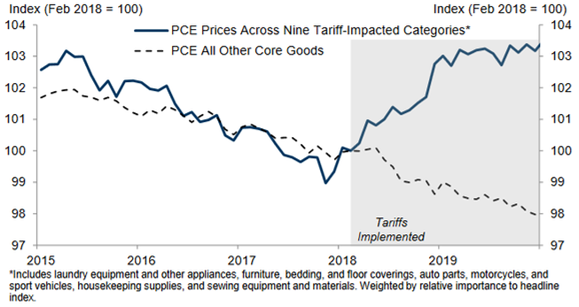

Tariffs are an unpredictable economic tool with clear inflationary implications, there is no doubt about that. Trump’s prior tariffs certainly had an impact on inflation, but with inflation at such a low level in 2018 few hardly cared. 7

That’s not going to be the case today. Americans care about inflation, and this will be a very tricky part of the Trump policy rollout. Tariffs can only be one part of the puzzle. Energy price cuts and deficit reduction are also key to offsetting tariff-induced price increases.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.washingtonpost.com/business/2025/01/27/trump-tariffs-mexico-china-canada-prices/

- https://www.piie.com/blogs/realtime-economics/2025/trumps-threatened-tariffs-projected-damage-economies-us-canada-mexico

- https://taxfoundation.org/research/all/federal/trump-tariffs-trade-war/

- Bloomberg

- https://thedailyshot.com/2025/01/31/consumer-spending-accelerated-in-q4-boosted-by-households-front-running-tariffs/

- https://x.com/charliebilello/status/1885069988572389764

- https://publishing.gs.com/

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.