The Appearance of Success

“Nothing Succeeds Like the Appearance of Success” – Christopher Lasch [xii]

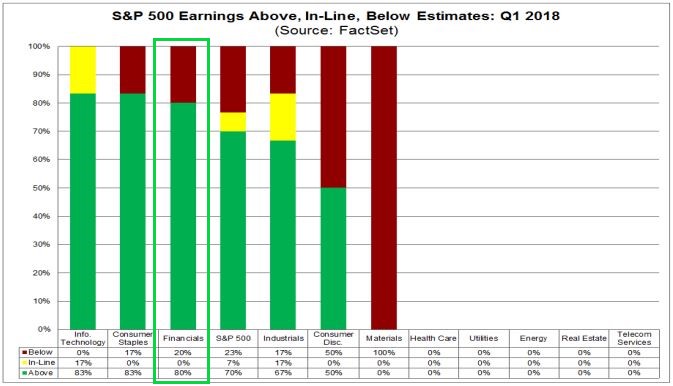

We are getting our first look at Q1 2018 earnings and they are extraordinary. Although only a small percentage of S&P 500 companies have reported, those that have reported have beat, or exceeded, high expectations. [i]

Because the sample size is extremely small (only 6 percent of S&P 500 companies have reported), it’s difficult to extract a broad-based meaning from these reports. [i] However, one sector that has reported earnings happens to represent a large cohort in our economy: Financials. [ii]

Financial services companies that have reported earnings for Q1 2018 have shown strong earnings growth above expectations. [i]

More specifically, Citibank, JP Morgan Chase, and Wells Fargo, all reported their first quarter results, which happened to exceed earnings expectations. [xiii]

Extracting a macro picture from these three companies is a stretch; however, given the size of their consumer businesses, we can examine their consumer banking businesses to craft a broad outlook:

- Citibank: 9 million accounts and 39 million credit cards [iv]

- JP Morgan Chase: 61 million U.S. households and 97 million credit/debit cards [iii]

- Wells Fargo: 70 million accounts [v]

Based on their size, it’s clear that we can deduct a significant macroeconomic picture from these three companies, which is likely to represent a large swath of U.S. consumers.

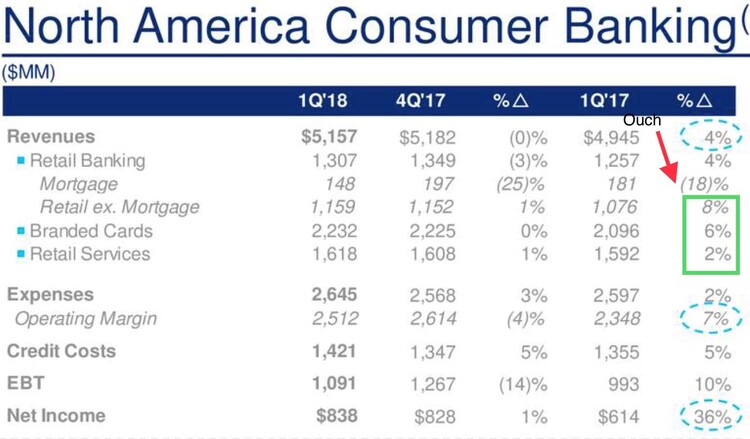

Citibank reported Q1 2018 numbers as follows: [vi]

Citibank is showing strong growth in retail banking, credit card, and retail services, which all suggest that the U.S. consumer and the U.S. economy is on strong footing. However, one area of concern was the significant reduction in mortgage lending on a year-over-year (YoY) and quarter-over-quarter (QoQ) basis.

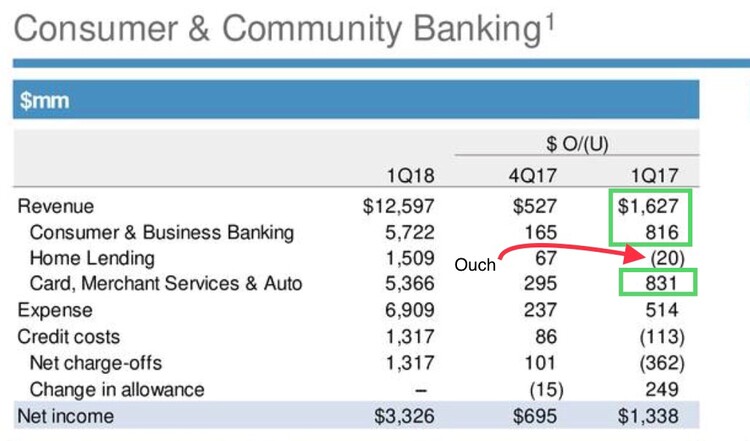

JP Morgan’s quarterly numbers were reported as follows: [vii]

Although JP Morgan’s numbers are less friendly to read, the over/under from the prior year tells the same story as Citibank. Total Consumer Revenue increased 12.92 percent YoY, while Consumer & Business Banking increased 14.26 percent and Card, Merchant Services, & Auto increased 15.49 percent. However, similar to Citibank, Home Lending at JP Morgan experienced a decline as well, albeit a much smaller decline compared to Citibank at only 1.33 percent. [vii]

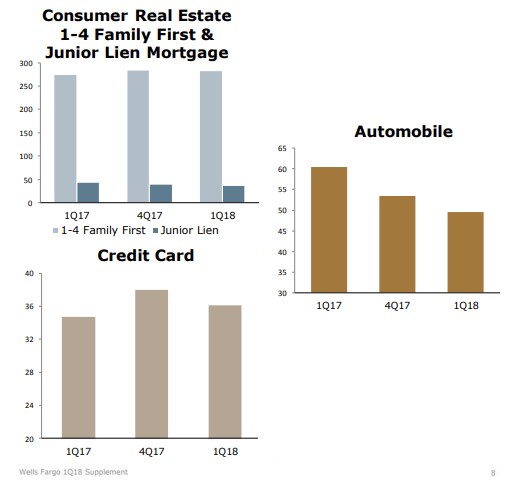

Now on to the Wells Fargo numbers (which I consider the most morally challenged bank among the three). It appears that the massive headline risk surrounding Wells Fargo’s morally challenged banking practices has caught up to all its relevant consumer banking lines of business. [viii]

It also appears that the Wells Fargo numbers tell a similar story; Home Lending (Mortgage) experienced declines similar to the other banks; however, on a quarterly basis, Credit Card and Automobile both experienced declines as well. [viii]

It’s no small matter when we start to see a pinch point in housing. According to the National Association of Home Builders, housing represents 15 – 18 percent of GDP. [ix]

It’s a generous interpretation to suggest that much of our economy is dependent on housing, but you get the point. Slowing home mortgages are something to take notice of, especially as we get further into this economic expansion.

Higher mortgage rates could certainly be a contributing factor. [x]

However, let’s not leave off the significant increase in market volatility that may also be influencing consumers as well. [xi]

Let’s just hope the appearance of success continues to prevail with the U.S. consumer, beyond the small weaknesses that are appearing within home mortgages.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Robert Dinelli, Investment Analyst, Phillips & Company

References:

i. https://insight.factset.com/hubfs/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_041318A.pdf

ii. https://www.bea.gov/iTable/iTable.cfm?ReqID=51&step=1#reqid=51&step=51&isuri=1&5114=a&5102=15

iii. https://www.jpmorganchase.com/corporate/investor-relations/document/3cea4108_strategic_update.pdf

iv. http://www.citigroup.com/citi/investor/data/qer417s.pdf?ieNocache=861

v. https://www08.wellsfargomedia.com/assets/pdf/about/corporate/wells-fargo-today.pdf

vi. https://seekingalpha.com/article/4162904-citigroup-inc-2018-q1-results-earnings-call-slides

vii. https://seekingalpha.com/article/4162833-jpmorgan-chase-and-co-2018-q1-results-earnings-call-slides

viii. https://seekingalpha.com/article/4162852-wells-fargo-and-co-2018-q1-results-earnings-call-slides

ix. https://www.nahb.org/en/research/housing-economics/housings-economic-impact/housings-contribution-to-gross-domestic-product-gdp.aspx

x. https://fred.stlouisfed.org/graph/?g=NUh

xi. https://fred.stlouisfed.org/series/VIXCLS

xii. https://www.brainyquote.com/quotes/christopher_lasch_130433

xiii. Bloomberg, L.P.