The Base Effect – Too Powerful to Ignore

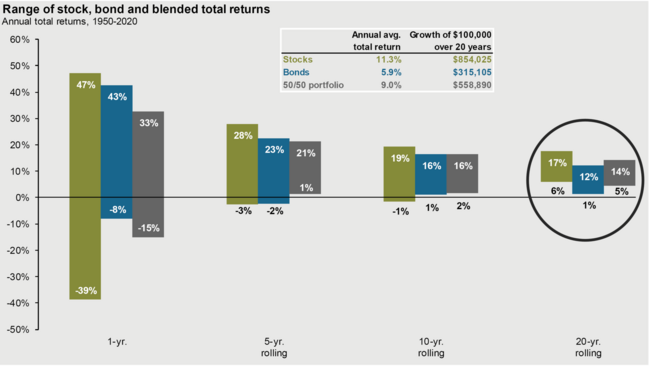

It’s a rare occasion when we as investors get to experience in real time why markets have always gone up over long periods of time. [i]

With over 30 years as a professional investor on behalf of myself and others, I wish I knew at day one what I know today. When investing in stocks:

- You own the future, not the past or present, when it comes to cash flows and growth

- Generally, you have to pay up for past growth in the form of higher valuations

- It’s easy to compound off small numbers (base) with large percentage growth

- It’s hard to compound off large numbers (base) with large percentage growth

- The cyclical nature of compounding and the base effect provide investors with a built-in guardrail if they can withstand the pain

Let’s summarize all of my axioms into one easy example:

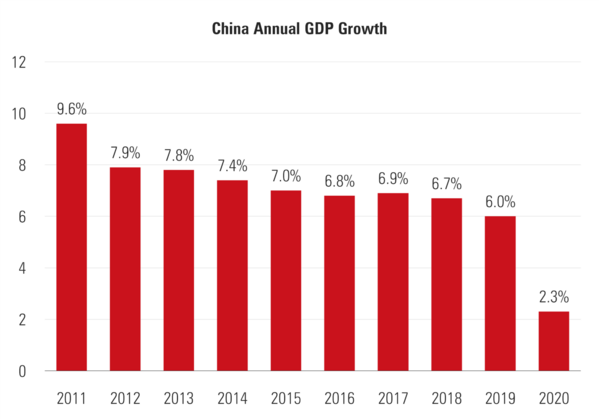

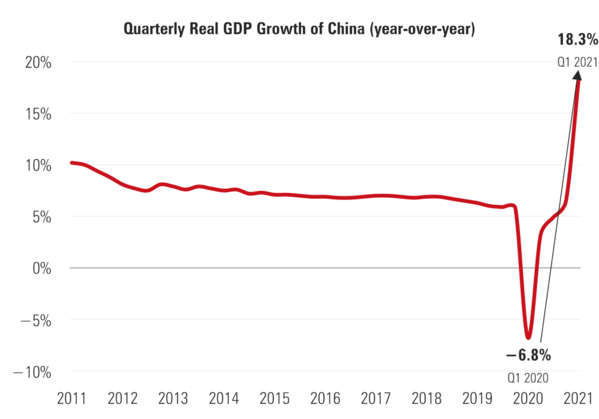

Last week, China reported they grew their GDP by 18.3% in the first quarter. This is an astonishing number, especially when you consider they are growing a $15 trillion economy. [ii]

However, as we all know China was in an early-2020 pandemic lockdown, so their year-over-year comparisons are pretty easy to beat. [ii]

This is the base effect at work. If you have enough patience, you can get back to very positive growth rates—barring some catastrophic event.

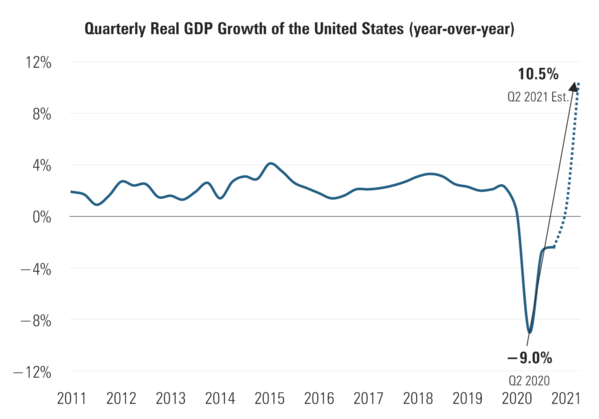

The same will hold true with U.S. GDP, perhaps not as dramatic in Q1 2021 but, certainly in Q2 2021 when you compare it to our pandemic lockdown levels last year. [iii]

In fact, you should expect to see incredible macroeconomic numbers for both the U.S. and China in the coming quarter as both countries work on rejuvenating their economies and bounce off very low bases.

In particular, corporate earnings should be another prime example:

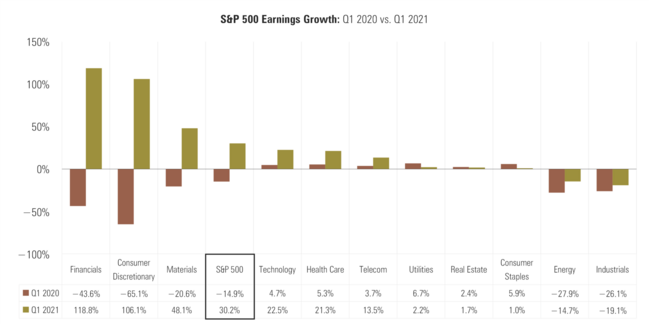

If you review current Q1 2021 expectations and the early reports on U.S. earnings you can see the power of the base effect in percentage terms. [iv]

In fact, the U.S. base effect won’t likely be felt until Q2 when we compare to Q2 2020 when we were at the depths of our full economic freeze.

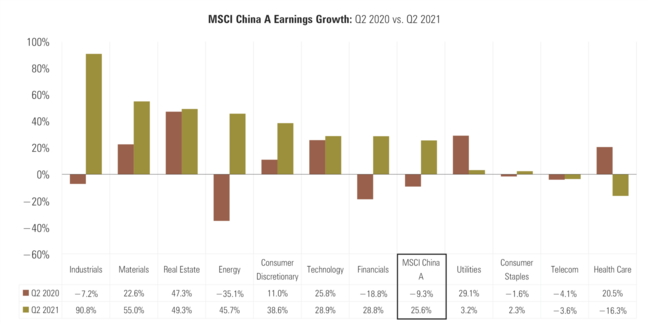

China is no different. [v]

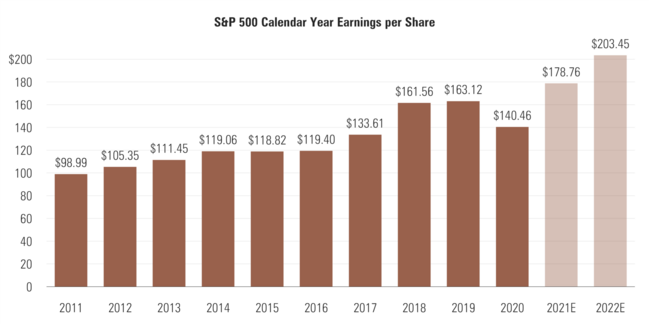

I don’t want to deceive anyone with these mathematical gymnastics. Investors should look at raw dollars and see if they are buying real dollar growth or simply base effect percentage growth. [iv]

That’s exactly what you’re going to get in Q2 2021, according to FactSet. Raw dollars for the S&P 500 are expected to return to near growth compared to 2019 and 2020. In fact, full year 2021 will be more than just a play on percentages but real earnings growth in absolute dollars.

The benefit of backfilling economic stimulus allows us to experience the power of percentage changes, but also real dollar earnings growth.

Get ready for some powerful headlines in the coming months. The base effect is too formidable for people to ignore.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

ii. https://www.bloomberg.com/quote/CNGDPYOY:IND

iii. https://www.bloomberg.com/quote/EHGDUSY:IND

iv. https://insight.factset.com/topic/earnings

v. https://www.msci.com/msci-china-a-international-indexes