The American Consumer: Cautious, Yes, But Far From Collapsing

For weeks, we've heard whispers of a slowing economy, and rightly so. But when we dig into the latest economic reports, a more nuanced picture emerges for the American consumer: one of caution, yes, but certainly not collapse. In fact, it's a story underpinned by continued wage growth and, more importantly, a significant rise in the nation's savings rate. 1

Let's unpack what the numbers are telling us.

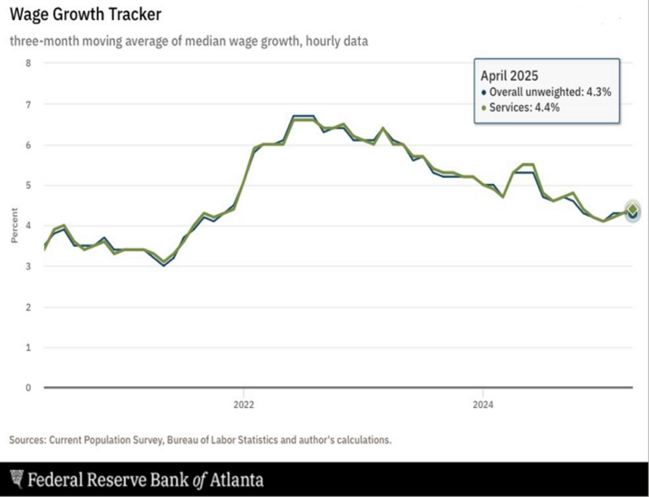

Wages Still Growing, Providing a Foundation

First, the good news for the backbone of our economy: wages are still rising. Average hourly earnings for private non-farm payrolls increased by 0.2% in April, bringing the year-over-year growth to a respectable 4.3%. While this pace has moderated from the rapid surges we saw immediately post-pandemic, it signifies that most Americans are still seeing their paychecks get bigger.

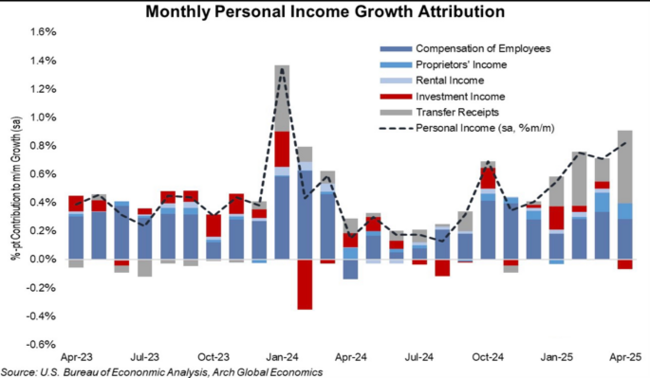

In almost every category we see personal income accelerating. While noting the rapid expansion in transfer payments from the government, income is rising in other areas as well.2

This steady, albeit cooling, wage growth is crucial. It provides the fundamental purchasing power that prevents a dramatic downturn in spending. People are earning more, which means they have the ability to spend.

The Big Story: Americans Are Saving More

Here's where the "cautious" part truly shines, and it's perhaps the most significant takeaway from the April report: the personal saving rate jumped to 4.9%. This is the highest we've seen in about a year, and it tells us a lot about the American household's current mindset.3

Think about it: despite incomes growing, consumers collectively choose to save a larger slice of their earnings. This isn't necessarily a sign of fear, but rather one of financial prudence and a rebuilding of buffers. After years of elevated inflation chipping away at purchasing power, and perhaps with some lingering economic uncertainties, it appears many households are prioritizing strengthening their financial foundations. They might be:

* Replenishing emergency funds.

* Paying down debt.

* Saving for larger purchases (like a down payment on a home or car) rather than immediately spending.

* Exercising more discernment about discretionary purchases.

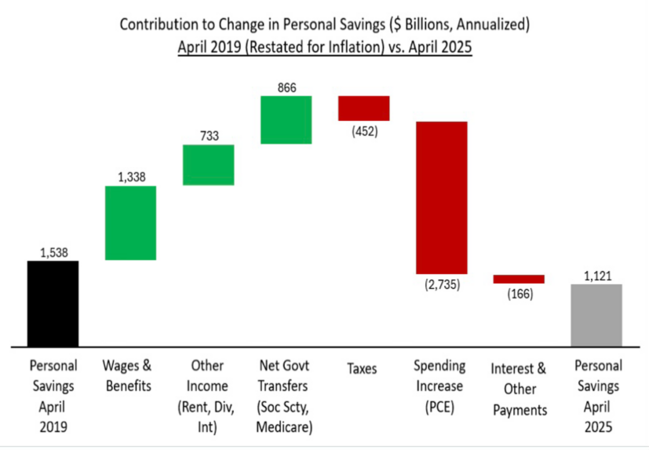

When looking at pre-pandemic to post-pandemic spending and savings, the consumer is still in great shape.4

Since April of 2019 the consumer spent $2.7 trillion more while earning $1.38 trillion in wages and benefits. When you consider the transfer payments at $866 billion and a modest $400 billion drawdown in personal savings the income and savings mix continue to support GDP growth.

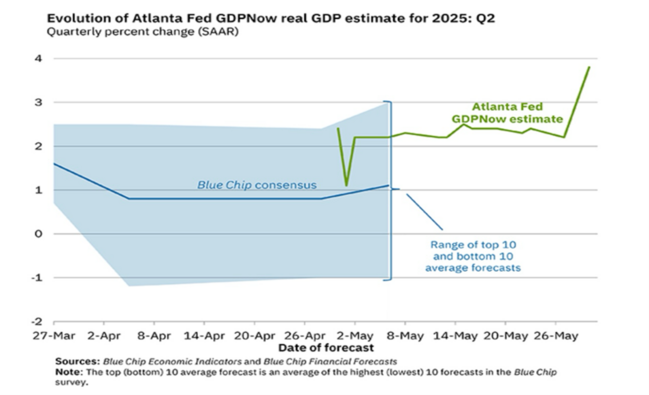

That’s fundamental why the Atlanta Federal Reserve thinks Q2, 2025 GDP growth will come in at a whopping 3.9%.5

Caution, Not Collapse: Why This Matters

For investors and anyone watching the economy, this is an important distinction. A "collapsing" consumer would be marked by significant job losses, declining incomes, and a sharp drop in spending across the board. That's not what we're seeing.

Instead, we're witnessing a consumer who is:

* Fundamentally healthy: Thanks to continued wage growth.

* More financially disciplined: As evidenced by the rising savings rate.

* Strategic in their spending: Prioritizing services and perhaps holding back on some goods.

It's the kind of rebalancing that could help keep inflation in check and avoid the boom-and-bust cycles that often come with unrestrained spending. Indeed, this behavior supports the economy’s progress toward the Fed’s goals of 2% inflation and full employment. 6

So, while the headlines might hint at a slowdown, the underlying data suggests the American consumer is resilient, capable, while cautious—a prudent position that could ultimately strengthen our economic foundation in the long run.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

1.) Wage Growth Tracker - Federal Reserve Bank of Atlanta

2.) Archive - undefined of Viet Hustler

3.) Real GDP – HubbardOBrienEconomics.com Blog

4.) Document

6.) https://x.com/David_Charts/status/1928876938015232354

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.