That was Quick - and it May Just be Getting Started

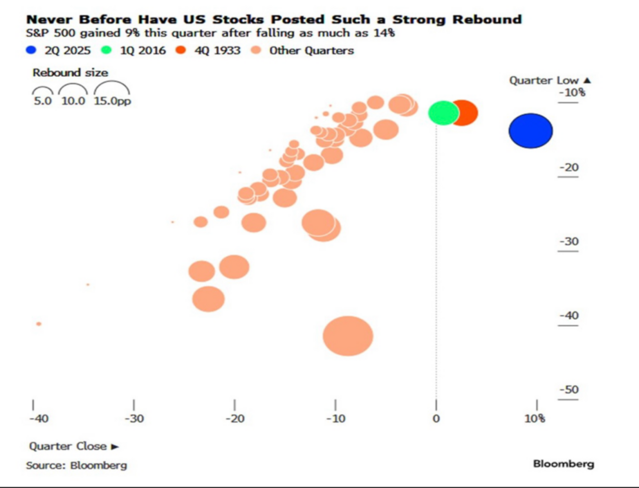

The S&P 500 hit an all-time high coming off a near bear market drawdown of 18.9% just a few months ago. In fact, it happened in record time.1

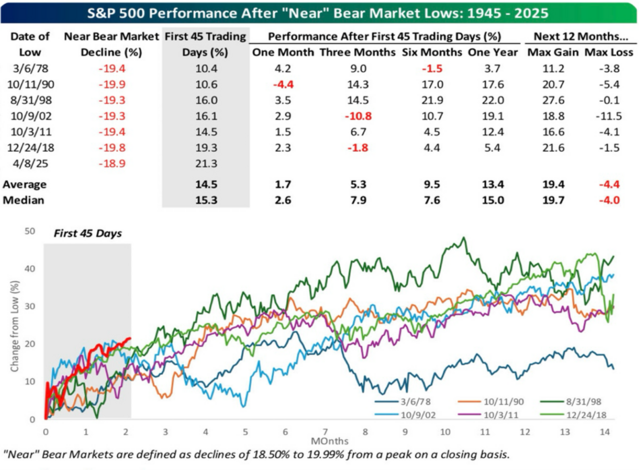

Now you might be thinking, “is the other shoe about to drop?” Well, historically these rapid recoveries have some legs to them. According to our friends at Bespoke, when the S&P 500 has a nearly 20% correction, the average return one year out is 13% with an average max loss of 4.4%.2

Historical anecdotes aside, there are some strong and compelling forces that can support higher equity prices.

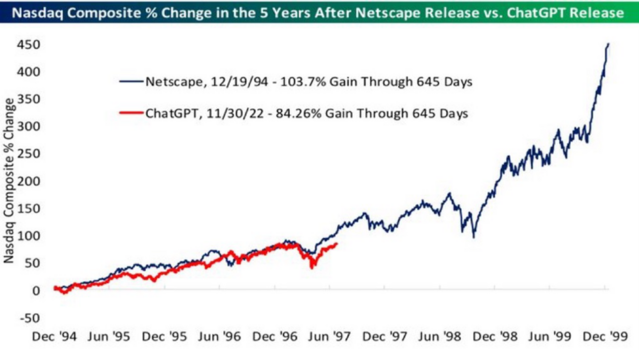

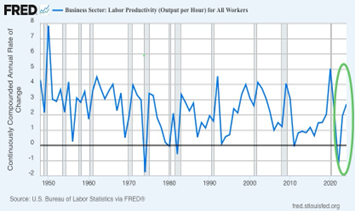

One, when you compare the data to the internet boom, we are still in the first half of the AI innovation boom, again according to the folks at Bespoke. Some of the biggest potential gains still lie ahead for the NASDAQ if the AI revolution is anything near the internet revolution. And AI productivity has the potential to far surpass the internet with quicker adoption and powerful time saving tools.3

Productivity improvements can lead to higher corporate earnings as they integrate all the methods and processes from artificial intelligence.4

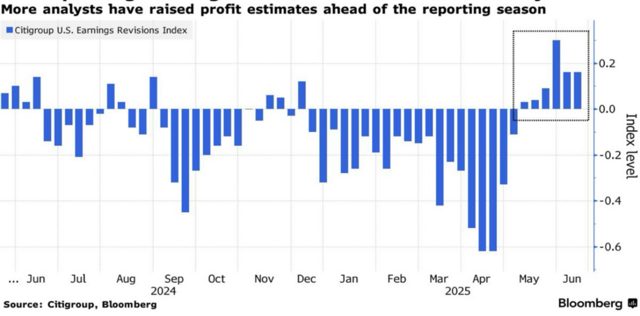

Another compelling reason there could be more tailwinds behind equity prices is in earnings estimates. More analysts have upgraded their earnings expectations for Q2. That increased optimism will be tested in a few weeks, and it is my view that the raised hopes will be met with solid results.5

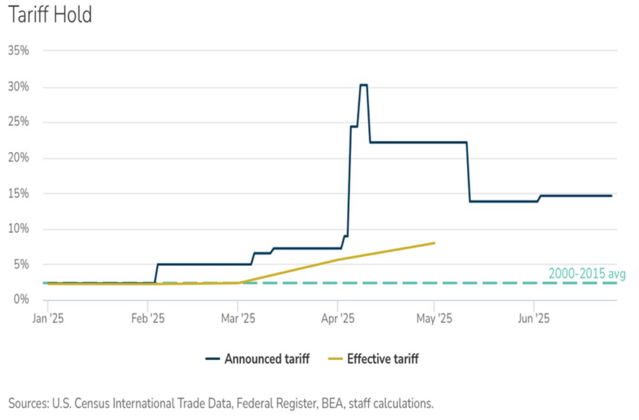

Further, tariff resolutions are just a few days away and the Trump tariff threats are appearing to be much more draconian than what’s being implemented.6 Perhaps that’s why we don’t see much in the way of inflation.7

The S&P recovered quickly, and while there are certainly some reasons to be circumspect about this rally, there are also strong reasons to support historical return patterns. This rally may just be getting started.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

1.) https://x.com/cvpayne/status/1938984999253930389

3.) US Stocks Brush Off Moody's, Echo Past Tech Booms | Nasdaq

4.) Understanding Money Mechanics #4: Fiat Money | New World Economics

5.) US Profit Outlook Rarely This Sour, Morgan Stanley’s Wilson Says - Bloomberg

6.) US Profit Outlook Rarely This Sour, Morgan Stanley’s Wilson Says - Bloomberg

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.